You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future Investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 40% Investment Total value $ million Laputa's equity 1 4 77 97 $112 $117 $ 27 37 42 50 60 70 24 28 18 21 From year 5 onward, EBITDA, depreciation, and Investment are expected to remain unchanged at year-4 levels Laputa is financed 50% by equity and 50% by debt. Its cost of equity is 14%, its debt yields 10%, and it pays corporate tax at 40%. million Year 2 3 20 15 a. Estimate the company's total value. (Do not round Intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.) 47 70 28 23 b. What is the value of Laputa's equity? (Do not round Intermediate calculations. Enter your answer in million rounded to 2 decimal places.)

You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future Investments in new plant and working capital: Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 40% Investment Total value $ million Laputa's equity 1 4 77 97 $112 $117 $ 27 37 42 50 60 70 24 28 18 21 From year 5 onward, EBITDA, depreciation, and Investment are expected to remain unchanged at year-4 levels Laputa is financed 50% by equity and 50% by debt. Its cost of equity is 14%, its debt yields 10%, and it pays corporate tax at 40%. million Year 2 3 20 15 a. Estimate the company's total value. (Do not round Intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.) 47 70 28 23 b. What is the value of Laputa's equity? (Do not round Intermediate calculations. Enter your answer in million rounded to 2 decimal places.)

Chapter16: Working Capital Policy And Short-term Financing

Section: Chapter Questions

Problem 11P

Related questions

Question

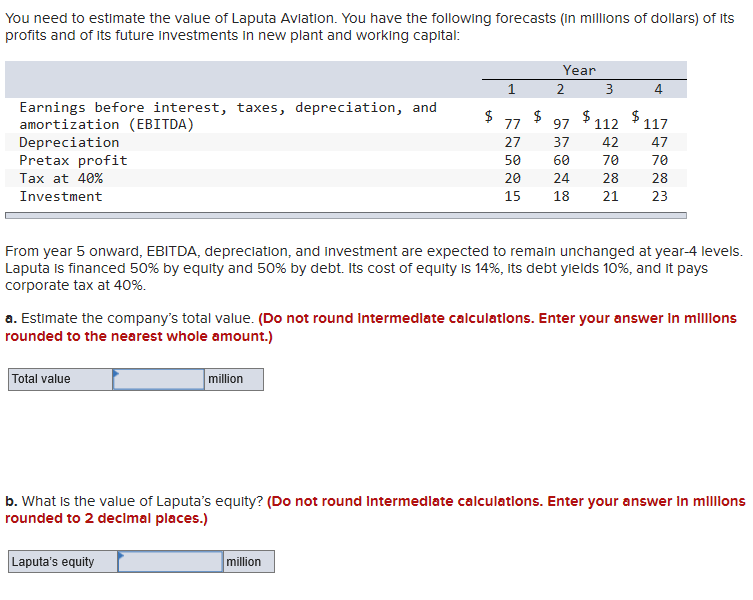

Transcribed Image Text:You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its

profits and of its future Investments in new plant and working capital:

Earnings before interest, taxes, depreciation, and

amortization (EBITDA)

Depreciation

Pretax profit

Tax at 40%

Investment

Total value

1

million

Laputa's equity

$

77

27

million

Year

2 3

$₁

From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels.

Laputa is financed 50% by equity and 50% by debt. Its cost of equity is 14%, its debt yields 10%, and it pays

corporate tax at 40%.

'112

97

37

42

50

60

70

20

24

28

15 18 21

a. Estimate the company's total value. (Do not round Intermediate calculations. Enter your answer in millions

rounded to the nearest whole amount.)

$117

47

70

28

23

b. What is the value of Laputa's equity? (Do not round Intermediate calculations. Enter your answer in millions

rounded to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning