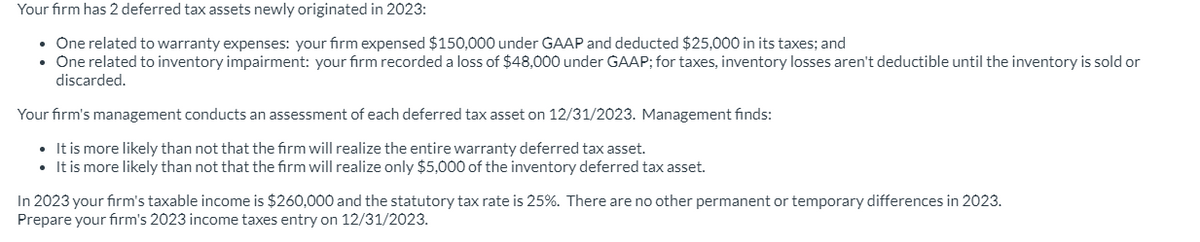

Your firm has 2 deferred tax assets newly originated in 2023: One related to warranty expenses: your firm expensed $150,000 under GAAP and deducted $25,000 in its taxes; and • One related to inventory impairment: your firm recorded a loss of $48,000 under GAAP; for taxes, inventory losses aren't deductible until the inventory is sold or discarded. Your firm's management conducts an assessment of each deferred tax asset on 12/31/2023. Management finds: It is more likely than not that the firm will realize the entire warranty deferred tax asset. • It is more likely than not that the firm will realize only $5,000 of the inventory deferred tax asset. In 2023 your firm's taxable income is $260,000 and the statutory tax rate is 25%. There are no other permanent or temporary differences in 2023. Prepare your firm's 2023 income taxes entry on 12/31/2023.

Your firm has 2 deferred tax assets newly originated in 2023: One related to warranty expenses: your firm expensed $150,000 under GAAP and deducted $25,000 in its taxes; and • One related to inventory impairment: your firm recorded a loss of $48,000 under GAAP; for taxes, inventory losses aren't deductible until the inventory is sold or discarded. Your firm's management conducts an assessment of each deferred tax asset on 12/31/2023. Management finds: It is more likely than not that the firm will realize the entire warranty deferred tax asset. • It is more likely than not that the firm will realize only $5,000 of the inventory deferred tax asset. In 2023 your firm's taxable income is $260,000 and the statutory tax rate is 25%. There are no other permanent or temporary differences in 2023. Prepare your firm's 2023 income taxes entry on 12/31/2023.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 2P

Related questions

Question

Transcribed Image Text:Your firm has 2 deferred tax assets newly originated in 2023:

One related to warranty expenses: your firm expensed $150,000 under GAAP and deducted $25,000 in its taxes; and

• One related to inventory impairment: your firm recorded a loss of $48,000 under GAAP; for taxes, inventory losses aren't deductible until the inventory is sold or

discarded.

Your firm's management conducts an assessment of each deferred tax asset on 12/31/2023. Management finds:

It is more likely than not that the firm will realize the entire warranty deferred tax asset.

• It is more likely than not that the firm will realize only $5,000 of the inventory deferred tax asset.

In 2023 your firm's taxable income is $260,000 and the statutory tax rate is 25%. There are no other permanent or temporary differences in 2023.

Prepare your firm's 2023 income taxes entry on 12/31/2023.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you