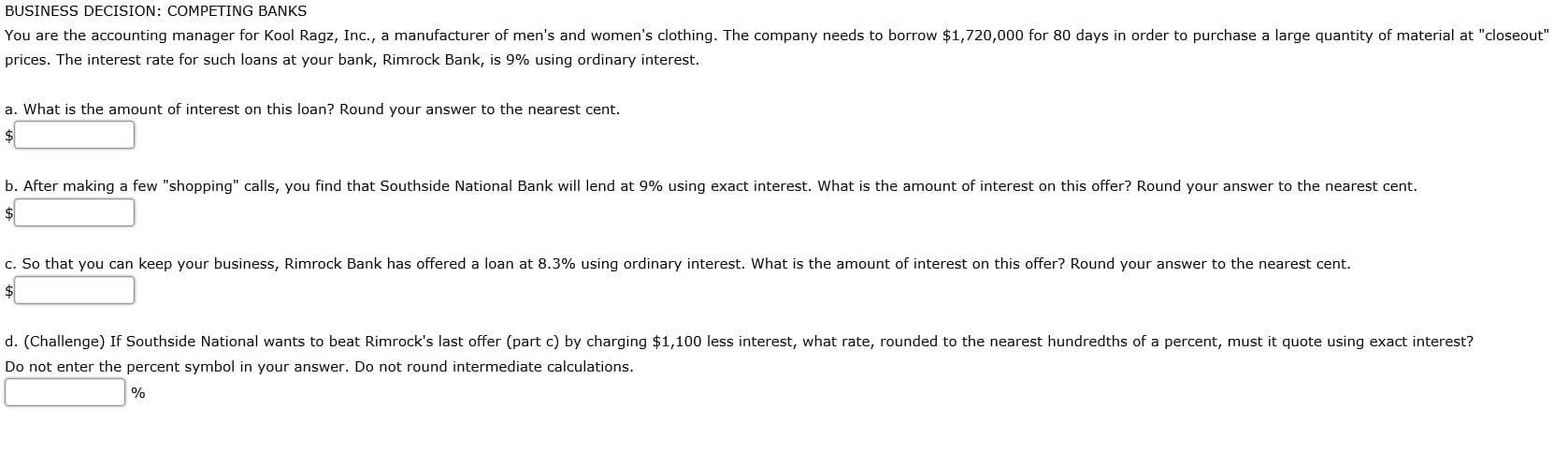

You are the accounting manager for Kool Ragz, Inc., a manufacturer of men's and women's clothing. The company needs to borrow $1,720,000 for 80 days in order to purchase a large quantity of material at "closeout" prices. The interest rate for such loans at your bank, Rimrock Bank, is 9% using ordinary interest. a. What is the amount of interest on this loan? Round your answer to the nearest cent. $ b. After making a few "shopping" calls, you find that Southside National Bank will lend at 9% using exact interest. What is the amount of interest on this offer? Round your answer to the nearest cent. $ c. So that you can keep your business, Rimrock Bank has offered a loan at 8.3% using ordinary interest. What is the amount of interest on this offer? Round your answer to the nearest cent. $ d. (Challenge) If Southside National wants to beat Rimrock's last offer (part c) by charging $1,100 less interest, what rate, rounded to the nearest hundredths of a percent, must it quote using exact interest? Do not enter the percent symbol in your answer. Do not round intermediate calculations. %

You are the accounting manager for Kool Ragz, Inc., a manufacturer of men's and women's clothing. The company needs to borrow $1,720,000 for 80 days in order to purchase a large quantity of material at "closeout" prices. The interest rate for such loans at your bank, Rimrock Bank, is 9% using ordinary interest. a. What is the amount of interest on this loan? Round your answer to the nearest cent. $ b. After making a few "shopping" calls, you find that Southside National Bank will lend at 9% using exact interest. What is the amount of interest on this offer? Round your answer to the nearest cent. $ c. So that you can keep your business, Rimrock Bank has offered a loan at 8.3% using ordinary interest. What is the amount of interest on this offer? Round your answer to the nearest cent. $ d. (Challenge) If Southside National wants to beat Rimrock's last offer (part c) by charging $1,100 less interest, what rate, rounded to the nearest hundredths of a percent, must it quote using exact interest? Do not enter the percent symbol in your answer. Do not round intermediate calculations. %

Chapter4: Time Value Of Money

Section: Chapter Questions

Problem 32P

Related questions

Question

Transcribed Image Text:u are the accounting manager for Kool Ragz, Inc., a manufacturer of men's and women's clothing. The company needs to borrow $1,720,000 for 80 days in order to purchase a large quantity of material at "close

ces. The interest rate for such loans at your bank, Rimrock Bank, is 9% using ordinary interest.

What is the amount of interest on this loan? Round your answer to the nearest cent.

After making a few "shopping" calls, you find that Southside National Bank will lend at 9% using exact interest. What is the amount of interest on this offer? Round your answer to the nearest cent.

So that you can keep your business, Rimrock Bank has offered a loan at 8.3% using ordinary interest. What is the amount of interest on this offer? Round your answer to the nearest cent.

(Challenge) If Southside National wants to beat Rimrock's last offer (part c) by charging $1,100 less interest, what rate, rounded to the nearest hundredths of a percent, must it quote using exact interest?

not enter the percent symbol in your answer. Do not round intermediate calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT