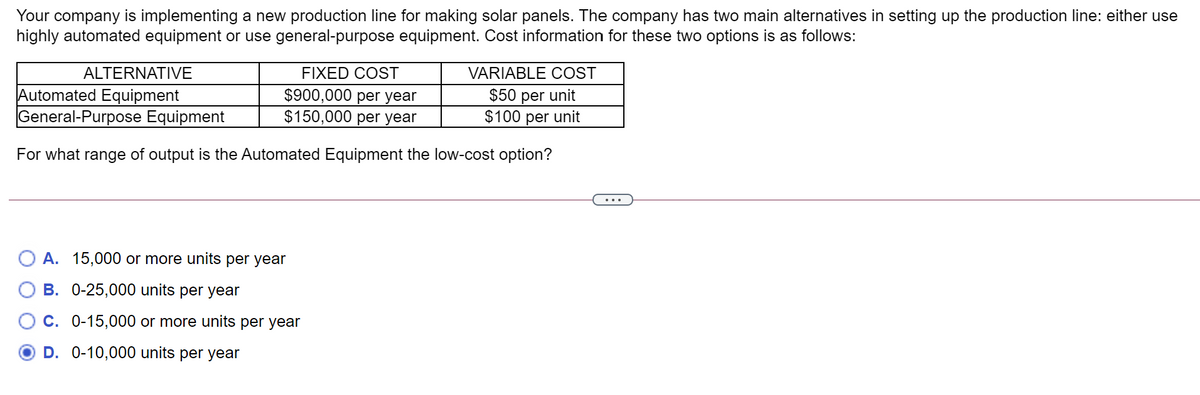

Your company is implementing a new production line for making solar panels. The company has two main alternatives in setting up the production line: either use highly automated equipment or use general-purpose equipment. Cost information for these two options is as follows: ALTERNATIVE FIXED COST VARIABLE COST Automated Equipment General-Purpose Equipment $900,000 per year $150,000 per year $50 per unit $100 per unit For what range of output is the Automated Equipment the low-cost option? O A. 15,000 or more units per year O B. 0-25,000 units per year O C. 0-15,000 or more units per year O D. 0-10,000 units per year

Your company is implementing a new production line for making solar panels. The company has two main alternatives in setting up the production line: either use highly automated equipment or use general-purpose equipment. Cost information for these two options is as follows: ALTERNATIVE FIXED COST VARIABLE COST Automated Equipment General-Purpose Equipment $900,000 per year $150,000 per year $50 per unit $100 per unit For what range of output is the Automated Equipment the low-cost option? O A. 15,000 or more units per year O B. 0-25,000 units per year O C. 0-15,000 or more units per year O D. 0-10,000 units per year

Chapter19: Pricing Concepts

Section: Chapter Questions

Problem 6DRQ

Related questions

Question

Transcribed Image Text:Your company is implementing a new production line for making solar panels. The company has two main alternatives in setting up the production line: either use

highly automated equipment or use general-purpose equipment. Cost information for these two options is as follows:

ALTERNATIVE

FIXED COST

VARIABLE COST

Automated Equipment

General-Purpose Equipment

$900,000 per year

$150,000 per year

$50 per unit

$100 per unit

For what range of output is the Automated Equipment the low-cost option?

O A. 15,000 or more units per year

B. 0-25,000 units per year

C. 0-15,000 or more units per year

D. 0-10,000 units per year

Expert Solution

Introduction

Fixed costs are the cost that remains constant through a period, say one year. Fixed costs include expenses such as rent, depreciation, amortization, etc. Variable costs include expenses that are volatile in nature such as operating expenses. variable expenses are based on various factors that are internal and external to a firm.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps