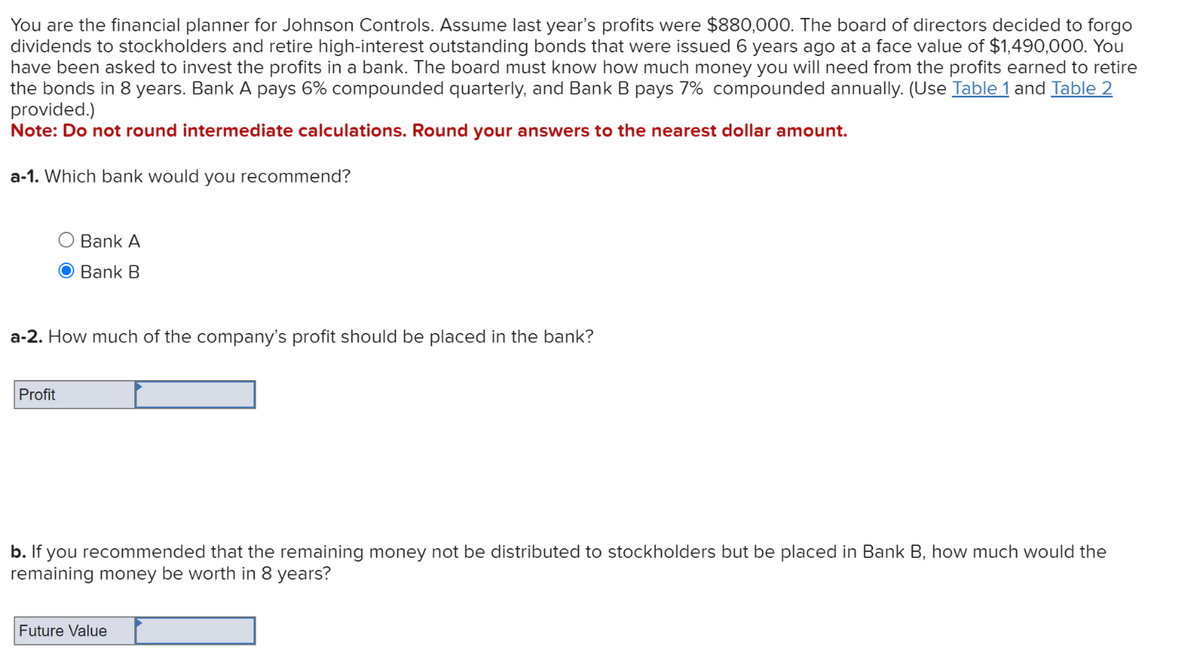

You are the financial planner for Johnson Controls. Assume last year's profits were $880,000. The board of directors decided to forgo dividends to stockholders and retire high-interest outstanding bonds that were issued 6 years ago at a face value of $1,490,000. You have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire the bonds in 8 years. Bank A pays 6% compounded quarterly, and Bank B pays 7% compounded annually. (Use Table 1 and Table 2 provided.) Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount. a-1. Which bank would you recommend? Bank A Bank B a-2. How much of the company's profit should be placed in the bank? Profit b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bank B, how much would the remaining money be worth in 8 years? Future Value

You are the financial planner for Johnson Controls. Assume last year's profits were $880,000. The board of directors decided to forgo dividends to stockholders and retire high-interest outstanding bonds that were issued 6 years ago at a face value of $1,490,000. You have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire the bonds in 8 years. Bank A pays 6% compounded quarterly, and Bank B pays 7% compounded annually. (Use Table 1 and Table 2 provided.) Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount. a-1. Which bank would you recommend? Bank A Bank B a-2. How much of the company's profit should be placed in the bank? Profit b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bank B, how much would the remaining money be worth in 8 years? Future Value

Chapter6: Risk And Return

Section: Chapter Questions

Problem 1kM

Related questions

Question

Transcribed Image Text:You are the financial planner for Johnson Controls. Assume last year's profits were $880,000. The board of directors decided to forgo

dividends to stockholders and retire high-interest outstanding bonds that were issued 6 years ago at a face value of $1,490,000. You

have been asked to invest the profits in a bank. The board must know how much money you will need from the profits earned to retire

the bonds in 8 years. Bank A pays 6% compounded quarterly, and Bank B pays 7% compounded annually. (Use Table 1 and Table 2

provided.)

Note: Do not round intermediate calculations. Round your answers to the nearest dollar amount.

a-1. Which bank would you recommend?

Bank A

Bank B

a-2. How much of the company's profit should be placed in the bank?

Profit

b. If you recommended that the remaining money not be distributed to stockholders but be placed in Bank B, how much would the

remaining money be worth in 8 years?

Future Value

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning