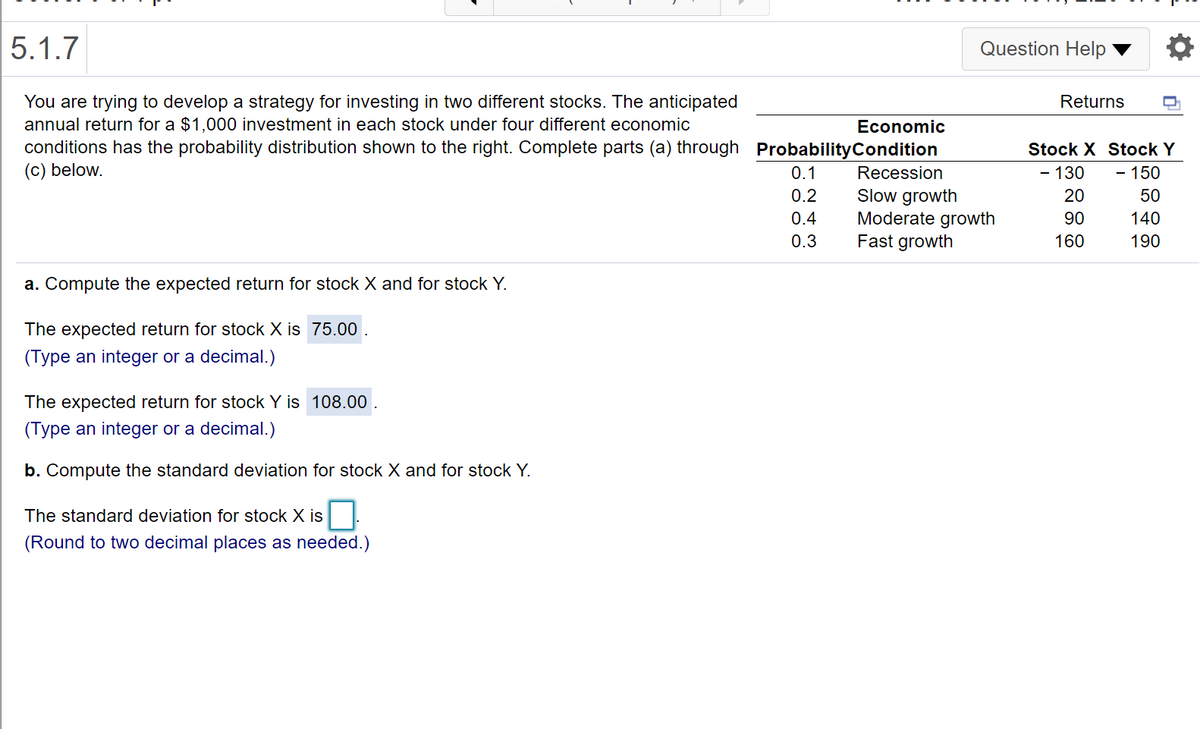

You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under four different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below.

You are trying to develop a strategy for investing in two different stocks. The anticipated annual return for a $1,000 investment in each stock under four different economic conditions has the probability distribution shown to the right. Complete parts (a) through (c) below.

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter8: Basic Stock Valuation

Section: Chapter Questions

Problem 16P

Related questions

Question

looking for help solving standard deviation for stock x and stock y, preferably with instructions on how to solve in excel.

Transcribed Image Text:5.1.7

Question Help

You are trying to develop a strategy for investing in two different stocks. The anticipated

annual return for a $1,000 investment in each stock under four different economic

conditions has the probability distribution shown to the right. Complete parts (a) through ProbabilityCondition

(c) below.

Returns

Economic

Stock X Stock Y

0.1

Recession

- 130

- 150

Slow growth

Moderate growth

Fast growth

0.2

20

50

0.4

90

140

0.3

160

190

a. Compute the expected return for stock X and for stock Y.

The expected return for stock X is 75.00 .

(Type an integer or a decimal.)

The expected return for stock Y is 108.00 .

(Type an integer or a decimal.)

b. Compute the standard deviation for stock X and for stock Y.

The standard deviation for stock X is

(Round to two decimal places as needed.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT