You want to buy a $150,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan at 4.9% interest for the rest. The bank will charge 3 points on the amount financed. a) What is the amount of the down payment? b) How much is the loan amount going to be? c) What will be the amount charged for 3 points? *1 point is 1 % of the mortgage amount

You want to buy a $150,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan at 4.9% interest for the rest. The bank will charge 3 points on the amount financed. a) What is the amount of the down payment? b) How much is the loan amount going to be? c) What will be the amount charged for 3 points? *1 point is 1 % of the mortgage amount

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA3: Time Value Of Money

Section: Chapter Questions

Problem 19E: Present Values Krista Kellman has an opportunity to purchase a government security that will pay...

Related questions

Question

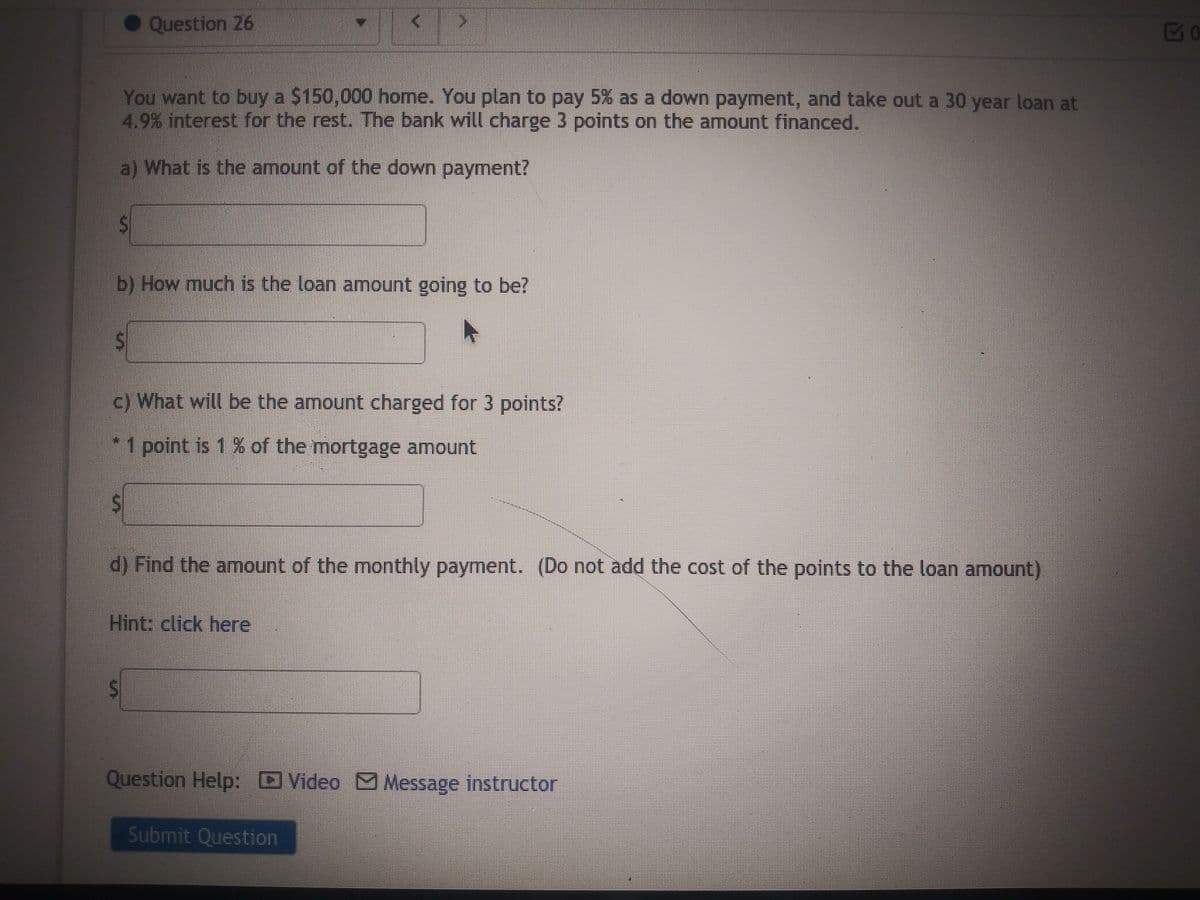

Transcribed Image Text:• Question 26

You want to buy a $150,000 home. You plan to pay 5% as a down payment, and take out a 30 year loan at

4.9% interest for the rest. The bank will charge 3 points on the amount financed.

a) What is the amount of the down payment?

S

b) How much is the loan amount going to be?

c) What will be the amount charged for 3 points?

*1 point is 1 % of the mortgage amount

d) Find the amount of the monthly payment. (Do not add the cost of the points to the loan amount)

Hint: click here

Question Help: Video M Message instructor

Submit Question

Expert Solution

Step 1

Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts for you. To get the remaining sub-parts, please repost the complete question and mention the sub-parts to be solved.

The mortgage refers to the loan that is provided by a bank or financial institution after keeping the legal title of the property that is being financed. The bank charges interest for the amount of loan given.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning