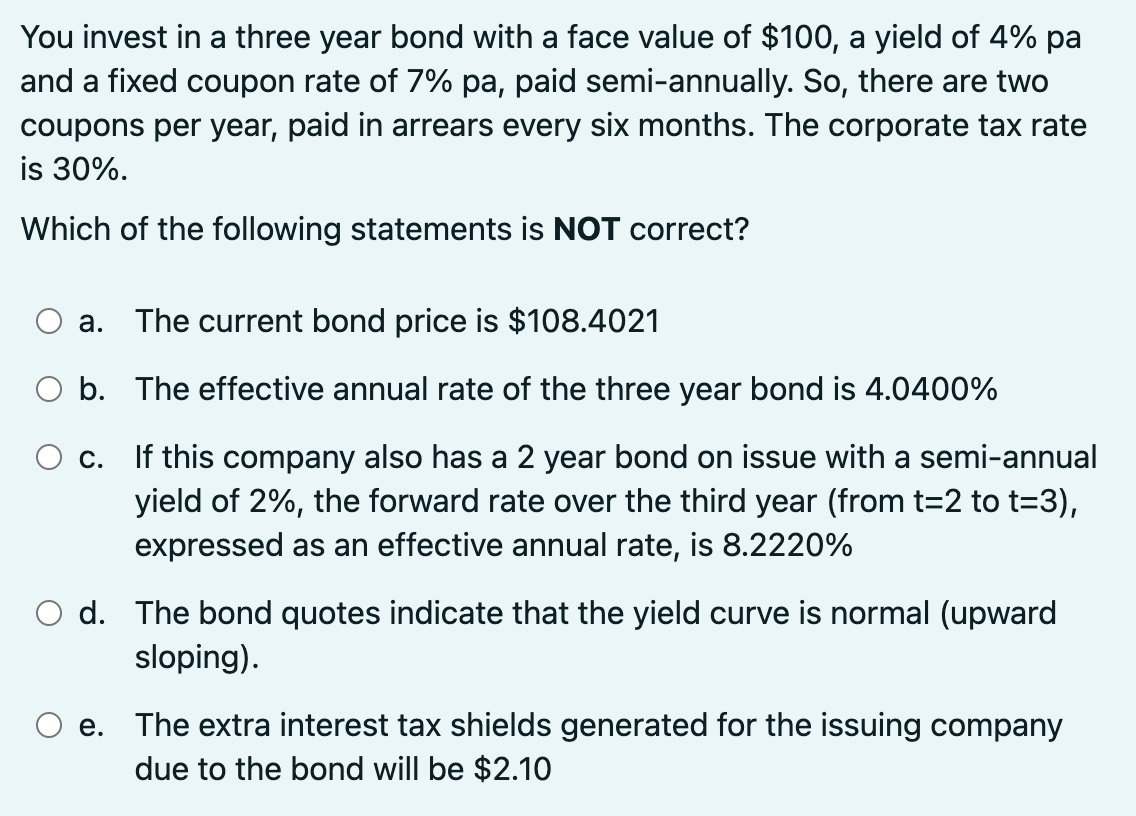

You invest in a three year bond with a face value of $100, a yield of 4% pa and a fixed coupon rate of 7% pa, paid semi-annually. So, there are two coupons per year, paid in arrears every six months. The corporate tax rate s 30%.

You invest in a three year bond with a face value of $100, a yield of 4% pa and a fixed coupon rate of 7% pa, paid semi-annually. So, there are two coupons per year, paid in arrears every six months. The corporate tax rate s 30%.

Chapter6: Fixed-income Securities: Characteristics And Valuation

Section: Chapter Questions

Problem 4P

Related questions

Question

2

Transcribed Image Text:You invest in a three year bond with a face value of $100, a yield of 4% pa

and a fixed coupon rate of 7% pa, paid semi-annually. So, there are two

coupons per year, paid in arrears every six months. The corporate tax rate

is 30%.

Which of the following statements is NOT correct?

а.

The current bond price is $108.4021

O b. The effective annual rate of the three year bond is 4.0400%

If this company also has a 2 year bond on issue with a semi-annual

yield of 2%, the forward rate over the third year (from t=2 to t=3),

C.

expressed as an effective annual rate, is 8.2220%

d. The bond quotes indicate that the yield curve is normal (upward

sloping).

e. The extra interest tax shields generated for the issuing company

due to the bond will be $2.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College