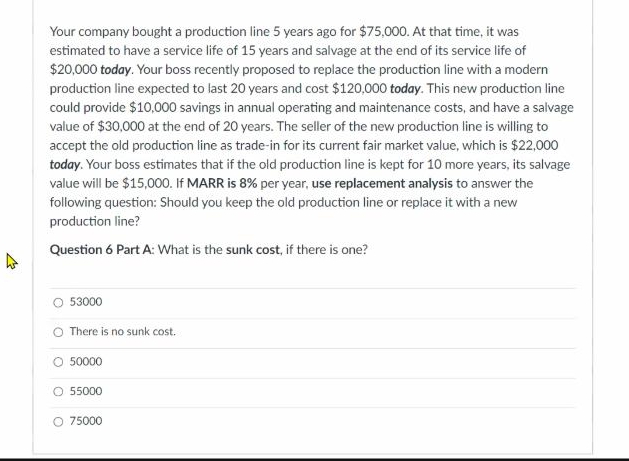

Your company bought a production line 5 years ago for $75,000. At that time, it was estimated to have a service life of 15 years and salvage at the end of its service life of $20,000 today. Your boss recently proposed to replace the production line with a modern production line expected to last 20 years and cost $120,000 today. This new production line could provide $10,000 savings in annual operating and maintenance costs, and have a salvage value of $30,000 at the end of 20 years. The seller of the new production line is willing to accept the old production line as trade-in for its current fair market value, which is $22,000 today. Your boss estimates that if the old production line is kept for 10 more years, its salvage value will be $15,000. If MARR is 8% per year, use replacement analysis to answer the following question: Should you keep the old production line or replace it with a new production line?

Your company bought a production line 5 years ago for $75,000. At that time, it was estimated to have a service life of 15 years and salvage at the end of its service life of $20,000 today. Your boss recently proposed to replace the production line with a modern production line expected to last 20 years and cost $120,000 today. This new production line could provide $10,000 savings in annual operating and maintenance costs, and have a salvage value of $30,000 at the end of 20 years. The seller of the new production line is willing to accept the old production line as trade-in for its current fair market value, which is $22,000 today. Your boss estimates that if the old production line is kept for 10 more years, its salvage value will be $15,000. If MARR is 8% per year, use replacement analysis to answer the following question: Should you keep the old production line or replace it with a new production line?

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 15P

Related questions

Question

Transcribed Image Text:Your company bought a production line 5 years ago for $75,000. At that time, it was

estimated to have a service life of 15 years and salvage at the end of its service life of

$20,000 today. Your boss recently proposed to replace the production line with a modern

production line expected to last 20 years and cost $120,000 today. This new production line

could provide $10,000 savings in annual operating and maintenance costs, and have a salvage

value of $30,000 at the end of 20 years. The seller of the new production line is willing to

accept the old production line as trade-in for its current fair market value, which is $22,000

today. Your boss estimates that if the old production line is kept for 10 more years, its salvage

value will be $15,000. If MARR is 8% per year, use replacement analysis to answer the

following question: Should you keep the old production line or replace it with a new

production line?

Question 6 Part A: What is the sunk cost, if there is one?

O 53000

O There is no sunk cost.

50000

O 55000

O 75000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning