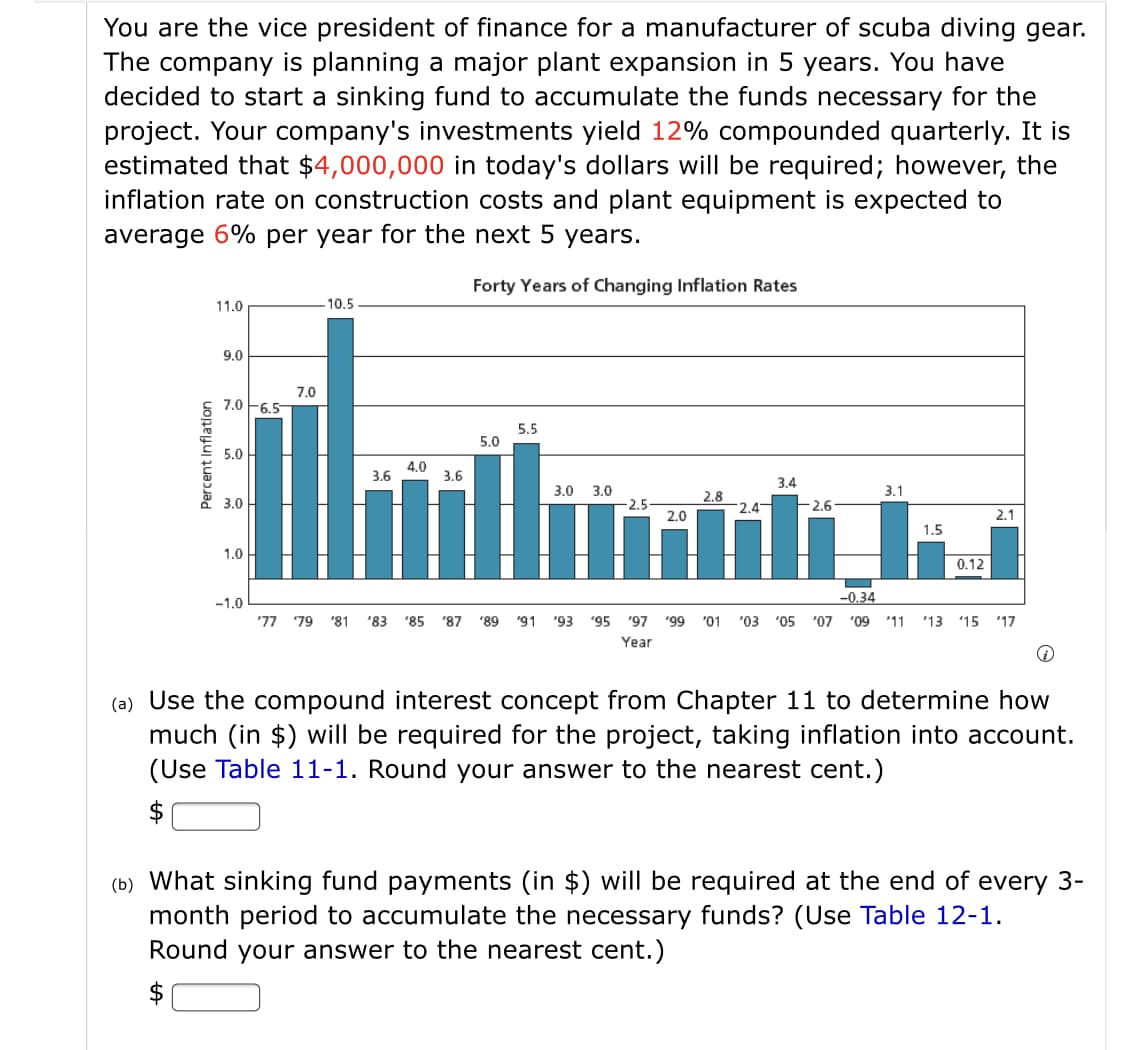

You are the vice president of finance for a manufacturer of scuba diving gear. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Your company's investments yield 12% compounded quarterly. It is estimated that $4,000,000 in today's dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 6% per year for the next 5 years. Forty Years of Changing Inflation Rates 11.0 10.5 9.0 7.0 7.0 F6.5 5.5 5.0 5.0 4.0 3.6 3.6 3,4 nlili. 3.0 3.0 2.5 3.1 * 3.0 2.8 2.6 2.0 2.1 1.5 1.0 0.12 -0,34 -1.0 "77 79 '81 '83 '85 '87 '89 '91 "93 '95 '97 '99 '01 "03 "05 "07 "09 '11 '13 '15 '17 Year (a) Use the compound interest concept from Chapter 11 to determine how much (in $) will be required for the project, taking inflation into account. (Use Table 11-1. Round your answer to the nearest cent.) $ (b) What sinking fund payments (in $) will be required at the end of every 3- month period to accumulate the necessary funds? (Use Table 12-1. Round your answer to the nearest cent.) $

You are the vice president of finance for a manufacturer of scuba diving gear. The company is planning a major plant expansion in 5 years. You have decided to start a sinking fund to accumulate the funds necessary for the project. Your company's investments yield 12% compounded quarterly. It is estimated that $4,000,000 in today's dollars will be required; however, the inflation rate on construction costs and plant equipment is expected to average 6% per year for the next 5 years. Forty Years of Changing Inflation Rates 11.0 10.5 9.0 7.0 7.0 F6.5 5.5 5.0 5.0 4.0 3.6 3.6 3,4 nlili. 3.0 3.0 2.5 3.1 * 3.0 2.8 2.6 2.0 2.1 1.5 1.0 0.12 -0,34 -1.0 "77 79 '81 '83 '85 '87 '89 '91 "93 '95 '97 '99 '01 "03 "05 "07 "09 '11 '13 '15 '17 Year (a) Use the compound interest concept from Chapter 11 to determine how much (in $) will be required for the project, taking inflation into account. (Use Table 11-1. Round your answer to the nearest cent.) $ (b) What sinking fund payments (in $) will be required at the end of every 3- month period to accumulate the necessary funds? (Use Table 12-1. Round your answer to the nearest cent.) $

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 13E: Buena Vision Clinic is considering an investment that requires an outlay of 600,000 and promises a...

Related questions

Question

Transcribed Image Text:You are the vice president of finance for a manufacturer of scuba diving gear.

The company is planning a major plant expansion in 5 years. You have

decided to start a sinking fund to accumulate the funds necessary for the

project. Your company's investments yield 12% compounded quarterly. It is

estimated that $4,000,000 in today's dollars will be required; however, the

inflation rate on construction costs and plant equipment is expected to

average 6% per year for the next 5

years.

Forty Years of Changing Inflation Rates

11.0

-10.5

9.0

7.0

7.0 F6.5

5.5

5.0

5.0

4.0

3.6

3.6

3.4

3.0 3.0

3.1

2.8

3.0

-2.5

-2.6

2.0

2.1

1.5

1.0

0.12

-0.34

-1.0

'77 79 '81

'83

'85 '87

'89

'91

'93 '95 "97

"99

"01

"03

"05 "07

"09

'11 '13 '15

'17

Year

(a) Use the compound interest concept from Chapter 11 to determine how

much (in $) will be required for the project, taking inflation into account.

(Use Table 11-1. Round your answer to the nearest cent.)

(b) What sinking fund payments (in $) will be required at the end of every 3-

month period to accumulate the necessary funds? (Use Table 12-1.

Round your answer to the nearest cent.)

$

Percent Inflation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College