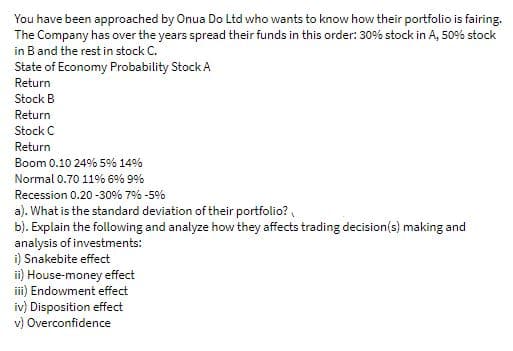

You have been approached by Onua Do Ltd who wants to know how their portfolio is fairing. The Company has over the years spread their funds in this order: 30% stock in A, 50% stock in B and the rest in stock C. State of Economy Probability Stock A Return Stock B Return Stock C Return Boom 0.10 24% 5% 14% Normal 0.70 11% 6% 9% Recession 0.20 -30% 7% -5% a). What is the standard deviation of their portfolio?, b). Explain the following and analyze how they affects trading decision(s) making and analysis of investments: i) Snakebite effect ii) House-money effect ii) Endowment effect iv) Disposition effect v) Overconfidence

You have been approached by Onua Do Ltd who wants to know how their portfolio is fairing. The Company has over the years spread their funds in this order: 30% stock in A, 50% stock in B and the rest in stock C. State of Economy Probability Stock A Return Stock B Return Stock C Return Boom 0.10 24% 5% 14% Normal 0.70 11% 6% 9% Recession 0.20 -30% 7% -5% a). What is the standard deviation of their portfolio?, b). Explain the following and analyze how they affects trading decision(s) making and analysis of investments: i) Snakebite effect ii) House-money effect ii) Endowment effect iv) Disposition effect v) Overconfidence

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 25P

Related questions

Question

Transcribed Image Text:You have been approached by Onua Do Ltd who wants to know how their portfolio is fairing.

The Company has over the years spread their funds in this order: 30% stock in A, 50% stock

in B and the rest in stock C.

State of Economy Probability Stock A

Return

Stock B

Return

Stock C

Return

Boom 0.10 24% 5% 14%

Normal 0.70 11% 6% 9%

Recession 0.20 -30% 7% -5%

a). What is the standard deviation of their portfolio?,

b). Explain the following and analyze how they affects trading decision(s) making and

analysis of investments:

i) Snakebite effect

ii) House-money effect

ii) Endowment effect

iv) Disposition effect

v) Overconfidence

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning