Your company has two divisions: One division sells software and the other division sells computers through a direct sales channel, primarily taking orders over the internet. You have decided that D Computer is very similar to your computer division, in terms of both risk and financing. You go online and find the following information: Dell's beta is 1.24, the risk-free rate is 4.7%, its market value equity is $67.7 billion, and it has $693 million worth of debt with a yield to maturity of 5.9%. Your tax rate is 38% and you use a market risk premium of 5.8% in your WACC estimates. a. What is an estimate of the WACC for your computer sales division? b. If your overall company WACC is 12.3% and the computer sales division represents 39% of the value of your firm, what is an estimate of the WACC for your software division? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. What is an estimate of the WACC for your computer sales division? The weighted average cost of capital for your computer sales division is%. (Round to two decimal places.) b. If your overall company WACC is 12.3% and the computer sales division represents 39% of the value of your firm, what is an estimate of the WACC for your software division? The WACC for your software division is%. (Round to two decimal places.)

Your company has two divisions: One division sells software and the other division sells computers through a direct sales channel, primarily taking orders over the internet. You have decided that D Computer is very similar to your computer division, in terms of both risk and financing. You go online and find the following information: Dell's beta is 1.24, the risk-free rate is 4.7%, its market value equity is $67.7 billion, and it has $693 million worth of debt with a yield to maturity of 5.9%. Your tax rate is 38% and you use a market risk premium of 5.8% in your WACC estimates. a. What is an estimate of the WACC for your computer sales division? b. If your overall company WACC is 12.3% and the computer sales division represents 39% of the value of your firm, what is an estimate of the WACC for your software division? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. What is an estimate of the WACC for your computer sales division? The weighted average cost of capital for your computer sales division is%. (Round to two decimal places.) b. If your overall company WACC is 12.3% and the computer sales division represents 39% of the value of your firm, what is an estimate of the WACC for your software division? The WACC for your software division is%. (Round to two decimal places.)

Financial Management: Theory & Practice

16th Edition

ISBN:9781337909730

Author:Brigham

Publisher:Brigham

Chapter9: The Cost Of Capital

Section: Chapter Questions

Problem 13MC: m. Jana is interested in establishing a new division that will focus primarily on developing new...

Related questions

Question

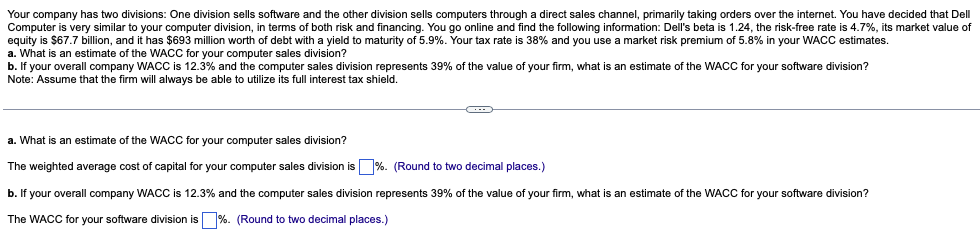

Transcribed Image Text:Your company has two divisions: One division sells software and the other division sells computers through a direct sales channel, primarily taking orders over the internet. You have decided that Dell

Computer is very similar to your computer division, in terms of both risk and financing. You go online and find the following information: Dell's beta is 1.24, the risk-free rate is 4.7%, its market value of

equity is $67.7 billion, and it has $693 million worth of debt with a yield to maturity of 5.9%. Your tax rate is 38% and you use a market risk premium of 5.8% in your WACC estimates.

a. What is an estimate of the WACC for your computer sales division?

b. If your overall company WACC is 12.3% and the computer sales division represents 39% of the value of your firm, what is an estimate of the WACC for your software division?

Note: Assume that the firm will always be able to utilize its full interest tax shield.

a. What is an estimate of the WACC for your computer sales division?

The weighted average cost of capital for your computer sales division is %. (Round to two decimal places.)

b. If your overall company WACC is 12.3% and the computer sales division represents 39% of the value of your firm, what is an estimate of the WACC for your software division?

The WACC for your software division is %. (Round two decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning