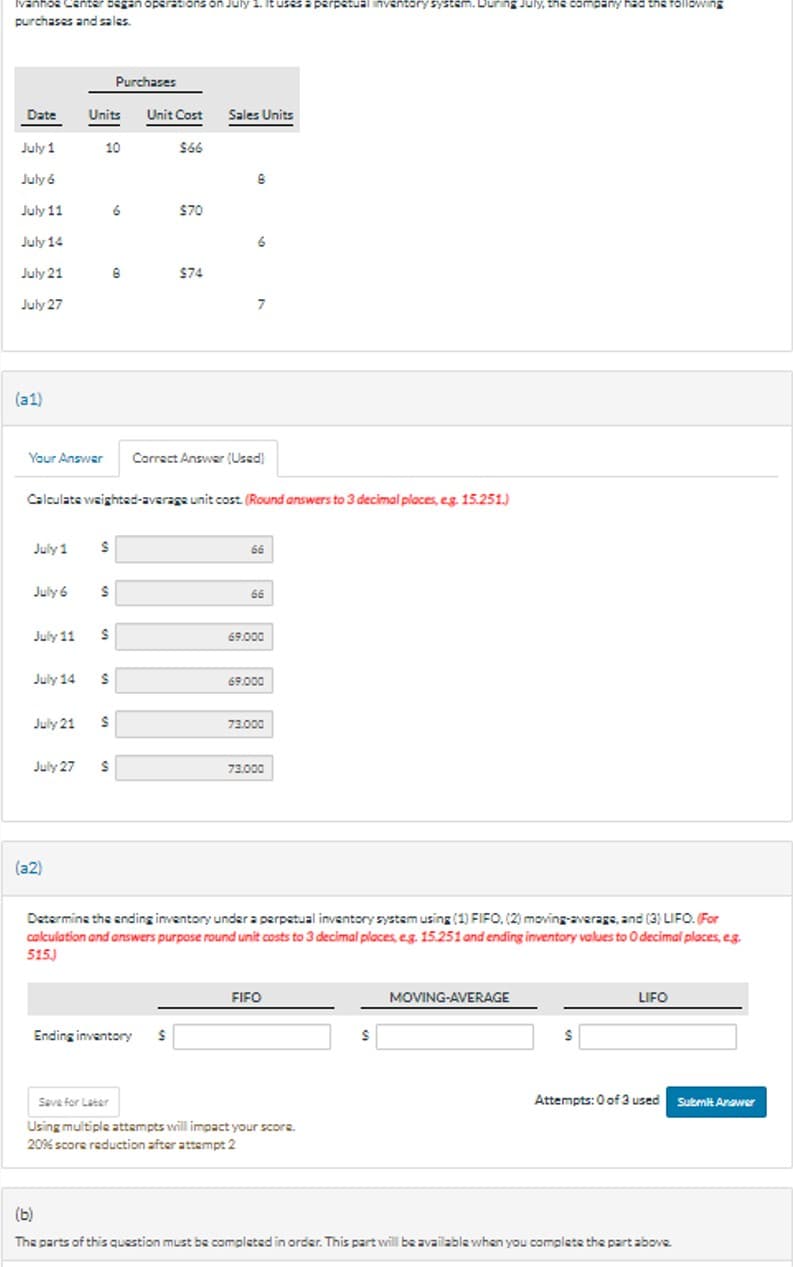

Your Answer Correct Answer (Used) Calculate weighted average unit cost. (Round answers to 3 decimal places, eg. 15.251.) July 1 19 $ 66 July 6 S 66 July 11 $ 69.000 July 14 July 21 S S 69.000 73.000 July 27 $ 73.000 (a2) Determine the ending inventory under a perpetual inventory system using (1) FIFO, (2) moving-average, and (3) LIFO. (For calculation and answers purpose round unit costs to 3 decimal places, eg. 15.251 and ending inventory values to O decimal places, eg. 515) FIFO MOVING-AVERAGE LIFO Ending inventory $ $ $

Ivanhoe center began opsratons on July 1. It uses a parpstual invantory system. Uuring July, the company had the following purchases and aales. Calsulate waighted-avarage unit cost (Round answers to 3 decimal places, eg. 15.251.) July 1$ July6 $ July 11$ July 14$ July 21$ July 27$ (a2) Determins the ending imentory under a perpatual inventory system using (1) FIFO, (2) moving-average, and (3) LIFO. (For calculation and answers purpose round unit costs to 3 decimal places, eg. 15.251 and ending inventory values to 0 decimal places, eg. 515.) Attempts: 0 of 3 used Using multiple attempts will impact your score. 2096 scors reduction after attempt 2 (b) The parts of this question must be completed in order. This part will be available when you complete the part above.

Step by step

Solved in 3 steps with 1 images