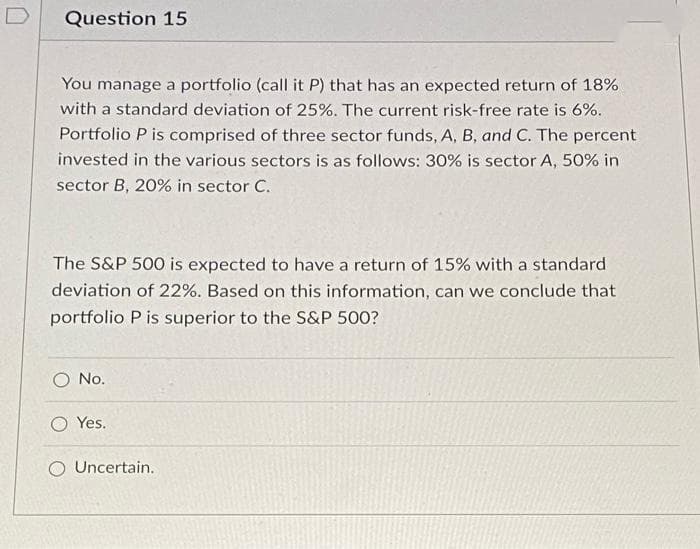

You manage a portfolio (call it P) that has an expected return of 18% with a standard deviation of 25%. The current risk-free rate is 6%. Portfolio P is comprised of three sector funds, A, B, and C. The percent invested in the various sectors is as follows: 30% is sector A, 50% in sector B, 20% in sector C. The S&P 500 is expected to have a return of 15% with a standard deviation of 22%. Based on this information, can we conclude that portfolio P is superior to the S&P 500? O No. O Yes. O Uncertain.

Q: William Beville's computer training school, in Richmond, stocks workbooks with the following…

A: The optimal quantity a business should acquire to reduce its inventory expenses, such as shortfall…

Q: K Suppose that a company has recently started manufacturing a new line of helicopters, and it took…

A: Given data is as follows: Days taken = 106.496 labor days to complete 16th helicopterLearning rate =…

Q: Using the FCFS rule for scheduling, the sequence is 1-2-3. For the schedule developed using the FCFS…

A: Sequencing is an appropriate order of plan as per which the process of operations works. It defines…

Q: Why is transportation forecasting so important, and why is it so difficult?

A: Introduction: Transportation Forecasting: When organizations can foresee the demands, they become…

Q: This exercise is based on the following data on four bodybuilding supplements. (Figures shown…

A: Given data is Creatine Glutamine BCAAs Cost ($) Xtend 0 2.5 7 1 Gainz 2 3 6 1.10…

Q: Why is operation management important for a business ?

A: ANSWER : Operations management is the process that generally plans, controls and supervises…

Q: Suppose you have a choice of three projects to choose from. Here the expected profits from these…

A: a)

Q: Carol Cagle has a repetitive manufacturing plant producing trailer hitches in Arlington, Texas. The…

A: Given data: Setup labor cost = $25/hr Annual Holding cost (H) = $12/unit Daily production (P) = 992…

Q: Girish Shambu and Delores Reisel are teammates at a discount store; their new job is assembling…

A: Ans) Learning Rate = 80% = 0.8 Second unit took = 5hrs b = log(learning rate)/log(2) =…

Q: A contractor is preparing a bid to install swimming pools at a new housing addition. The estimated…

A: The estimate time for second pool is calculated by first pool hour multiply with Learning rate.

Q: wen the following MRP matrix: LLC: 0 ITEM: X LOT SIZE: MIN 100 Gross Requirements Scheduled Receipts…

A: Ans) Total Inventory or Project on hand to through period 1 to 7 = (10+30+80+30+70+90+10) = 320…

Q: Jus de Fruit Co. has set up for automated production of its new bottled Triple Berry Colada. Six…

A: Given the data stated below, For this dataset, I have taken 6 samples and four subgroups, I would…

Q: Use the Inventory Control information above to answer this question. Since it costs $0.50 to store a…

A: Given, Demand D = 20000 copies Cost to store book for an year = $0.5 Setup S = $200 x = number of…

Q: 4. You have prepared the project information that is given below: Activity Predecessor Normal Time…

A: Find the given details below: Activity Predecessor Normal Time Normal Cost Crash Cost Crash time…

Q: Should Laura talk with Drew’s manager about the situation now? Why or why not?

A: A cross-functional initiative to enhance customer service in her organisation has invited Laura…

Q: The CEO of Carol O'Lights Manufacturing, produces custom-built relay devices for auto makers. The…

A: Ans) Prepare the Arrow on node diagram. Use predecessor to build AON Diagram. Formula for…

Q: Determine the utilization and the efficiency for each of these situations: A car wash operation…

A: Efficiency is the proportion between actual output and effective capacity. Similarly, the…

Q: What is the Late Start on Activity C? What is the slack on Activity C? What is the slack on…

A: A network diagram related to the project is which shows the set sequence of the task that is done to…

Q: George Heinrich Printing Company wants to schedule the following seven jobs where each job must be…

A: Find the Given details below: Given details: Job Order Machine A Machine B 1 15 3 2 7 9 3…

Q: What ethical, social, and political issues are raised by information systems? What specific…

A: Ethical, social and political issues are interrelated. These issues cannot be talked about in…

Q: A small candy shop is preparing for the holiday season. The owner must decide how many bags of…

A: Given data is Bag Required peanut Required raisin Selling price Standard 0.5 0.5 $3.75 Delux…

Q: ene is working with the operations manager to determine what the standard labor cost is for a spice…

A: Given- Time for processes -Milling of Wood = 1 hourCutting of wood = 43 minutes = 0.716667…

Q: uld increase the chance of catastrophic failure on the system?

A: A catastrophic failure is a total, unexpected, and abrupt breakdown of a machine, electronic system,…

Q: Kelly-Lambing, Inc., a builder of government contracted small ships, has a steady work force of 10…

A: Total time available = 2440×10= 24400 hours (given)Time taken in completing 1st boat = 6100…

Q: Volvo Logistics handles shipping for Volvo Trucks NorthAmerica from two Factories. One of these…

A: This is a transportation problem, which can be solved by excel. Solver constraints:

Q: 3. Project Monitoring (Earned Value Analysis) You have been given a project to transfer 10,000 units…

A: Given- Budget at Completion = £5000Actual cost (AC) = £950Total Output = 10,000 unitsSteady Rate =…

Q: Suppose the contracted volume changes to 275,000 gear housings. Based on the total cost, the…

A: Given data: Process General-Purpose Equipment (GPE) Flexible Manufacturing…

Q: Small boxes of Caesar salad croutons are labeled "net weight 3.5 ounces." To construct control…

A: Given-

Q: Educate staff and management of V&A Waterfront on different dynamics in Operations Management, by…

A: Planning, organising, and regulating the resources required to generate a company's goods and…

Q: The muffler assembly fabrication cell now averages 18 assemblies per hour and the lead time has been…

A: Given, Container size C = 15 units Safety stock S = 12.5% Average demand D = 18 per hour Lead time L…

Q: 4) In a 3 x 3 transportation problem, let xij be the amount shipped from source i to destination j…

A: Find the given details below: Given details: 1 2 3 Supply ui 1 C11 C12 C13 15 -2 2 C21…

Q: What steps you could have taken before and after the payment of bonus to ensure your decision is a…

A: One of the most effective financial incentives for recognizing an employee's accomplishment both…

Q: Make a list of two ways to reduce rework expenses. What role, in your opinion, does gradual delivery…

A: Optimal planning Without a proper and structured plan, it is sure that rework will happen sooner or…

Q: A normally distributed population has a mean of 578 and a standard deviation of 7.50. Find the…

A: Given, Sample size n = 100 Mean μ = μx = 578 Standard deviation δ= 7.5 Sample standard deviation δx=…

Q: A defense contractor in Dallas has six jobs awaiting processing. Processing time and due dates are…

A: Given-

Q: Using the FCFS rule for scheduling, the sequence is 1-2-3 For the schedule developed using the FCFS…

A: Sequencing is an appropriate order of plan as per which the process of operations works. It defines…

Q: Materials requirement planning (MRP) is used to manage inventory in the upper echelon of the supply…

A: EXPLANATION : Material requirements planning (MRP) is a framework for calculating the materials and…

Q: 3) Consider the assignment problem having the following cost table. Assignee A B C D a) Formulate…

A: Part (A): Decision Variables: Suppose-Xij be the decision variable, where assignee (i=1,2,3,4)…

Q: Find Optimal solution for this example (loop) ? ( NOT Initial basic feasible solution )

A: Given Information: VAM (Vogel's approximation method) of finding the Initial basic feasible…

Q: n a hostile takeover, what does the term "going private" reference? Multiple Choice A leveraged…

A: going private" reference > A confiscatory taking

Q: a) Based on the given information regarding the activities for the project, the project completion…

A: A network diagram related to the project shows the sequence of the task that is performed to…

Q: Gollee those cats sure go through a lot of food," Geoff exclaimed as he saw the shopping list pad…

A:

Q: You know that the average defect rate for a pen producer is 0.018. This production process is…

A: Upper control limit refers to greater value of maximum value . It is shown in the control chart.

Q: N2 More specifically, what are the two main reasons why certain things should not be up for…

A: Products and services are the only two things that companies are ready to sell. But also for some…

Q: Using the FCFS rule for scheduling, the sequence is 1-2-3 For the schedule developed using the FCFS…

A: FCFS: FCFS stands for First Come and First Serve. As per the FCFS rule, the process…

Q: Draw the Schedule Network diagram and durate. Ⓒ3 Col Colate for word pass Calculate Back Word paes

A: A network diagram related to the project shows the sequence of the task that is performed to…

Q: Courtney is a programmer receiving requests each week to analyze a large data base. Five jobs were…

A: Given-

Q: ?Q) Solve the LPP problems below by using big M-Method MIN Z=8X1+2X2 S.T X1+2X2=66 X1+6X2268…

A: Given LLP- Min Z = 8x1 + 2x2Subject to-x1 + 2x2= 66x1 + 6x2≥ 68x1 + 4x2≤82x1,x2≥0

Q: Answer the question based on article given- Thanks Q1-Write a description of parts and process…

A: A part and process document is a step-by-step description of process execution from beginning to…

Q: 4) Max Z = 4x1 + 8x2 s.t. 2x1 + 4x2 < 14 6x1 + 2x2 ≤ 12 Xi ≥0 Problem 4 should be graphed first.…

A: Given data is Max Z=4x1+8x2 Subject to constraints: 1.) 2x1+4x2≤142.) 6x1+2x2≤12xi≥0

13

Step by step

Solved in 2 steps

- A European put option allows an investor to sell a share of stock at the exercise price on the exercise data. For example, if the exercise price is 48, and the stock price is 45 on the exercise date, the investor can sell the stock for 48 and then immediately buy it back (that is, cover his position) for 45, making 3 profit. But if the stock price on the exercise date is greater than the exercise price, the option is worthless at that date. So for a put, the investor is hoping that the price of the stock decreases. Using the same parameters as in Example 11.7, find a fair price for a European put option. (Note: As discussed in the text, an actual put option is usually for 100 shares.)Suppose you currently have a portfolio of three stocks, A, B, and C. You own 500 shares of A, 300 of B, and 1000 of C. The current share prices are 42.76, 81.33, and, 58.22, respectively. You plan to hold this portfolio for at least a year. During the coming year, economists have predicted that the national economy will be awful, stable, or great with probabilities 0.2, 0.5, and 0.3. Given the state of the economy, the returns (one-year percentage changes) of the three stocks are independent and normally distributed. However, the means and standard deviations of these returns depend on the state of the economy, as indicated in the file P11_23.xlsx. a. Use @RISK to simulate the value of the portfolio and the portfolio return in the next year. How likely is it that you will have a negative return? How likely is it that you will have a return of at least 25%? b. Suppose you had a crystal ball where you could predict the state of the economy with certainty. The stock returns would still be uncertain, but you would know whether your means and standard deviations come from row 6, 7, or 8 of the P11_23.xlsx file. If you learn, with certainty, that the economy is going to be great in the next year, run the appropriate simulation to answer the same questions as in part a. Repeat this if you learn that the economy is going to be awful. How do these results compare with those in part a?Suppose you begin year 1 with 5000. At the beginning of each year, you put half of your money under a mattress and invest the other half in Whitewater stock. During each year, there is a 40% chance that the Whitewater stock will double, and there is a 60% chance that you will lose half of your investment. To illustrate, if the stock doubles during the first year, you will have 3750 under the mattress and 3750 invested in Whitewater during year 2. You want to estimate your annual return over a 30-year period. If you end with F dollars, your annual return is (F/5000)1/30 1. For example, if you end with 100,000, your annual return is 201/30 1 = 0.105, or 10.5%. Run 1000 replications of an appropriate simulation. Based on the results, you can be 95% certain that your annual return will be between which two values?

- You are considering a 10-year investment project. At present, the expected cash flow each year is 10,000. Suppose, however, that each years cash flow is normally distributed with mean equal to last years actual cash flow and standard deviation 1000. For example, suppose that the actual cash flow in year 1 is 12,000. Then year 2 cash flow is normal with mean 12,000 and standard deviation 1000. Also, at the end of year 1, your best guess is that each later years expected cash flow will be 12,000. a. Estimate the mean and standard deviation of the NPV of this project. Assume that cash flows are discounted at a rate of 10% per year. b. Now assume that the project has an abandonment option. At the end of each year you can abandon the project for the value given in the file P11_60.xlsx. For example, suppose that year 1 cash flow is 4000. Then at the end of year 1, you expect cash flow for each remaining year to be 4000. This has an NPV of less than 62,000, so you should abandon the project and collect 62,000 at the end of year 1. Estimate the mean and standard deviation of the project with the abandonment option. How much would you pay for the abandonment option? (Hint: You can abandon a project at most once. So in year 5, for example, you abandon only if the sum of future expected NPVs is less than the year 5 abandonment value and the project has not yet been abandoned. Also, once you abandon the project, the actual cash flows for future years are zero. So in this case the future cash flows after abandonment should be zero in your model.)In the cash balance model from Example 11.5, the timing is such that some receipts are delayed by one or two months, and the payments for materials and labor must be made a month in advance. Change the model so that all receipts are received immediately, and payments made this month for materials and labor are 80% of sales this month (not next month). The period of interest is again January through June. Rerun the simulation, and comment on any differences between your outputs and those from the example.Referring to Example 11.1, if the average bid for each competitor stays the same, but their bids exhibit less variability, does Millers optimal bid increase or decrease? To study this question, assume that each competitors bid, expressed as a multiple of Millers cost to complete the project, follows each of the following distributions. a. Triangular with parameters 1.0, 1.3, and 2.4 b. Triangular with parameters 1.2, 1.3, and 2.2 c. Use @RISKs Define Distributions window to check that the distributions in parts a and b have the same mean as the original triangular distribution in the example, but smaller standard deviations. What is the common mean? Why is it not the same as the most likely value, 1.3?

- The IRR is the discount rate r that makes a project have an NPV of 0. You can find IRR in Excel with the built-in IRR function, using the syntax =IRR(range of cash flows). However, it can be tricky. In fact, if the IRR is not near 10%, this function might not find an answer, and you would get an error message. Then you must try the syntax =IRR(range of cash flows, guess), where guess" is your best guess for the IRR. It is best to try a range of guesses (say, 90% to 100%). Find the IRR of the project described in Problem 34. 34. Consider a project with the following cash flows: year 1, 400; year 2, 200; year 3, 600; year 4, 900; year 5, 1000; year 6, 250; year 7, 230. Assume a discount rate of 15% per year. a. Find the projects NPV if cash flows occur at the ends of the respective years. b. Find the projects NPV if cash flows occur at the beginnings of the respective years. c. Find the projects NPV if cash flows occur at the middles of the respective years.Based on Grossman and Hart (1983). A salesperson for Fuller Brush has three options: (1) quit, (2) put forth a low level of effort, or (3) put forth a high level of effort. Suppose for simplicity that each salesperson will sell 0, 5000, or 50,000 worth of brushes. The probability of each sales amount depends on the effort level as described in the file P07_71.xlsx. If a salesperson is paid w dollars, he or she regards this as a benefit of w1/2 units. In addition, low effort costs the salesperson 0 benefit units, whereas high effort costs 50 benefit units. If a salesperson were to quit Fuller and work elsewhere, he or she could earn a benefit of 20 units. Fuller wants all salespeople to put forth a high level of effort. The question is how to minimize the cost of encouraging them to do so. The company cannot observe the level of effort put forth by a salesperson, but it can observe the size of his or her sales. Thus, the wage paid to the salesperson is completely determined by the size of the sale. This means that Fuller must determine w0, the wage paid for sales of 0; w5000, the wage paid for sales of 5000; and w50,000, the wage paid for sales of 50,000. These wages must be set so that the salespeople value the expected benefit from high effort more than quitting and more than low effort. Determine how to minimize the expected cost of ensuring that all salespeople put forth high effort. (This problem is an example of agency theory.)If a monopolist produces q units, she can charge 400 4q dollars per unit. The variable cost is 60 per unit. a. How can the monopolist maximize her profit? b. If the monopolist must pay a sales tax of 5% of the selling price per unit, will she increase or decrease production (relative to the situation with no sales tax)? c. Continuing part b, use SolverTable to see how a change in the sales tax affects the optimal solution. Let the sales tax vary from 0% to 8% in increments of 0.5%.