You are required to produce a C++ program which solves the following: A worker is paid according to the number of hours they have worked. Write a program to enter the worker's: - initials (first and last name) basic rate of pay and the number of hours they have worked Calculate the gross pay. Display their initials and all the inputted/calculated values. Extend this program to allow the calculation and display of overtime, as well as basic pay as follows: > Additional inputs: overtime hours and overtime rate of pay. > Additional calculations: gross overtime pay, total gross pay (basic + overtime). > Additional display: overtime pay and the total gross pay (basic + overtime). Further extend this program to allow the calculation and display of net pay after

You are required to produce a C++ program which solves the following: A worker is paid according to the number of hours they have worked. Write a program to enter the worker's: - initials (first and last name) basic rate of pay and the number of hours they have worked Calculate the gross pay. Display their initials and all the inputted/calculated values. Extend this program to allow the calculation and display of overtime, as well as basic pay as follows: > Additional inputs: overtime hours and overtime rate of pay. > Additional calculations: gross overtime pay, total gross pay (basic + overtime). > Additional display: overtime pay and the total gross pay (basic + overtime). Further extend this program to allow the calculation and display of net pay after

C++ for Engineers and Scientists

4th Edition

ISBN:9781133187844

Author:Bronson, Gary J.

Publisher:Bronson, Gary J.

Chapter3: Assignment, Formatting, And Interactive Input

Section: Chapter Questions

Problem 10PP: (Electrical eng.) The amplification of electronic circuits is measured in units of decibels, which...

Related questions

Question

Please solve it with setw and endl

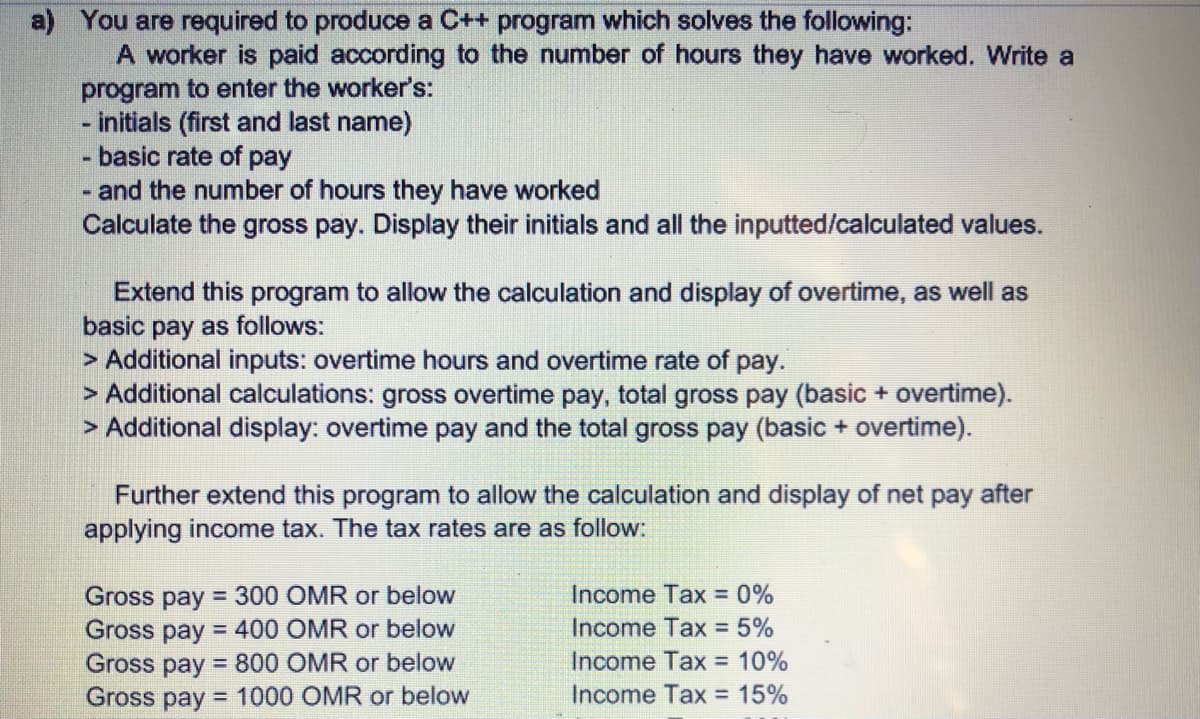

Transcribed Image Text:a) You are required to produce a C++ program which solves the following:

A worker is paid according to the number of hours they have worked. Write a

program to enter the worker's:

- initials (first and last name)

basic rate of pay

- and the number of hours they have worked

Calculate the gross pay. Display their initials and all the inputted/calculated values.

1.

Extend this program to allow the calculation and display of overtime, as well as

basic pay as follows:

> Additional inputs: overtime hours and overtime rate of pay.

> Additional calculations: gross overtime pay, total gross pay (basic + overtime).

> Additional display: overtime pay and the total gross pay (basic + overtime).

Further extend this program to allow the calculation and display of net pay after

applying income tax. The tax rates are as follow:

Gross pay = 300 OMR or below

Gross pay = 400 OMR or below

Gross pay = 800 OMR or below

Gross pay = 1000 OMR or below

Income Tax = 0%

%3D

Income Tax = 5%

Income Tax = 10%

Income Tax = 15%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, computer-science and related others by exploring similar questions and additional content below.Recommended textbooks for you

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning

C++ for Engineers and Scientists

Computer Science

ISBN:

9781133187844

Author:

Bronson, Gary J.

Publisher:

Course Technology Ptr

C++ Programming: From Problem Analysis to Program…

Computer Science

ISBN:

9781337102087

Author:

D. S. Malik

Publisher:

Cengage Learning