You have been assigned to check the valuation of InfoSystems, a software firm, done by a colleague of you. Infosystems has an expected life 5 years, constant cash flows over this period, and zero salvage value. The income statement of the Infosystems is given as follows: Years 1-5 Revenues €1000 -Operating expenses €550 EBIT €450 - Interest expesnes €85 Taxable income €365 - Taxes €146 Net income €219 Infosystems has no capital expenditures, depreciation or working capital needs, i.e. the earnings are the cash flows to the firm. The cost of capital is 10% i. Estimate the value of Infosystems. ii. Assume that the value derived in (i) is the one also estimated by your colleague. How would you change your calculations if you are given that the cash flows are real cash flows and the cost of capital is the nominal cost of capital. The expected inflation rate is 2% annually. Comment on your answer.

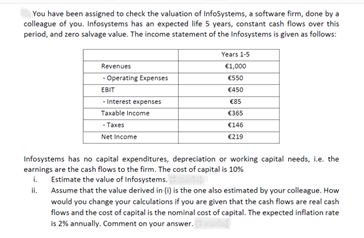

You have been assigned to check the valuation of InfoSystems, a software firm, done by a

colleague of you. Infosystems has an expected life 5 years, constant cash flows over this

period, and zero salvage value. The income statement of the Infosystems is given as follows:

| Years 1-5 | |

| Revenues | €1000 |

| -Operating expenses | €550 |

| EBIT | €450 |

| - Interest expesnes | €85 |

| Taxable income | €365 |

| - Taxes | €146 |

| Net income | €219 |

Infosystems has no capital expenditures,

earnings are the cash flows to the firm. The cost of capital is 10%

i. Estimate the value of Infosystems.

ii. Assume that the value derived in (i) is the one also estimated by your colleague. How

would you change your calculations if you are given that the cash flows are real cash

flows and the cost of capital is the nominal cost of capital. The expected inflation rate

is 2% annually. Comment on your answer.

Step by step

Solved in 4 steps