You own a store. Beginning inventory on January I was $4,000. Ending inventory on December 31 was $2.500. You purchased $27,000 f new merchandse ung the yar Sale revenue for the year was $51,000. Selling, general, and administrative (SGAA) costs for the year were $4,000. a) Compute the cost of goods sold (COGS) for the year. b) Prepare the income statement for the year. Reveoue COGS Gross Margin SGBA costs Profit

You own a store. Beginning inventory on January I was $4,000. Ending inventory on December 31 was $2.500. You purchased $27,000 f new merchandse ung the yar Sale revenue for the year was $51,000. Selling, general, and administrative (SGAA) costs for the year were $4,000. a) Compute the cost of goods sold (COGS) for the year. b) Prepare the income statement for the year. Reveoue COGS Gross Margin SGBA costs Profit

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 11RE: Johnson Corporation had beginning inventory of 20,000 at cost and 35,000 at retail. During the year,...

Related questions

Question

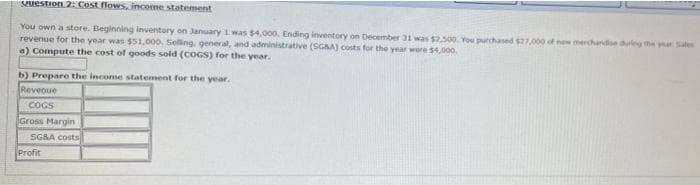

Transcribed Image Text:Puestion 2: Cost flows, income statement

You own a store. Beginning inventory on January 1 was $4,000. Ending inventory on December 31 was $2.500. You purchased $27000 of new merchande dung the ya Sales

revenue for the year was $51,000. Selling, general, and adeministrative (SGAA) costs for the year were $4,00o.

a) Compute the cost of goods sold (COGS) for the year.

b) Prepare the income statement for the year.

Reveoue

COGS

Gross Margin

SGBA costs

Profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage