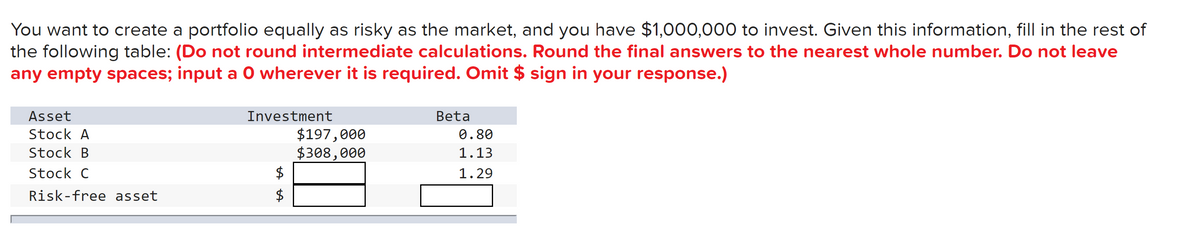

You want to create a portfolio equally as risky as the market, and you have $1,000,000 to invest. Given this information, fill in the rest of the following table: (Do not round intermediate calculations. Round the final answers to the nearest whole number. Do not leave any empty spaces; input a O wherever it is required. Omit $ sign in your response.) Asset Stock A Investment Stock B $197,000 $308,000 Stock C $ Risk-free asset $ Beta 0.80 1.13 1.29

Q: Douglas needs to borrow $15, 600 today for his tuition bill. He agrees to pay back the loan in a…

A: Definition-In the context of the formula r=(FVPV)1n−1, the interest rate (r) represents the periodic…

Q: Alternative Financing Plans Desmond Co. is considering the following alternative financing plans:…

A: Earnings per share for a stock refers to the overall net income that is available for a stockholder…

Q: Troy is interested in buying a particular stock whose current dividend is $1.35, and whose dividend…

A: Current Dividend (D0) = $1.35Growth rate for first two years = 5% or 0.05Constant growth rate after…

Q: After completing a bachelors degree, you have $15,000.00 in student loans to pay back at an interest…

A: Calculating the Monthly Payment on a Student LoanWe can calculate the monthly payment on the student…

Q: Compute the (1) net present value, (2) profitability index, and (3) internal rate of return for each…

A: Capital budgeting is a tool to assess and select long-term investment possibilities. It entails…

Q: XYZ has an expected Free Cash Flow of $109M next year and will remain the same in perpetuity. It has…

A: The objective of the question is to calculate the intrinsic value of the common stock of XYZ…

Q: The city of Kelowna, British Columbia, is considering various proposals regarding the improvement of…

A: The Benefit-Cost Ratio (B/C Ratio) is a financial metric used to evaluate the profitability or…

Q: Janet is comparing two tax-efficient investments options. Janet is 25 and her marginal tax rate is…

A: The objective of the question is to compare two tax-efficient investment options for Janet and…

Q: Stafford loans are the most popular form of student loan in the United States. The current interest…

A: Loan amount = $29,000Interest rate = 4.34%Number of years = 4 years

Q: Expando, Inc., is considering the possibility of building an additional factory that would produce a…

A: The net present value (NPV) is a financial measure used to analyze the profitability of an…

Q: Convertible Premiums The Tsetsekos Company was planning to finance an expansion. The principal…

A: Conversion price is the price at which the security gets converted in to a common stock. In our…

Q: For each of the following annuities, calculate the annual cash flow: Note: Do not round intermediate…

A: The Time Value of Money takes into account the opportunity cost of having money now versus in the…

Q: A large automobile manufacturer has developed a continuous variable transmission (CVT) that…

A:

Q: Balloon Payments Amanda Rice has arranged to purchase a $775,000 vacation home in the Bahamas with a…

A: An amortization table is a tabular representation of the loan repayments to be made throughout the…

Q: "Financing capotal projects from loans over a long period of time forces the present and future…

A: The statement is referring to the concept of intergenerational equity in public finance.…

Q: You owe $24,000 on student loans at an interest rate of 5.45% compounded monthly. You want to pay…

A: Given loan amount is Interest Rate is Time period since number of payments is monthly total number…

Q: With the growing popularity of casual surf print clothing, two recent MBA graduates decided to…

A: The NPV of a project is used to measure the profitability of the project. It is done by discounting…

Q: Assume Highline Company has just paid an annual dividend of $0.98. Analysts are predicting an 10.8%…

A: The dividend discount model (DDM) is a method used to value a stock by estimating its intrinsic…

Q: The Lawrence Company has a ratio of long term debt to long term debt plus equity of .39 and a…

A: 1.Current ratio is calculated as follows:-Current ratio = 2.profit margin is calculated as…

Q: uppose 5%, TH 13%, and by-1.9. a. What is n, the required rate of return on Stock I? Round your…

A: Rf = 5%Rm = 13%Beta = 1.9

Q: Maturity Price of $1,000 Par Bond (Zero-Coupon) 1year 943.40 2 873.52 3 816.37 a. An 8.5% coupon…

A: Yield to maturity refers to the rate at which the investor earns effectively on an annual basis if…

Q: Suppose you are 30 years old and would like to reure do this? Assume a constant APR of 5% and that…

A: Amount withdrawn per year = $100,000Current age = 30 yearsAPR = 5%Retirement age = 65 years

Q: (Present value of an uneven stream of payments) You are given three investment alternatives to…

A: Present value of cash flows can be calculated in excel by using the excel formula ''=NPV''

Q: Suppose you want to have $600, 000 for retirement in 15 years. Your account earns 9% interest. Feel…

A: Future value=$600000Period= 15 yearsInterest rate=9%Monthly period=n=180Monthly interest…

Q: QUESTION: Kari is purchasing a home for $220,000. The down payment is 25% and the balance will be…

A: Variables in the question:Cost of home=$220,000Down payment=25%Balance will be financed with…

Q: A stock has an expected return of 13.4 percent and a beta of 1.15, and the expected return on the…

A: The Capital Asset Pricing Model (CAPM) is a financial model that establishes a relationship between…

Q: Why do u think it is impotant to allow funding for maintainance and extensions and not only the…

A: The objective of the question is to understand the importance of allocating funds for maintenance…

Q: A mutual fund manager has a $20 million portfolio with a beta of 1.7. The risk-free rate is 4.5%,…

A: The CAPM model refers to the relationship between the systematic risk faced by the investment and…

Q: Sheep Ranch Golf Academy is evaluating new golf practice equipment. The "Dimple- Max" equipment…

A: Equivalent annual cost is a financial metric that helps you compare the costs of different projects…

Q: A 40-year-old woman decides to put funds into a retirement plan. She can save $2,000 a year and earn…

A:

Q: 2. How would you describe the correlation between risk and return in investments, and what are the…

A: In this question, we are required to determine:The correlation between risk and return in…

Q: Given the following cash flow, what would be the value of P if the inflows and outflows balance each…

A: Present value is the current value of the future sum of money, at a specified rate of return.Present…

Q: You have assigned the following values to these three firms: Upcoming Dividend $1.30 1.46 0.70 Estee…

A: PriceUpcoming dividendGrowthBetaEstee Lauder$35.00$1.3013.40%0.82Kimco…

Q: This problem demonstrates the dependence of an annuity's present value on the size of the periodic…

A: Present value is what a sum of money in the future is worth in today’s dollars at a rate of…

Q: Off to yield 1.91%. (a) What is the price of each $10,000.00 T-bill on April 1? (b) What is the…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: sh Gardens Co. bought a new truck for $58, 000. It paid $6, 380 of this amount as a down payment and…

A:

Q: (Comprehensive problem) You would like to have $54,000 in 16 years. To accumulate this amount, you…

A: Future value = $54,000Period = 16 yearsInterest rate = 6% per annum

Q: Dirk Ward borrowed $14,000.00 for investment purposes on May 19 on a demand note providing for a…

A: To calculate the accrued interest on December 31, we need to first calculate the interest that…

Q: 2. Sandwiches Inc. has net income of $2,250.00 and total equity of $12,900.00. The debt - equity…

A: Option A is correctThe internal growth rate is 6.36%Explanation:Step 1: The calculation of the…

Q: Consider two investment opportunities, Investment A and Investment B. Investment A pays interest at…

A: Here we have been gien two investment options with different compounding times per year.Hence we…

Q: Madetaylor Inc. manufactures financial calculators. The company is deciding whether to introduce a…

A: after-tax salvage value is calculated as follows:- after-tax salvage value =

Q: Recommend an asset allocation that matches the Johnsons' financial objectives and their moderate…

A: Financial objectives refer to specific, measurable targets and goals related to an organization's…

Q: nded monthly and calls for equal monthly payments over the next 30 years. Her first ment will be due…

A: An amortization table is a tabular representation of the loan repayments to be made throughout the…

Q: O Unes, Functions Systoms Solving a tax rate or interest rate problem using a system of linear..…

A: The final answers are:Desktop: $1820Laptop: $2270. Explanation:

Q: Elmo's Burger's has a bond outstanding with an annual coupon rate of 3.9% and a face value of…

A: annual coupon = par value x coupon rate

Q: Suppose nu=5%, TH=13%, and b₁ = 1.9. a. What is n, the required rate of return on Stock I? Round…

A: CAPM model is one of the model that investors have used for determining the cost of equity or the…

Q: What is the discounted payback period? Enter your answer rounded to two decimal places Number

A: Discounted payback period is a financial tool used to evaluate the feasibility of an investment. It…

Q: A firm reported after-tax operating income of $25 million in the most recent year and expects…

A: The value of a firm is the worth of its assets, liabilities, and the impact it has on the market.It…

Q: The price of a home is $120,000. The bank requires a 15% down payment. The buyer is offered two…

A: Please find Answer belowExplanation:Step 1:Let,s calculate the monthly payment for the 15-year…

Q: Starting on the day Thomas was born, his mother has invested $50 at the beginning of every month in…

A: Saving analysis involves examining your expenses and income to understand where your money is going…

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

- You want to create a portfolio equally as risky as the market, and you have $1,200,000 to invest. Consider the following information: Asset Investment Beta Stock A $300,000 0.70 Stock B $360,000 1.25 Stock C 1.55 Risk-free asset Required: (a) What is the investment in Stock C? (Do not round your intermediate calculations.) (b) What is the investment in risk-free asset? (Do not round your intermediate calculations.)An investment banker has recommended a $100,000 portfolio containing assets B, D, and F. $20,000 will be investedin asset B, with a beta of 1.5; $50,000 will be invested in asset D, with a beta of 1.7; and $30,000 will be invested inasset F, with a beta of 0.6. The beta of the portfolio is 1.25 1.45 1.33 unable to be determined from the information providedYou have been provided the following data about the securities of three firms, the market portfolio, and the risk-free asset: a. Fill in the missing values in the table. (Leave no cells blank - be certain to enter 0 wherever required. Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) * With the market portfolio b-1. What is the expected return of Firm A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-2. What is your investment recommendation regarding Firm A for someone with a well-diversified portfolio? multiple choice 1 Buy Sell b-3. What is the expected return of Firm B? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b-4. What is your investment recommendation regarding Firm B for someone with a well-diversified portfolio? multiple choice 2 Sell Buy b-5. What is the expected return of Firm C?…

- Suppose that the S&P 500, with a beta of 1.0, has an expected return of 12% and T-bills provide a risk- free return of 5% a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of (1) 0; (2) 0.25; (3) 0.50; (4) 0.75; (5) 1.0 ? Note: Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beta rounded to 2 decimal places. b. How does the expected return vary with beta? Note: Do not round intermediate calculations.Suppose that the S&P 500, with a beta of 1.0, has an expected return of 12% and T-bills provide a risk-free return of 3% a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of Expected Return Beta (i) 0 (ii) 0.25 (iii) 0.50 (iv) 0.75 (v) 1.0 (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beta rounded to 2 decimal places.) b. How does expected return vary with beta? (Do not round intermediate calculations.) Fill in the bolded part The expected return (increases/decrease) by ( %) for a one unit increase in beta.Suppose you are given the following inputs for the Fama-Frech-3-Factor model. Required Return for Stock i: bi=0.8, kRF=8%, the market risk premium is 6%, ci=-0.6, the expected value for the size factor is 5%, di=-0.4, and the expected value for the book-to-market factor is 4%. Task: Estimate the required rate of return of this asset using the Capital asset pricing model and compare it with the Fama-French-3-factor model.

- An investor has an opportunity to invest in two risky assets and a risk-free asset. Theexpected return of the two risky assets are μ1 = 0.12, μ2 = 0.15. Their standarddeviations are σ1 = 0.05 and σ2 = 0.1, and the correlation coefficient between theirreturn is 0.2. The risk-free rate is 0.05. Suppose the investor has $1000 and he wantsto hold a portfolio with expected return of 0.1. If the investor is risk averse, how muchshould he invest in the two risky assets and the risk-free asset?You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: Suppose a risk-free asset has an expected return of 5%. By definition, its standard deviation is zero, and its correlation with any other asset is also zero. Using only Asset A and the risk-free asset, plot the attainable portfolios.You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: Write out the equation for the Capital Market Line (CML), and draw it on the graph. Interpret the plotted CML. Now add a set of indifference curves and illustrate how an investor’s optimal portfolio is some combination of the risky portfolio and the risk-free asset. What is the composition of the risky portfolio?

- You have been hired at the investment firm of Bowers & Noon. One of its clients doesn’t understand the value of diversification or why stocks with the biggest standard deviations don’t always have the highest expected returns. Your assignment is to address the client’s concerns by showing the client how to answer the following questions: What is the Capital Asset Pricing Model (CAPM)? What are the assumptions that underlie the model? What is the Security Market Line (SML)?You have been hired at the investment firm of Bowers Noon. One of its clients doesnt understand the value of diversification or why stocks with the biggest standard deviations dont always have the highest expected returns. Your assignment is to address the clients concerns by showing the client how to answer the following questions: d. Construct a plausible graph that shows risk (as measured by portfolio standard deviation) on the x-axis and expected rate of return on the y-axis. Now add an illustrative feasible (or attainable) set of portfolios and show what portion of the feasible set is efficient. What makes a particular portfolio efficient? Dont worry about specific values when constructing the graphmerely illustrate how things look with reasonable data.Suppose that the S&P 500, with a beta of 1.0, has an expected return of 12% and T-bills provide a risk-free return of 4%. a. What would be the expected return and beta of portfolios constructed from these two assets with weights in the S&P 500 of (i) 0; (ii) 0.25; (iii) 0.50; (iv) 0.75; (v) 1.0? (Leave no cells blank - be certain to enter "0" wherever required. Do not round intermediate calculations. Enter the value of Expected return as a percentage rounded to 2 decimal places and value of Beta rounded to 2 decimal places.) b. How does expected return vary with beta? (Do not round intermediate calculations.)