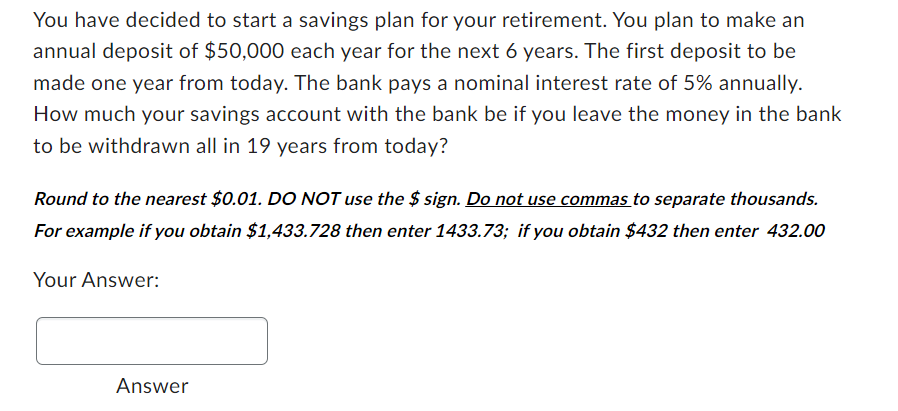

You have decided to start a savings plan for your retirement. You plan to make an annual deposit of $50,000 each year for the next 6 years. The first deposit to be made one year from today. The bank pays a nominal interest rate of 5% annually. How much your savings account with the bank be if you leave the money in the bank to be withdrawn all in 19 years from today? Round to the nearest $0.01. DO NOT use the $sign. Do not use commas to separate thousands. For example if you obtain $1,433.728 then enter 1433.73; if you obtain $432 then enter 432.00 Your Answer: Answer

You have decided to start a savings plan for your retirement. You plan to make an annual deposit of $50,000 each year for the next 6 years. The first deposit to be made one year from today. The bank pays a nominal interest rate of 5% annually. How much your savings account with the bank be if you leave the money in the bank to be withdrawn all in 19 years from today? Round to the nearest $0.01. DO NOT use the $sign. Do not use commas to separate thousands. For example if you obtain $1,433.728 then enter 1433.73; if you obtain $432 then enter 432.00 Your Answer: Answer

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 32P

Related questions

Question

Transcribed Image Text:You have decided to start a savings plan for your retirement. You plan to make an

annual deposit of $50,000 each year for the next 6 years. The first deposit to be

made one year from today. The bank pays a nominal interest rate of 5% annually.

How much your savings account with the bank be if you leave the money in the bank

to be withdrawn all in 19 years from today?

Round to the nearest $0.01. DO NOT use the $sign. Do not use commas to separate thousands.

For example if you obtain $1,433.728 then enter 1433.73; if you obtain $432 then enter 432.00

Your Answer:

Answer

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning