You open the newspaper and read that Europe is headed for a recession. Use the Fed model to forecast what you expect to happen to the U.S. economy. a. A European recession is a macroeconomic shock that decrease in b. Demonstrate the effects of the macroeconomic shock, using the IS-MP framework. Real interest rate (in) X 6.0 5.5 5.0 45 4.0 3.5 3.0 2.5 20 1.6 U.S. aggregate expenditure, due to a MP

You open the newspaper and read that Europe is headed for a recession. Use the Fed model to forecast what you expect to happen to the U.S. economy. a. A European recession is a macroeconomic shock that decrease in b. Demonstrate the effects of the macroeconomic shock, using the IS-MP framework. Real interest rate (in) X 6.0 5.5 5.0 45 4.0 3.5 3.0 2.5 20 1.6 U.S. aggregate expenditure, due to a MP

Chapter16: Expectations Theory And The Economy

Section16.5: Looking At Things From The Supply Side: Real Business Cycle Theorists

Problem 2ST

Related questions

Question

Hand written solutions are strictly prohibited

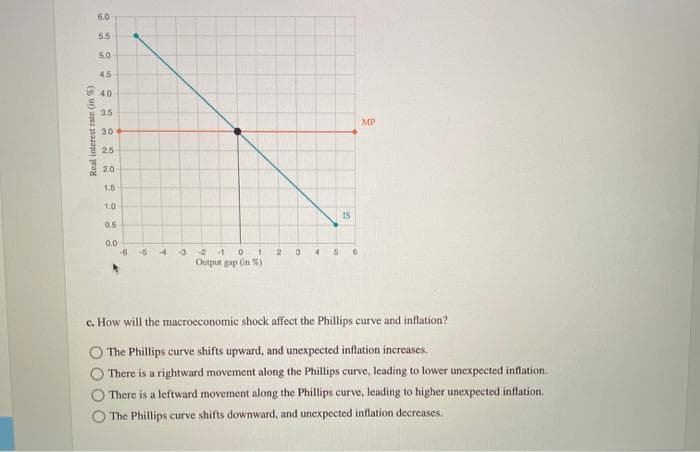

Transcribed Image Text:Real interest rate (in %)

6.0

5.5

5.0

4.5

4.0

3.5

3.0

25

2.0

1.5

1.0

0.5

0.0

-6 -5 4

3

-2 -1 0 1

Output gap (in 56)

2

3 4

IS

5 6

MP

c. How will the macroeconomic shock affect the Phillips curve and inflation?

The Phillips curve shifts upward, and unexpected inflation increases.

There is a rightward movement along the Phillips curve, leading to lower unexpected inflation.

There is a leftward movement along the Phillips curve, leading to higher unexpected inflation.

The Phillips curve shifts downward, and unexpected inflation decreases.

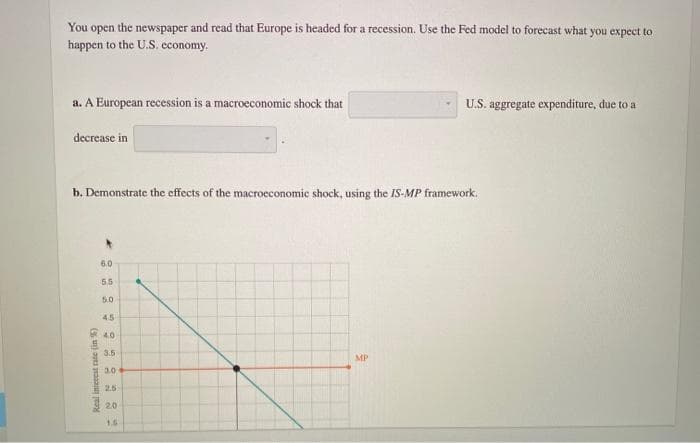

Transcribed Image Text:You open the newspaper and read that Europe is headed for a recession. Use the Fed model to forecast what you expect to

happen to the U.S. economy.

a. A European recession is a macroeconomic shock that

decrease in

b. Demonstrate the effects of the macroeconomic shock, using the IS-MP framework.

Real interest rate (in %)

6.0

5,5

5.0

45

4.0

3.5

3.0

2.5

2.0

1.5

U.S. aggregate expenditure, due to a

MP

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning