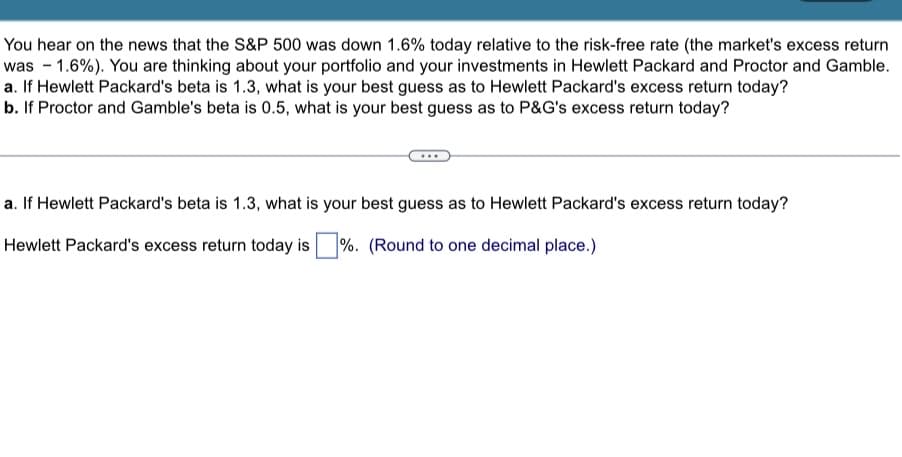

You hear on the news that the S&P 500 was down 1.6% today relative to the risk-free rate (the market's excess return was -1.6%). You are thinking about your portfolio and your investments in Hewlett Packard and Proctor and Gamble. a. If Hewlett Packard's beta is 1.3, what is your best guess as to Hewlett Packard's excess return today? b. If Proctor and Gamble's beta is 0.5, what is your best guess as to P&G's excess return today? a. If Hewlett Packard's beta is 1.3, what is your best guess as to Hewlett Packard's excess return today? Hewlett Packard's excess return today is %. (Round to one decimal place.)

You hear on the news that the S&P 500 was down 1.6% today relative to the risk-free rate (the market's excess return was -1.6%). You are thinking about your portfolio and your investments in Hewlett Packard and Proctor and Gamble. a. If Hewlett Packard's beta is 1.3, what is your best guess as to Hewlett Packard's excess return today? b. If Proctor and Gamble's beta is 0.5, what is your best guess as to P&G's excess return today? a. If Hewlett Packard's beta is 1.3, what is your best guess as to Hewlett Packard's excess return today? Hewlett Packard's excess return today is %. (Round to one decimal place.)

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 14P

Related questions

Question

Transcribed Image Text:You hear on the news that the S&P 500 was down 1.6% today relative to the risk-free rate (the market's excess return

was -1.6%). You are thinking about your portfolio and your investments in Hewlett Packard and Proctor and Gamble.

a. If Hewlett Packard's beta is 1.3, what is your best guess as to Hewlett Packard's excess return today?

b. If Proctor and Gamble's beta is 0.5, what is your best guess as to P&G's excess return today?

a. If Hewlett Packard's beta is 1.3, what is your best guess as to Hewlett Packard's excess return today?

Hewlett Packard's excess return today is %. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning