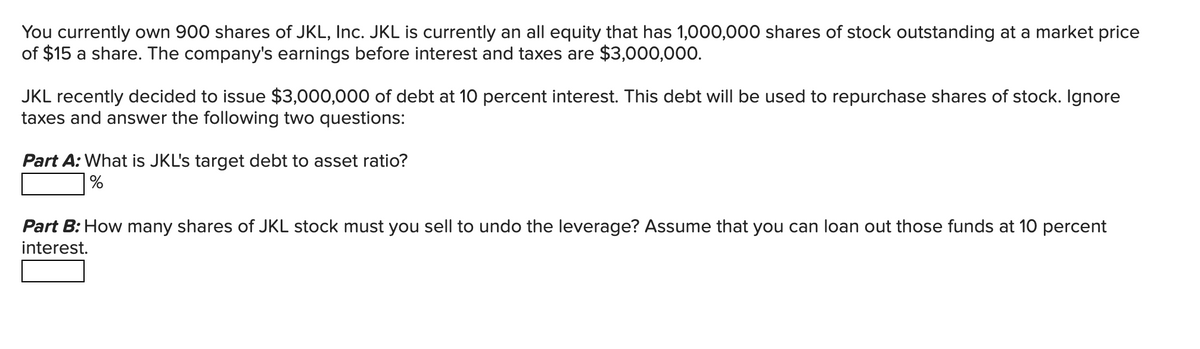

You currently own 900 shares of JKL, Inc. JKL is currently an all equity that has 1,000,000 shares of stock outstanding at a market price of $15 a share. The company's earnings before interest and taxes are $3,000,000. JKL recently decided to issue $3,000,000 of debt at 10 percent interest. This debt will be used to repurchase shares of stock. Ignore taxes and answer the following two questions: Part A: What is JKL's target debt to asset ratio? | % Part B: How many shares of JKL stock must you sell to undo the leverage? Assume that you can loan out those funds at 10 percent interest.

You currently own 900 shares of JKL, Inc. JKL is currently an all equity that has 1,000,000 shares of stock outstanding at a market price of $15 a share. The company's earnings before interest and taxes are $3,000,000. JKL recently decided to issue $3,000,000 of debt at 10 percent interest. This debt will be used to repurchase shares of stock. Ignore taxes and answer the following two questions: Part A: What is JKL's target debt to asset ratio? | % Part B: How many shares of JKL stock must you sell to undo the leverage? Assume that you can loan out those funds at 10 percent interest.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 27E: Percy Company has 15,000 shares of common stock outstanding during all of 2019. It also has 2...

Related questions

Question

Transcribed Image Text:You currently own 900 shares of JKL, Inc. JKL is currently an all equity that has 1,000,000 shares of stock outstanding at a market price

of $15 a share. The company's earnings before interest and taxes are $3,000,000.

JKL recently decided to issue $3,000,000 of debt at 10 percent interest. This debt will be used to repurchase shares of stock. Ignore

taxes and answer the following two questions:

Part A: What is JKL's target debt to asset ratio?

%

Part B: How many shares of JKL stock must you sell to undo the leverage? Assume that you can loan out those funds at 10 percent

interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College