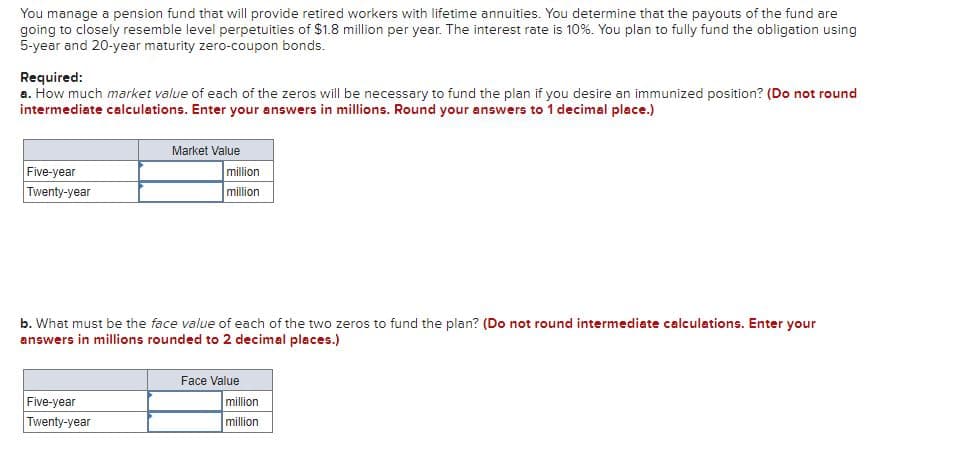

You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the fund are going to closely resemble level perpetuities of $1.8 million per year. The interest rate is 10%. You plan to fully fund the obligation using 5-year and 20-year maturity zero-coupon bonds. Required: a. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? (Do not round intermediate calculations. Enter your answers in millions. Round your answers to 1 decimal place.) Five-year Twenty-year Market Value Five-year Twenty-year million million b. What must be the face value of each of the two zeros to fund the plan? (Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Face Value million million

You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the fund are going to closely resemble level perpetuities of $1.8 million per year. The interest rate is 10%. You plan to fully fund the obligation using 5-year and 20-year maturity zero-coupon bonds. Required: a. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? (Do not round intermediate calculations. Enter your answers in millions. Round your answers to 1 decimal place.) Five-year Twenty-year Market Value Five-year Twenty-year million million b. What must be the face value of each of the two zeros to fund the plan? (Do not round intermediate calculations. Enter your answers in millions rounded to 2 decimal places.) Face Value million million

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 22P

Related questions

Question

Can I get assistance on this question please?

Transcribed Image Text:You manage a pension fund that will provide retired workers with lifetime annuities. You determine that the payouts of the fund are

going to closely resemble level perpetuities of $1.8 million per year. The interest rate is 10%. You plan to fully fund the obligation using

5-year and 20-year maturity zero-coupon bonds.

Required:

a. How much market value of each of the zeros will be necessary to fund the plan if you desire an immunized position? (Do not round

intermediate calculations. Enter your answers in millions. Round your answers to 1 decimal place.)

Market Value

Five-year

million

Twenty-year

million

b. What must be the face value of each of the two zeros to fund the plan? (Do not round intermediate calculations. Enter your

answers in millions rounded to 2 decimal places.)

Face Value

Five-year

Twenty-year

million

million

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT