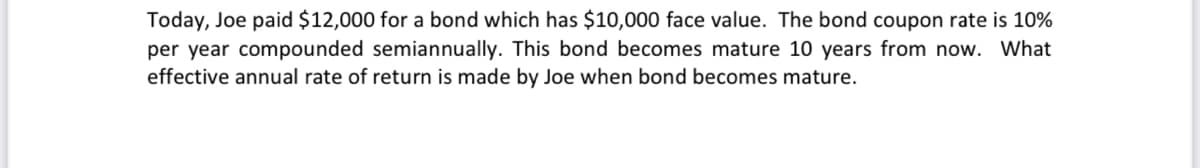

Today, Joe paid $12,000 for a bond which has $10,000 face value. The bond coupon rate is 10% per year compounded semiannually. This bond becomes mature 10 years from now. What effective annual rate of return is made by Joe when bond becomes mature.

Q: Johnson, the CFO of Homer Industries, Inc is trying to determine the Weighted Cost of Capital (WACC)…

A: Weighted average cost of capital is weighted cost of equity, weighted cost of debt after tax and…

Q: Makhado Limited has a target capital structure of 60% equity and 40% debt. The before-tax cost of…

A: Weighted average cost of capital is very important from point of view of the capital decision making…

Q: In a gaming room of a high-traffic video arcade wishes to determine the return on its video machine.…

A:

Q: How does pe effect the stock market

A: PE reflects the price to earning ratio. It is the ratio of current market price to the earning for…

Q: Carson, Inc. invests in cost saving technology. Based on the data below, the annual cost savings…

A: The gain achieved from activities that lower an organization's overall spending on assets that…

Q: 12X+5.135-5.135X X= (3.765/6.875)= .547635. There are some problem as below: 12X-5.135X should be…

A: WACC is the weighted average cost of capital and depends on debt to equity ratio of the company.…

Q: The project's NPV? WACC: 10.00% Year 0 1 2 3 Cash flows -$1,000 $450…

A: The NPV is based on discounted cash flows. The NPV provides the information of net cash flows…

Q: On July 30, 2021, the following information was available to an investor: Yield on 10 Year TIPS:…

A: TIPS are treasury inflation-protected securities. These securities are indexed to inflation and…

Q: The following data are taken from a United States Department of Agriculture (USDA) report for the…

A: Total Supply = Beginning Stocks + Production + Imports Ending Stock = Total Supply - Use It is also…

Q: Determine the periodic payments on the given loan or mortgage. HINT [See Example 5.] (Round your…

A: As per the given information: Annual payment rate (APR) = 7% = 0.07 P = $4,000,000 T = 20 years n =…

Q: You are looking to purchase Company A. Your projections for the EBITDA of Company A are as Follows:…

A: Value of a company Based on EBITDA and EBITDA multiple, the value of firm or enterprise is…

Q: K A corporate bond makes payments of $9.67 every month for ten years with a final payment of…

A: Final payment of bond comprises of face value and periodic coupon payment, i.e., Final payment =…

Q: Finding the Target Capital Structure [LO3] Fama's Llamas has a weighted average cost of capital of…

A: The debt equity ratio is ratio of total loan capital to the equity capital in the capital structure…

Q: How much will the coupon payments be of a 15-year $500 bond with a 9% coupon rate and quarterly…

A: To calculate the coupon payment amount we will use the below formula Coupon amount = FV*(C/M)…

Q: 'inding the W Given the following information for Eve Power Co., find the WACC. Assume the company's…

A: The WACC weighted average cost of capital is the weighted cost of debt , weighted cost of equity and…

Q: Can you re-check your work?

A: Information Provided: Semiannual payments = $4016.00 Years = 23 Interest rate = 14%

Q: beta of 0.9. The yield on a 3-month T-bill is 4% and the yield on a 10-year T-bond is 8%. The market…

A: As per capital asset pricing model :- Cost of equity= risk free rate + beta * market risk premium…

Q: As a member of UA Corporation's financial staff, you must estimate the Year 1 cash flow for a…

A: Operating cash flow of the project helps in understanding if the business is able to generate…

Q: Oil Drilling company is considering the installation of new automated drilling equipment. The new…

A: Capital Budgeting Capital budgeting and investment appraisal are planning processes used to assess…

Q: 5. explain what the benefits of escrow for both the borrower and the lender may be? Do disadvantages…

A: When you make big investment or purchase property in the market than there is need of third party…

Q: Evaluate ordinary annuity Assume monthly payouts - round your answer to nearest cent. M = $50 R =…

A: Present Value: The present value (PV) is the present sum of a series of fixed payments. The series…

Q: Financial analysis is very important factor for a successful project, discuss its strength and…

A: Financial controls are rules and procedures developed by an organization to manage its financial…

Q: heavy equipment for a certain project and the details are as follows: ITEM: MACHINE A: MACHINE B:…

A: Annual Costs= Annual operating cost +Annual labor cost +0.10(Annual labor cost) + 0.04(First cost)

Q: If she starts making deposit amounts in one year and her deposits increase at the inflation rate of…

A: Inflation: The Wholesale Price Index's (WPI) annual percentage change in value is known as…

Q: ni is a self-manufactured, he wants to calculate how much the price for their new product if the…

A: The price to be charged to customer depends on the production cost and logistic cost and transport…

Q: If $15,000 is invested at 3.5% for 20 years, find the future value if the interest is compounded the…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: If Rita receives $36.44 interest for a deposit earning 6% simple interest for 10 days, what is the…

A: Interest received = $36.44 Interest rate = 0.06 or 6% Number of days = 10 Amount deposit = ? In…

Q: invests $80,000 today at 10% per annum, compounded quarterly. What will the balance of Sam's…

A: Effective rate = 0.10/4 = 0.025 n = 5 * 4 = 20 Current amount = 80000

Q: The payment for a certain loan was arranged such that Dino will pay $5,500 every month for the first…

A: Present Value: The present value (PV) is the present sum of a series of fixed payments. The series…

Q: company is estimating its optimal capital structure. Now the company has a capital structure that…

A: Beta of the stock shows the systematic risk that risk related to the overall market and show…

Q: Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of…

A: Internal rate of return : It is the return that the project is estimated to generate to cover its…

Q: An automobile manufacturer is consid will save $7,500,000 per year in manua salvage value at the end…

A: IRR is internal rate of return is the discount rate at which present value of savings from equipment…

Q: Net Present Value (NPV) • Definition • Formula & Calculation in 6 Steps • 2 Illustrative Examples…

A: Hi, since you have posted a question with multiple sub-parts, we will answer the first three as per…

Q: Caspian Sea Drinks is considering the purchase of a new water filtration system produced by Rube…

A: The incremental cash flow measures the effect of a new project on the cash flows of the company. It…

Q: Assume you have a student loan that you will pay off in 10 years. How much will you save in interest…

A: In this question we will make use of the table provided in the second image i.e. monthly payment on…

Q: Given the following incomplete sensitivity analysis, what is the net present value of annual cash…

A: Sensitivity Analysis: Sensitivity Analysis involves the study of the impact of one factor on a…

Q: You needed $10,000 and obtained the following loan: Loan specifics: You are expected to pay 24 equal…

A:

Q: Marissa borrowed $1,010 today and is to repay the loan in two equal payments, one in 3 months and…

A: A loan is an agreement between two parties where one party gets a set amount from the other party in…

Q: Cummings Products is considering two mutually exclusive investments whose expected net cash flows…

A: NPV profile It is a graph where NPVs are plotted on Y-axis and discount rates are plotted on x-axis.…

Q: A new city truck can be purchased for $2,400,000. Its expected useful life is six years, at which…

A: Present Value: The present value (PV) is the present sum of a series of fixed payments. The series…

Q: A stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return…

A: Current price of stock is calculated using following equation Price of stock = D1 / (r-g) Where, D1…

Q: The payback method measures: The profitability of an investment. The net cash inflow from an…

A: Pay back period is most popular method of capital budgeting decisions and is quite simple to use and…

Q: Greater role assumed by government in bailing out financial intermediaries – too big to fail…

A: Financial intermediary is referred as the institution or an individual, which act as a middleman…

Q: An individual borrows ₱150,000 from a bank at 10% annually compounded interest to be repaid in 6…

A: Loan can be amortized by repaying it in equal instalments. Each payment comprises of both interest…

Q: Proposal B: Investment in commercial space Hitesh Builders, owned by one of his ex-students, are…

A: Net present value (NPV) It is a capital budgeting tool to decide on whether the provided investment…

Q: 2.1 Calculate the weighted average cost of capital by making use of target capital structure. 2.2…

A: Information Provided: Equity weight = 60% Debt weight = 40% Tax rate = 28% Cost of equity = 13%…

Q: LL Incorporated's currently outstanding 10% coupon bonds have a yield to maturity of 7.8%. LL…

A: Yield to maturity(YTM) is the rate of return that a bondholder will get if received all promised…

Q: The Bloomberg screen below shows the Nasdaq Index price over the last year. Describe the technical…

A: In the chart, there are 3 technical indicators used:50 day simple moving average (SMA) - pink…

Q: What is lease assignment? What is subletting? Explain at least one main difference between these…

A: In the world of finance in general and letting out of properties in particular the concepts of lease…

Q: You think that there is an arbitrage opportunity on the market. The current stock price of Wesley…

A: Put-call parity is used to find out the actual price of the options that have the same…

Step by step

Solved in 2 steps

- Krystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?Jimmy has a bond with a $1,000 face value and a coupon rate of 9.5% paid semiannually. It has a five-year life. If investors are willing to accept a 14 percent rate of return on bonds of similar quality, what is the present value or worth of this bond? Show your work. What is the impact of paying interest semi-annually rather than annually? Explain.A Bond with a face value of $15000 matures in 8 years. The bond rate of interest is 10% paid semi-annually. If you buy this bond for $12000, at what effective annual rate of interest did you receive?

- Bob uses 19481 to purchase a 10-year par-value bond (i.e. redeems at face-value). Coupons are paid out annually (end of the year) and each coupon is equal to 2% of the face-value of the bond. If each coupon payment is invested into an account that earns an effective annual interest rate of 2.4%, then what is the face-value of the bond if Bob realizes an overall yield of 3.36% per year effective over the 10 year period? Give your answer rounded to the nearest whole number (i.e. X).James Smith bought 10-year bonds issued by Harvest Foods five years ago for $930.00. The bonds make semiannual coupon payments at a rate of 8.0 percent. If the current price of the bonds is $1,040.77, what is the yield that James would earn by selling the bonds today?You will receive $60 interest every six months from your investment in a corporate bond. The bond will mature in five years from now and it has a face value of $2,000. This means that if you hold the bond until its maturity, you will continue to receive $150 interest semiannually and $2,000 face value at the end of five years.(a) What is the present value of the bond in the absence of inflation if the market interest rate is 9% '?(b) What would happen to the value of the bond if the inflation rate over thenext five years is expected to be 4%?

- Consider a six-year, 10% coupon bond (yearly coupon payments) with a face value of $1000 that John bought for $950. (a). What is the yield to maturity of this bond? (b). Suppose after holding it for one year, (and receiving one coupon payment), John sells it for $1050. What is the return John got from holding this bond for one year?Many years ago, Topnotch Knives issued a zero coupon bond with a $1,000 face value. The bond matures in three years. If the current market rate on similar bonds is 12 percent, (a) what is the bond's current value? Suppose the market rate stays at 12 percent for the next three years. What (b) current yield and (c) capital gains yield will bondholders receive each year during the remainder of the bond's life?Please assist with the following question below with handwritten working: An investor purchased a bond that pays $5 coupons annually at the end of every year for five years. The purchase price was $100 and it was redeemed at par after five years. If the annual effective inflation rate over the time period was 3%, calculate the real rate of return earned by the investor on this bond.

- Shannon purchases a bond for $952.00. The bond matures in 3 years, and Shannon will redeem it at its face value of $1,000. Coupon payments are paid annually. If Shannon will earn a yield of 12%/year compounded yearly, what is the bond coupon rate?Eight years ago, Over-the-Top Trampolines issued a 15-year bond with a $1,000 par value and a 6 percent coupon rate (interest is paid annually). Today the going rate of interest on similar bonds is 6 percent. (a) What is the bond’s current value? If the market rate stays at 6 percent for the remainder of the bond’s life, what (b) current yield and (c) capital gains yield will bondholders receive during the next two years (i.e., Years 9 and 10)?