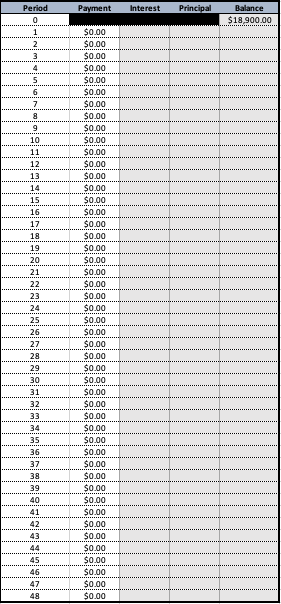

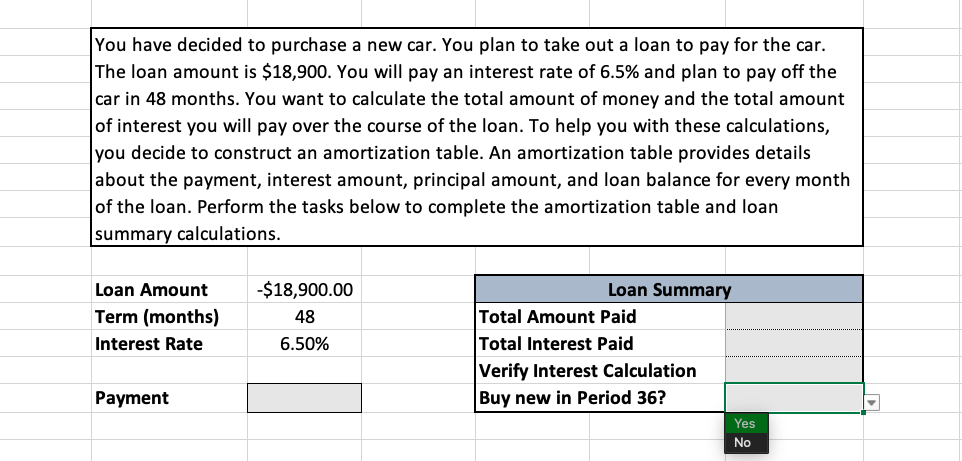

You have decided to purchase a new car. You plan to take out a loan to pay for the car. The loan amount is $18,900. You will pay an interest rate of 6.5% and plan to pay off the car in 48 months. You want to calculate the total amount of money and the total amount of interest you will pay over the course of the loan. To help you with these calculations, |you decide to construct an amortization table. An amortization table provides details about the payment, interest amount, principal amount, and loan balance for every month of the loan. Perform the tasks below to complete the amortization table and loan summary calculations.

You have decided to purchase a new car. You plan to take out a loan to pay for the car. The loan amount is $18,900. You will pay an interest rate of 6.5% and plan to pay off the car in 48 months. You want to calculate the total amount of money and the total amount of interest you will pay over the course of the loan. To help you with these calculations, |you decide to construct an amortization table. An amortization table provides details about the payment, interest amount, principal amount, and loan balance for every month of the loan. Perform the tasks below to complete the amortization table and loan summary calculations.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter17: Accounting For Notes And Interest

Section: Chapter Questions

Problem 1MYW

Related questions

Question

AMORTIZATION

Transcribed Image Text:Period

Payment

Interest

Principal

Balance

$18.900.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

1

.***.....

2

*******

3

6.

9

10

11

12

13

14

15

16

17

18

$00

$0.00

$00

$0.00

$00

$0.00

$00

$0.00

$00

$0.00

$00

$0.00

$00

$0.00

$00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

$0.00

19

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

46

47

48

$0.00

Transcribed Image Text:You have decided to purchase a new car. You plan to take out a loan to pay for the car.

The loan amount is $18,900. You will pay an interest rate of 6.5% and plan to pay off the

car in 48 months. You want to calculate the total amount of money and the total amount

of interest you will pay over the course of the loan. To help you with these calculations,

you decide to construct an amortization table. An amortization table provides details

about the payment, interest amount, principal amount, and loan balance for every month

of the loan. Perform the tasks below to complete the amortization table and loan

summary calculations.

Loan Amount

-$18,900.00

Loan Summary

Term (months)

Total Amount Paid

Total Interest Paid

48

Interest Rate

6.50%

Verify Interest Calculation

Payment

Buy new in Period 36?

Yes

No

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning