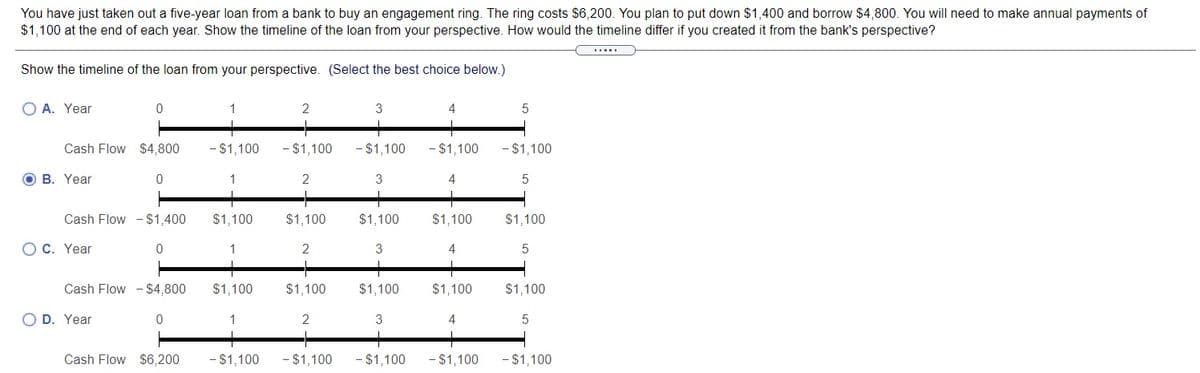

You have just taken out a five-year loan from a bank to buy an engagement ring. The ring costs $6,200. You plan to put down $1,400 and borrow $4,800. You will need to make annual payments of $1,100 at the end of each year. Show the timeline of the loan from your perspective. How would the timeline differ if you created it from the bank's perspective? Show the timeline of the loan from your perspective. (Select the best choice below.) O A. Year 1 3 4 Cash Flow $4,800 - $1,100 $1,100 - $1,100 -$1,100 - $1,100 O B. Year 1 3 4 Cash Flow - $1,400 $1,100 $1,100 $1,100 $1,100 $1,100 OC. Year Cash Flow - $4,800 $1.100 $1,100 $1,100 $1,100 $1,100 O D. Year 1 Cash Flow $6,200 -$1,100 -$1,100 -$1,100 -$1,100 -$1,100

You have just taken out a five-year loan from a bank to buy an engagement ring. The ring costs $6,200. You plan to put down $1,400 and borrow $4,800. You will need to make annual payments of $1,100 at the end of each year. Show the timeline of the loan from your perspective. How would the timeline differ if you created it from the bank's perspective? Show the timeline of the loan from your perspective. (Select the best choice below.) O A. Year 1 3 4 Cash Flow $4,800 - $1,100 $1,100 - $1,100 -$1,100 - $1,100 O B. Year 1 3 4 Cash Flow - $1,400 $1,100 $1,100 $1,100 $1,100 $1,100 OC. Year Cash Flow - $4,800 $1.100 $1,100 $1,100 $1,100 $1,100 O D. Year 1 Cash Flow $6,200 -$1,100 -$1,100 -$1,100 -$1,100 -$1,100

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 14P

Related questions

Question

100%

Transcribed Image Text:You have just taken out a five-year loan from a bank to buy an engagement ring. The ring costs $6,200. You plan to put down $1,400 and borrow $4,800. You will need to make annual payments of

$1,100 at the end of each year. Show the timeline of the loan from your perspective. How would the timeline differ if you created it from the bank's perspective?

Show the timeline of the loan from your perspective. (Select the best choice below.)

O A. Year

1

2

3

4

Cash Flow $4,800

- $1,100

-$1,100

- $1,100

- $1,100

- $1,100

O B. Year

1

2

3

4

Cash Flow - $1,400

$1,100

$1,100

$1,100

$1,100

$1,100

O C. Year

1

2

3

4

Cash Flow - $4,800

$1,100

$1,100

$1,100

$1,100

$1,100

O D. Year

1

2

3

4

Cash Flow $6,200

- $1,100

-$1,100

- $1,100

- $1,100

- $1,100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning