You consider the purchase of a copier for your business. The initial

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 8PB: Montello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is...

Related questions

Question

Transcribed Image Text:Required

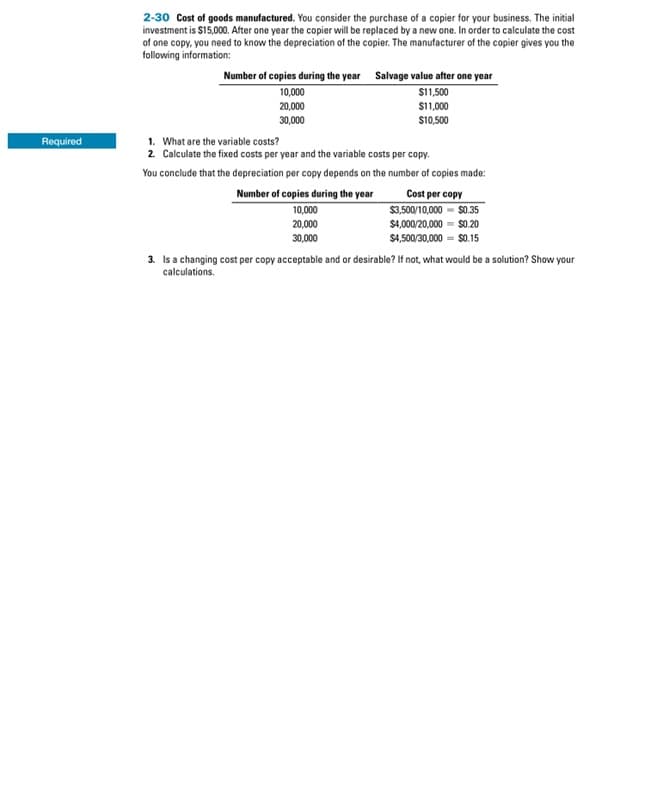

2-30 Cost of goods manufactured. You consider the purchase of a copier for your business. The initial

investment is $15,000. After one year the copier will be replaced by a new one. In order to calculate the cost

of one copy, you need to know the depreciation of the copier. The manufacturer of the copier gives you the

following information:

Number of copies during the year Salvage value after one year

10,000

20,000

30,000

$11,500

$11,000

$10,500

1. What are the variable costs?

2. Calculate the fixed costs per year and the variable costs per copy.

You conclude that the depreciation per copy depends on the number of copies made:

Number of copies during the year

10,000

20,000

30,000

Cost per copy

$3,500/10,000 - $0.35

$4,000/20,000 = $0.20

$4,500/30,000 = $0.15

3. Is a changing cost per copy acceptable and or desirable? If not, what would be a solution? Show your

calculations.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage