you like you!), you are assuming the educa plan to put money into an investment a You believe that you will need about S no

Q: The direct materials price variance for October is: The direct materials quantity variance for…

A: “Since you have posted a question with multiple sub parts, we will provide the solution only to the…

Q: Identify one advantage of corporate form of business over a proprietorship

A: Proprietorship, also known as a sole proprietorship, is a type of business ownership where a single…

Q: if the IRS rejects the electronic portion of a taxpaers indivdaul income tax return for processing…

A: A person or company that has been given permission by the Internal Revenue Service (IRS) to submit…

Q: he Accounts Question: Why should debits t

A: Debits to expense accounts should exceed the credits because expenses represent the costs incurred…

Q: Income Statement, Statement of Owners Equity, Balance Sheet

A: The statement of owners’ equity is the statement in which the change in the owners funds are shown…

Q: Doug's Custom Construction Company is considering three new projects, each requiring an equipment…

A: Year Cash flows of AA Cash flows of BB Cash flows of CC 0 $ -26,840.00 $…

Q: The following data are for four independent process-costing departments. Inputs are added…

A: Equivalent units of production shows the work done by the entity on certain number of units during a…

Q: The following selected accounts from Crane Corporation's general ledger are presented below for the…

A: Income statement is a part of financial statement.Income statement includes all the income and…

Q: The following data are given for Zoyza Company: Line Item Description Value Budgeted production (at…

A: The variance is the difference between standard and actual production overhead costs. The fixed…

Q: Crane Company sells product 2005WSC for $40 per unit and uses the LIFO method. The cost of one unit…

A: The values of inventory to be reported on the balance sheet of a firm depend on the accounting…

Q: Cath Maulion is a lawyer who doesn't think that she needs an accountant. She is the one who made the…

A: Statement of financial position refers to the statement which shows the assets, liabilities and…

Q: accounting When a company makes a sale on credit, what does the account receivable represent on…

A: The balance sheet represents the financial position of the business with assets and liabilities on a…

Q: Use the following data on Table 3 to decide should the Company lease or purchase the new production…

A: According to variables including the length of the lease period and whether the lessee assumes the…

Q: On January 1, 2023, Gordon Co. enters into a contract to sell a customer a wiring base and a…

A: As per the accounting standard (IFRS 15) Revenue from contracts with customer which is based on 5…

Q: On January 1, 2020, Crane Company leased equipment to Flynn Corporation. The following information…

A: Lease: A contractual agreement for an asset between two parties. The parties involved are the lessee…

Q: Javier and Anita Sanchez purchased a home on January 1, 2021, for $696,000 by paying $232,000 down…

A: An itemized deduction is a deduction representing expenses that can be deducted from adjusted gross…

Q: E&Z Reader was founded in January to provide text reading and recording services. Selected…

A: Accounting equation: It implies to a financial equation that establishes a relationship between the…

Q: Presented below is information related to Required: How much did Flores Company have in expenses for…

A: An accounting equation is an important concept in accounting that proves the establishment of an…

Q: Required: 1) Assign all manufacturing overheads to production and service costs. 2) Reallocate the…

A: Meaning of Allocation of overhead It means allocating or distributing a common cost to different…

Q: If DCC uses a dual-rate for allocating its costs based on usage, how much cost will be allocated to…

A: Given in the question: Cost Equation = $285,000 + $0.02 per page Company is using the dual rate…

Q: e joint costs using the ces and round the final allocations to the nearest dollar.…

A: COST ALLOCATION When item of cost are Identifiable directly with some products or departments such…

Q: Santana Rey is considering the purchase of equipment for Business Solutions that would allow the…

A: Payback Period:- Payback period is a financial metric used to evaluate the time it takes for an…

Q: Jody White, owner of White's Stencilling Service in Grande Prairie, has requested that you prepare…

A: Please find the financial statements of White's Stencilling Service in below steps.

Q: 58. Messersmith Company is constructing a building. Construction began in 2022 and the building was…

A: Accumulated expenses are the aggregate of all expenditures incurred throughout the period. These…

Q: Following is the general format of a four-column bank reconciliation with the various presentation…

A: Bank reconciliation statement is prepared to list out all the transaction due to which the balance…

Q: Please explain the principle considerations of a board of directors in making decisions involving…

A: Business is defined as any activity that assists in earning an income to the owner or the person who…

Q: Please do not give solution in image format thanku

A: DEPRECIATION EXPENSE Depreciation means gradual decrease in the value of an asset due to normal wear…

Q: Annual Project Investment Income 22A $240,100 $16.700 23A 24A Project 22A 23A 270,100 Annual income…

A: A method known as the internal rate of return is used to evaluate the profitability of certain…

Q: Determine the taxable amount of Social Security benefits for the following situations. If required,…

A: Please find the calculation of Taxable Social Security Benefits of Tyler & Candice in below…

Q: The summarised reformulated items (£) for BOLL Ltd in 2019 are given below: Net Operating Assets…

A: The Return on Common Equity (ROCE) using the first level decomposition approach is a financial ratio…

Q: job Cost Flows, Journal Entries On April 1, Sangvikar Company had the following balances in its…

A: The overhead is applied to the production on the basis of predetermined overhead rate. The overhead…

Q: Sandhill Inc. and Wildhorse Co. have an exchange with commercial substance. The asset given up by…

A: According to the question given, we need to prepare the journal entry to show the correct option.…

Q: the last one is showing wrong

A: Answer 3) When a special order circumstance occurs, management must compute the necessary costs to…

Q: Thea Gerona owns a massage spa and has the following accounts. She wanted to know her statement of…

A: The Financial statements of the business include income Statement and balance sheet. The balance…

Q: ABC Company has the following information for the year ended December 31, 2022: Sales revenue:…

A: The amount of money that a business or individual makes after subtracting all costs, taxes, and…

Q: Mothercity Traders is a gift shop in Cape Town. Mothercitx Traders uses the perpetual inventory…

A: Lets understand the basics. Accounting equation shows that assets are always equals to equity plus…

Q: Using a discount rate of 10 %, determine the payback time, cumulative present value, discounted net…

A: Payback period will be the time taken for any project to recover its outflows. A payback period will…

Q: What is the total net present value of these projects? Total net present value

A: The future profitability of an investment, project, or business is assessed using net present value.…

Q: information in this worksheet to complete Wk 4 Practice. orthside Medical Balance Sheet December 31,…

A: The analysis which is done by the entity to compare the data for two years is referred to as the…

Q: Prepare the depreciation schedule, using the declining-balance method (twice the straight-line…

A: Depreciation is the non-cash expense which is charged on the non-current assets due to regular wear…

Q: Exercise 9-5 Direct Labor Variances [LO9-5] SkyChefs, Inc., prepares in-flight meals for a number of…

A: Let's check for the formulas: (A) Standard Labor Hours: (No. of meals ×No. of DLH). (B)Standard…

Q: ow the external will use the accounting information to do decisions

A: Accounting information can be defined as the financial reports and data produced by way of…

Q: Subject - Acounting Last month when Holiday Creations, Incorporated, sold 41,000 units, total sales…

A: The contribution margin analysis is usually carried out for determining the break-even point in…

Q: Darsh and Darpan share an apartment. Both have separate cell phone plans. The costs are $70 and $90,…

A: Cost allocation is the technique which is used by the cost accountants to allocate a common cost to…

Q: David’s Clothing started business January 1, 2021, and uses the LIFO retail method to estimate…

A: Ending inventory refers to the value of the inventory that remains unsold and is still held by a…

Q: Drilling Company uses activity-based costing and provides this information: Driver Rate…

A: Activity-based costing (ABC) is a costing method that assigns the cost of each activity to all…

Q: M-a-k-e- -a- -d-e-t-a-i-l-e-d- -s-o-l-u-t-i-o-n- -a-n-d- -e-x-p-l-a-n-a-t-i-o-n- -o-f- -h-o-w-…

A: Banks or lenders do the task and activities through which it can be determined about how much money…

Q: Sandy Bank, Number of cances produced and sold Total costs Variable costs Fixed costs Incorporated,…

A: In simple terms, the contribution margin measures the profitability of each unit or sale and…

Q: Problem 1 Instructions a. Determine the budgeted cell conversion cost per hour. b. Determine the…

A: Conversion costs are the expenses or costs incurred in the process of production, converting raw…

Q: Internal Service Fund Governmental Activities Internal Service Fund Governmental Activities Record…

A: Introduction: Each business transaction should pass journal entry by showing debit side and credit…

Step by step

Solved in 3 steps with 1 images

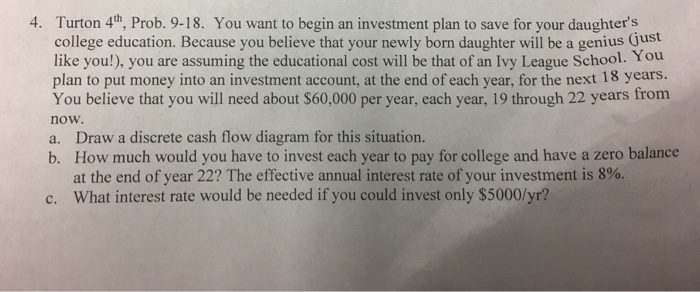

- A man wants to help provide a college education for his young daughter. He can afford to invest $1500/yr for the next 5 years, beginning on the girl’s 5th birthday. He wishes to give his daughter $10,000 on her 18th, 19th, 20th, and 21st birthdays, for a total of $40,000. Assuming 6% interest, what uniform annual investment will he have to make on the girl’s 9th through 17th birthdays? PLEASE USE EXCEL SOFTWARE TO SOLVE. WOULD GIVE POSITIVE RATING.Answer in excel 4. A high school student counselor for college education advises a senior that if she attends a private college to which she has been accepted, her annual cost after scholarship will be $12000 for each of four years. After graduating, she can expect to earn for the next twenty years $8000 year more a year than she would have if she did not go to college.a. What is the internal rate of return on this investment?You calculate that you will need $75,000 in ten years to be able to pay for your daughter's college education. If you invest $20,000 today, what rate of return will you need to achieve this goal? Select one: A. Between 12% and 13% B. Between 13% and 14% C. Between 14% and 15% D. Between 15% and 16%

- Mark is trying to decide if he should attend college or not. Part of his decision will be based on the return on investment of college. He estimates costs to attend Texas Tech for 4 years including room and board are $20,000 per year. He also assumes tuition costs will rise by 3.5% per year. How much is a 4-year degree going to cost Mark? $92,183.27 $84,298.86 $7,231,158.87 $1,314,002.834. Assume the total cost of a college education will be $300,000 when your child enters college in 18 years. You presently have $65,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child’s college education? (Do not round intermediate calculations and round your final answer to 2 decimal places. (e.g., 32.16)) Annual rate of interest %A young couple is planning for the education of their two children. They plan to invest the same amount of money at the end of each of the next 16 years, i.e., the first contribution will be made at the end of the year and the final contribution will be made at the time the oldest child enters college. The money will be invested in securities that are certain to earn a return of 8 percent each year. The oldest child will begin college in 16 years and the second child will begin college in 18 years. Assume each child begins school in January and each school year is a calendar year. The parents anticipate college costs of $25,000 per year (per child). These costs must be paid at the end of each year (i.e. the tuition for the oldest child’s first year of college must be paid at the end of the 17th year). If each child takes four years to complete their college degrees, then how much money must the couple save each year?

- Gabe and Sarah would like to begin saving for their children's college education. They would like to know the amount of college funds that would be necessary on day one of college to pay for all tuition costs for each child. The current tuition at the university is $25,000. The couple is comfortable assuming an annual rate of return of 6% on their college investment savings program. They anticipate that each child will begin college at age 18 and attend for four years. The Consumer Price Index (CPI) is expected to be 3% and the expected college inflation rate is 5% per year.I tried to answer the following exercise. Please let me know if it is correct. If I didn't do it right, please correct me. You would like to have $200,000 in a college fund in 15 years. How much do you need today if you expect to earn 12% while you are investing to pay for your child’s college? Answer: PV=200,000/(1+0.12)^15= 200,000/5.4736=36,539.02 The amount needed today to invest at 12% for 15 years to grows 200,000 is 36,539.02Megan Berry, a freshman horticulture major at the University of Minnesota, has some financial questions for the next three years of school and beyond. Round your answers for the following questions to the nearest dollar. Megan is already looking ahead to graduation and a job, and she wants to buy a new car not long after her graduation. If after graduation she begins an investment program of $3,000 per year in an investment yielding 5 percent, what will be the value of the fund after three years? (Hint: Use Appendix A-3 or the Garman/Forgue companion website.) Round Future Value of Series of Equal Amounts in intermediate calculations to four decimal places. $ Megan's Aunt Karroll told her that she would give Megan $1,200 at the end of each year for the next three years to help with her college expenses. Assuming an annual interest rate of 5 percent, what is the present value of that stream of payments? (Hint: Use Appendix A-4 or the Garman/Forgue companion website.) Round Present…

- 46. Your younger sister, Brittany, will start college in five years. She has just informed your parents that she wants to go to Eastern State U., which will cost $30,000 per year for four years (costs assumed to come at the end of each year). Anticipating Brittany's ambitions, your parents started investing $5,000 per year five years ago and will continue to do so for five more years. How much more will your parents have to invest each year for the next five years to have the necessary funds for Brittany's education? Use 10 percent as the appropriate interest rate throughout this problem (for discounting or compounding). Round all values to whole numbers. 47. Brittany (from Problem 46) is now 18 years old (five years have passed), and she wants to get married instead of going to college. Your parents have accumulated the necessary funds for her education. Instead of funding her schooling, your parents are paying $10.000 for her current wedding and plan to take year-end vacations…Assume the total cost of a college education will be $355,000 when your child enters college in 16 years. You presently have $57,000 to invest. What annual rate of interest must you earn on your investment to cover the cost of your child’s college education? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)Youngs want to know the cost of college education for the two children so that they can approach Angel’s father about fully funding 529 Plans. The current cost of education is $35,000 per year in today’s dollars and the inflation rate is expected to be 5%. They expect the children to be in school for 6 years each, and while they don’t know, they expect the 529 Plan’s investment rate to be 8.5%. Step 1: Calculate the inflation-adjusted, six-year cost of each child’s college education N = i = FV = PMT = PV= Step 2: Calculate the present value of the lump-sum cost of each child’s six years of college. For the 4 old For the 2 year old FV = FV = N = N = i = i = PMT = PMT = PV = PV = Total PV of two children: Step 3: Calculate the payment needed to each child’s 529 Plan For the 4 old For the 2 year old PV = PV = N = N = i = i = FV = FV = PMT = PMT = Total…