You decide to save $410 every month for five years to buy a (round to nearest dollar) earn 8%? $

You decide to save $410 every month for five years to buy a (round to nearest dollar) earn 8%? $

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 5FPE

Related questions

Question

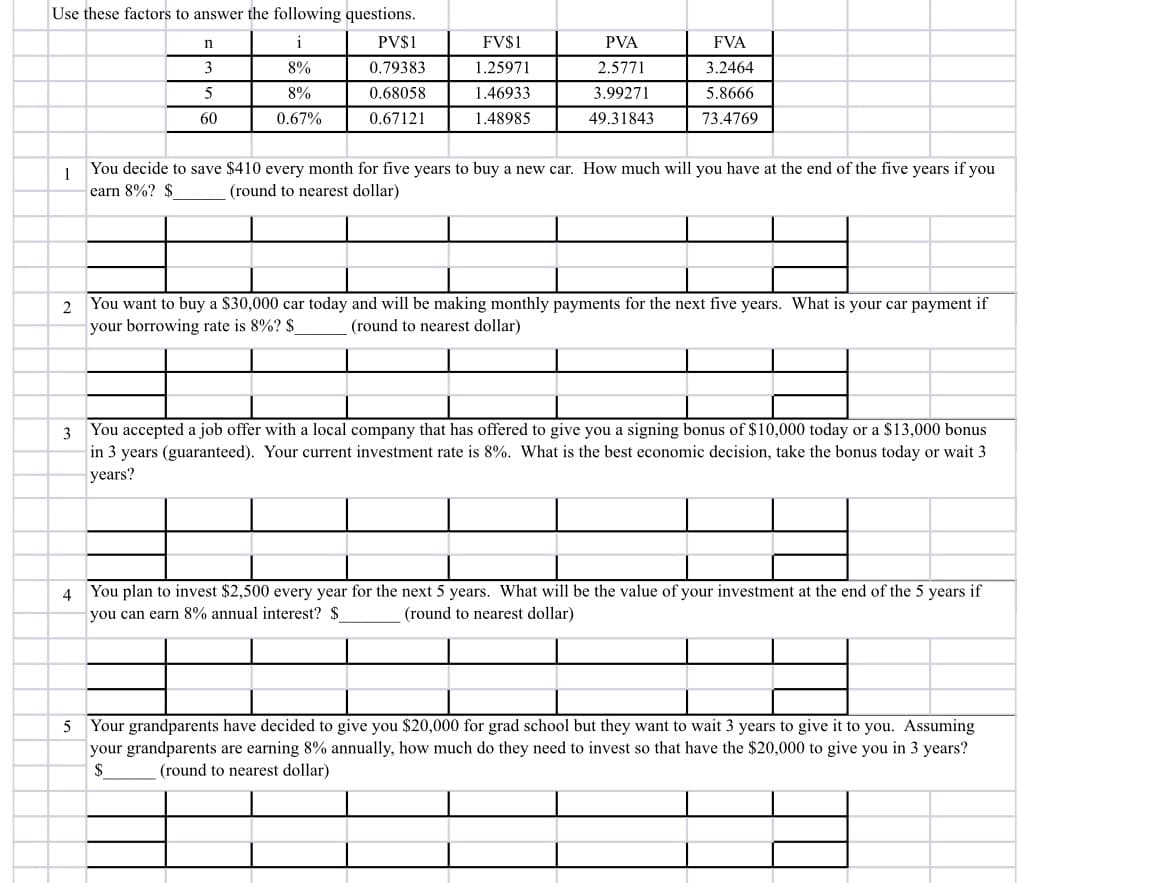

Transcribed Image Text:Use these factors to answer the following questions.

i

PV$1

FV$1

PVA

FVA

3

8%

0.79383

1.25971

2.5771

3.2464

5

8%

0.68058

1.46933

3.99271

5.8666

60

0.67%

0.67121

1.48985

49.31843

73.4769

1

You decide to save $410 every month for five years to buy a new car. How much will you have at the end of the five years if you

earn 8%? $

(round to nearest dollar)

You want to buy a $30,000 car today and will be making monthly payments for the next five years. What is your car payment if

your borrowing rate is 8%? $

(round to nearest dollar)

3 You accepted a job offer with a local company that has offered to give you a signing bonus of $10,000 today or a $13,000 bonus

in 3 years (guaranteed). Your current investment rate is 8%. What is the best economic decision, take the bonus today or wait 3

years?

4 You plan to invest $2,500 every year for the next 5 years. What will be the value of your investment at the end of the 5 years if

(round to nearest dollar)

you can earn 8% annual interest? $

Your grandparents have decided to give you $20,000 for grad school but they want to wait 3 years to give it to you. Assuming

your grandparents are earning 8% annually, how much do they need to invest so that have the $20,000 to give you in 3 years?

$

5

(round to nearest dollar)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 5 images

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning