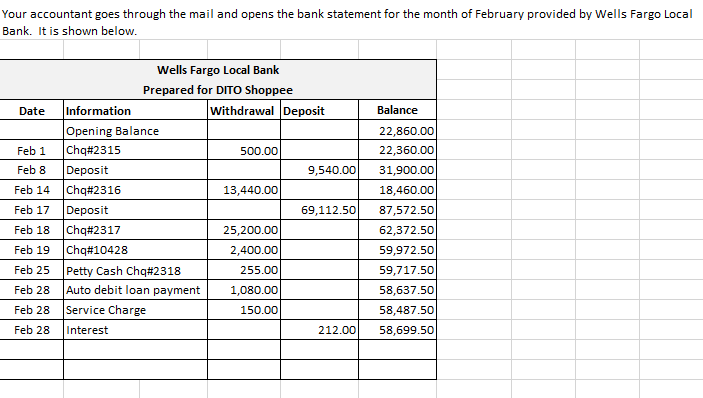

Your accountant goes through the mail and opens the bank statement for the month of February provided by Wells Fargo Local Bank. It is shown below. Wells Fargo Local Bank Prepared for DITO Shoppee Withdrawal Deposit Information Opening Balance Chq#2315 Deposit Feb 14 Chq#2316 Deposit Feb 18 Chą#2317 Feb 19 Chq#10428 Feb 25 Petty Cash Chq#2318 Auto debit loan payment Date Balance 22,860.00 22,360.00 31,900.00 18,460.00 87,572.50 62,372.50 59,972.50 59,717.50 58,637.50 58,487.50 58,699.50 Feb 1 500.00 Feb 8 9,540.00 13,440.00 Feb 17 69,112.50 25,200.00| 2,400.00 255.00 Feb 28 1,080.00 Feb 28 Service Charge 150.00 Feb 28 Interest 212.00

Your accountant goes through the mail and opens the bank statement for the month of February provided by Wells Fargo Local Bank. It is shown below. Wells Fargo Local Bank Prepared for DITO Shoppee Withdrawal Deposit Information Opening Balance Chq#2315 Deposit Feb 14 Chq#2316 Deposit Feb 18 Chą#2317 Feb 19 Chq#10428 Feb 25 Petty Cash Chq#2318 Auto debit loan payment Date Balance 22,860.00 22,360.00 31,900.00 18,460.00 87,572.50 62,372.50 59,972.50 59,717.50 58,637.50 58,487.50 58,699.50 Feb 1 500.00 Feb 8 9,540.00 13,440.00 Feb 17 69,112.50 25,200.00| 2,400.00 255.00 Feb 28 1,080.00 Feb 28 Service Charge 150.00 Feb 28 Interest 212.00

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter6: Bank Accounts, Cash Funds, And Internal Controls

Section: Chapter Questions

Problem 3PB

Related questions

Question

prepare a bank reconciliation report.

Transcribed Image Text:Your accountant goes through the mail and opens the bank statement for the month of February provided by Wells Fargo Local

Bank. It is shown below.

Wells Fargo Local Bank

Prepared for DITO Shoppee

Information

withdrawal Deposit

Balance

Date

Opening Balance

22,860.00

Feb 1

Chq#2315

500.00

22,360.00

Feb 8

Deposit

9,540.00

31,900.00

Feb 14

Chq#2316

13,440.00

18,460.00

Feb 17

Deposit

69,112.50

87,572.50

Feb 18

Chq#2317

25,200.00

62,372.50

Feb 19

Chq#10428

2,400.00

59,972.50

Feb 25 Petty Cash Chq#2318

Auto debit loan payment

255.00

59,717.50

Feb 28

1,080.00

58,637.50

Feb 28 Service Charge

58,487.50

150.00

Feb 28

Interest

212.00

58,699.50

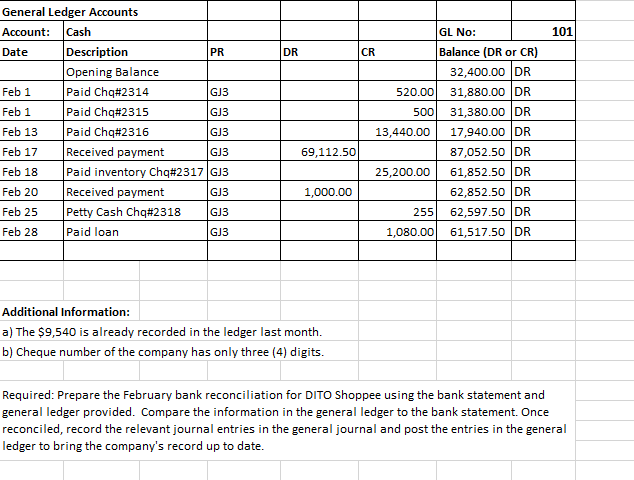

Transcribed Image Text:General Ledger Accounts

Account:

Cash

GL No:

101

Date

Description

PR

DR

CR

Balance (DR or CR)

Opening Balance

Paid Chq#2314

Paid Chq#2315

Paid Chq#2316

Received payment

Paid inventory Chq#2317 GJ3

Received payment

Petty Cash Chq#2318

Paid loan

32,400.00 DR

31,880.00 DR

500

Feb 1

GJ3

520.00

Feb 1

GJ3

31,380.00 DR

17,940.00 DR

87,052.50 DR

Feb 13

GJ3

13,440.00

Feb 17

GJ3

69,112.50

61,852.50 DR

62,852.50 DR

Feb 18

25,200.00

Feb 20

GJ3

1,000.00

62,597.50 DR

61,517.50 DR

Feb 25

GJ3

255

Feb 28

GJ3

1,080.00

Additional Information:

a) The $9,540 is already recorded in the ledger last month.

b) Cheque number of the company has only three (4) digits.

Required: Prepare the February bank reconciliation for DITO Shoppee using the bank statement and

general ledger provided. Compare the information in the general ledger to the bank statement. Once

reconciled, record the relevant journal entries in the general journal and post the entries in the general

ledger to bring the company's record up to date.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning