You have the opportunity to receive $5.000 today or to receive $5,500 in 3 years? Approximately what interest rate would make these two sums equivalent to each other, so it wouldn't make any difference to you as to which option you received?

You have the opportunity to receive $5.000 today or to receive $5,500 in 3 years? Approximately what interest rate would make these two sums equivalent to each other, so it wouldn't make any difference to you as to which option you received?

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter9: Current Liabilities, Contingencies, And The Time Value Of Money

Section: Chapter Questions

Problem 9.21MCE

Related questions

Question

Q. 3

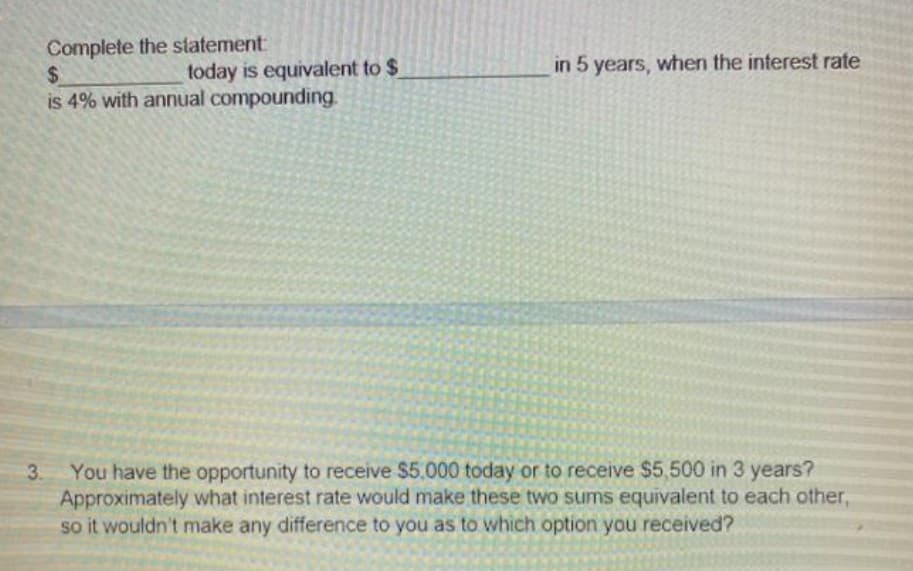

Transcribed Image Text:Complete the statement

%24

is 4% with annual compounding.

today is equivalent to $

in 5 years, when the interest rate

You have the opportunity to receive $5,000 today or to receive $5,500 in 3 years?

Approximately what interest rate would make these two sums equivalent to each other,

so it wouldn't make any difference to you as to which option you received?

3.

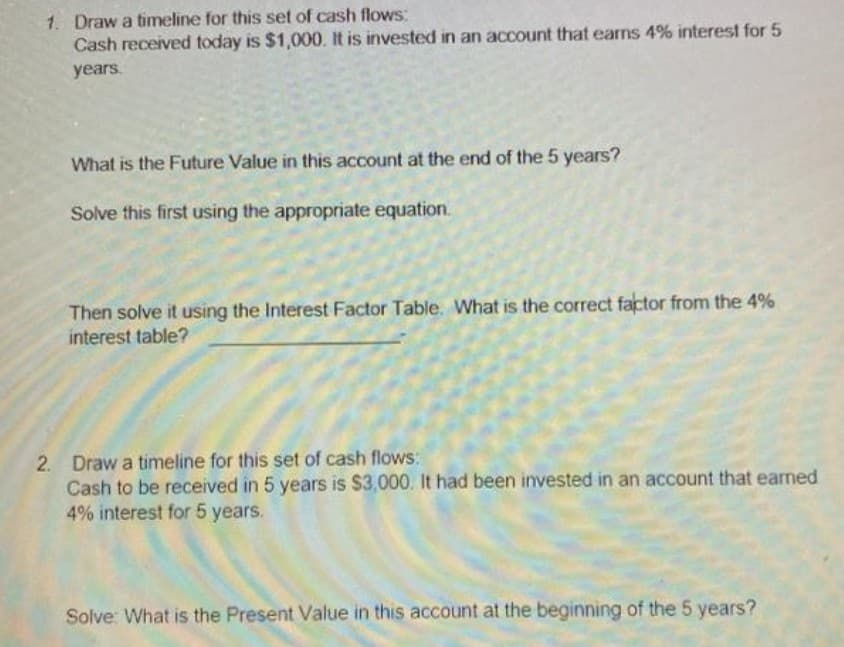

Transcribed Image Text:1. Draw a timeline for this set of cash flows:

Cash received today is $1,000. It is invested in an account that earns 4% interest for 5

years.

What is the Future Value in this account at the end of the 5 years?

Solve this first using the appropriate equation.

Then solve it using the Interest Factor Table. What is the correct factor from the 4%

interest table?

2. Draw a timeline for this set of cash flows:

Cash to be received in 5 years is $3,000. It had been invested in an account that earned

4% interest for 5 years.

Solve: What is the Present Value in this account at the beginning of the 5 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning