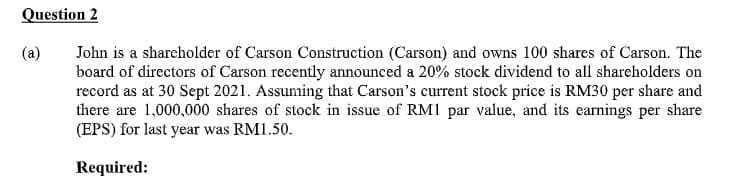

John is a sharcholder of Carson Construction (Carson) and owns 100 shares of Carson. The board of directors of Carson recently announced a 20% stock dividend to all shareholders on record as at 30 Sept 2021. Assuming that Carson's current stock price is RM30 per share and there are 1,000,000 shares of stock in issue of RM1 par value, and its earnings per share (EPS) for last year was RM1.50.

John is a sharcholder of Carson Construction (Carson) and owns 100 shares of Carson. The board of directors of Carson recently announced a 20% stock dividend to all shareholders on record as at 30 Sept 2021. Assuming that Carson's current stock price is RM30 per share and there are 1,000,000 shares of stock in issue of RM1 par value, and its earnings per share (EPS) for last year was RM1.50.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 8MC: Hyde Corporations capital structure at December 31, 2018, was as follows: On July 2, 2019, Hyde...

Related questions

Question

(i) Calculate the market capitalisation and earnings per share of Carson before and after

the stock dividend.

(ii) Based on the calculations in part (a) (i) above, explain the impact of the stock dividend on John’s ownership position and the market price of his stock investment

in the company.

Transcribed Image Text:Question 2

(a)

John is a sharcholder of Carson Construction (Carson) and owns 100 shares of Carson. The

board of directors of Carson recently announced a 20% stock dividend to all shareholders on

record as at 30 Sept 2021. Assuming that Carson's current stock price is RM30 per share and

there are 1,000,000 shares of stock in issue of RM1 par value, and its earnings per share

(EPS) for last year was RM1.50.

Required:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning