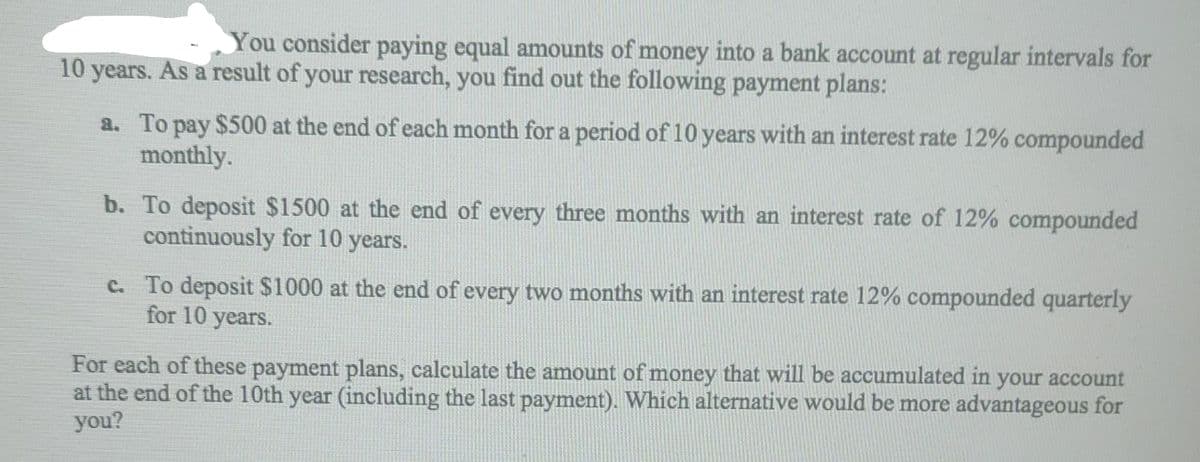

You consider paying equal amounts of money into a bank account at regular intervals for 10 years. As a result of your research, you find out the following payment plans: a. To pay $500 at the end of each month for a period of 10 years with an interest rate 12% compounded monthly. b. To deposit $1500 at the end of every three months with an interest rate of 12% compounded continuously for 10 years. c. To deposit $1000 at the end of every two months with an interest rate 12% compounded quarterly for 10 years. For each of these payment plans, calculate the amount of money that will be accumulated in your account at the end of the 10th year (including the last payment). Which alternative would be more advantageous for you?

You consider paying equal amounts of money into a bank account at regular intervals for 10 years. As a result of your research, you find out the following payment plans: a. To pay $500 at the end of each month for a period of 10 years with an interest rate 12% compounded monthly. b. To deposit $1500 at the end of every three months with an interest rate of 12% compounded continuously for 10 years. c. To deposit $1000 at the end of every two months with an interest rate 12% compounded quarterly for 10 years. For each of these payment plans, calculate the amount of money that will be accumulated in your account at the end of the 10th year (including the last payment). Which alternative would be more advantageous for you?

Algebra and Trigonometry (6th Edition)

6th Edition

ISBN:9780134463216

Author:Robert F. Blitzer

Publisher:Robert F. Blitzer

ChapterP: Prerequisites: Fundamental Concepts Of Algebra

Section: Chapter Questions

Problem 1MCCP: In Exercises 1-25, simplify the given expression or perform the indicated operation (and simplify,...

Related questions

Topic Video

Question

Q4

Transcribed Image Text:You consider paying equal amounts of money into a bank account at regular intervals for

10 years. As a result of your research, you find out the following payment plans:

a. To pay $500 at the end of each month for a period of 10 years with an interest rate 12% compounded

monthly.

b. To deposit $1500 at the end of every three months with an interest rate of 12% compounded

continuously for 10 years.

c. To deposit $1000 at the end of every two months with an interest rate 12% compounded quarterly

for 10 years.

For each of these payment plans, calculate the amount of money that will be accumulated in your account

at the end of the 10th year (including the last payment). Which alternative would be more advantageous for

you?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, algebra and related others by exploring similar questions and additional content below.Recommended textbooks for you

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra and Trigonometry (6th Edition)

Algebra

ISBN:

9780134463216

Author:

Robert F. Blitzer

Publisher:

PEARSON

Contemporary Abstract Algebra

Algebra

ISBN:

9781305657960

Author:

Joseph Gallian

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra And Trigonometry (11th Edition)

Algebra

ISBN:

9780135163078

Author:

Michael Sullivan

Publisher:

PEARSON

Introduction to Linear Algebra, Fifth Edition

Algebra

ISBN:

9780980232776

Author:

Gilbert Strang

Publisher:

Wellesley-Cambridge Press

College Algebra (Collegiate Math)

Algebra

ISBN:

9780077836344

Author:

Julie Miller, Donna Gerken

Publisher:

McGraw-Hill Education