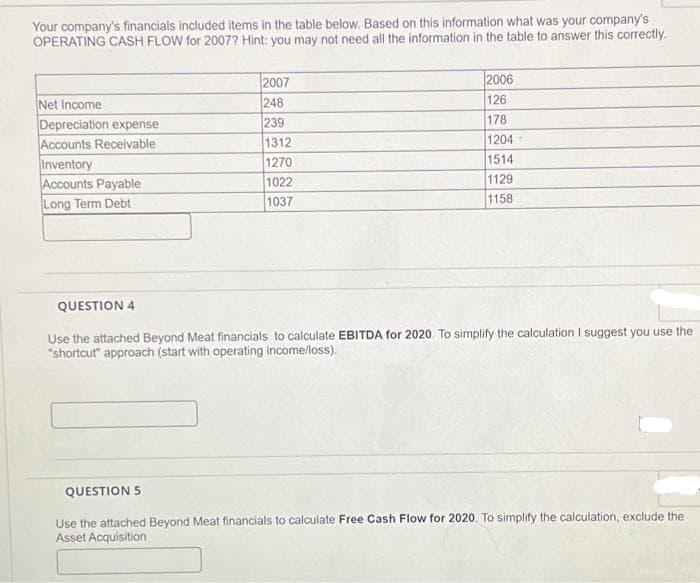

Your company's financials included items in the table below. Based on this information what was your company's OPERATING CASH FLOW for 2007? Hint: you may not need all the information in the table to answer this correctly. Net Income Depreciation expense Accounts Receivable Inventory Accounts Payable Long Term Debt 2007 248 239 1312 1270 1022 1037 2006 126 178 1204 1514 1129 1158 QUESTION 4 Use the attached Beyond Meat financials to calculate EBITDA for 2020. To simplify the calculation I suggest you use the "shortcut" approach (start with operating income/loss). QUESTION 5 Use the attached Beyond Meat financials to calculate Free Cash Flow for 2020. To simplify the calculation, exclude the Asset Acquisition

Your company's financials included items in the table below. Based on this information what was your company's OPERATING CASH FLOW for 2007? Hint: you may not need all the information in the table to answer this correctly. Net Income Depreciation expense Accounts Receivable Inventory Accounts Payable Long Term Debt 2007 248 239 1312 1270 1022 1037 2006 126 178 1204 1514 1129 1158 QUESTION 4 Use the attached Beyond Meat financials to calculate EBITDA for 2020. To simplify the calculation I suggest you use the "shortcut" approach (start with operating income/loss). QUESTION 5 Use the attached Beyond Meat financials to calculate Free Cash Flow for 2020. To simplify the calculation, exclude the Asset Acquisition

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter7: Financial Activities

Section: Chapter Questions

Problem 3AIC

Related questions

Question

Transcribed Image Text:Your company's financials included items in the table below. Based on this information what was your company's

OPERATING CASH FLOW for 2007? Hint: you may not need all the information in the table to answer this correctly.

Net Income

Depreciation expense

Accounts Receivable

Inventory

Accounts Payable

Long Term Debt

2007

248

239

1312

1270

1022

1037

2006

126

178

1204

1514

1129

1158

QUESTION 4

Use the attached Beyond Meat financials to calculate EBITDA for 2020. To simplify the calculation I suggest you use the

"shortcut" approach (start with operating income/loss).

QUESTION 5

Use the attached Beyond Meat financials to calculate Free Cash Flow for 2020. To simplify the calculation, exclude the

Asset Acquisition

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning