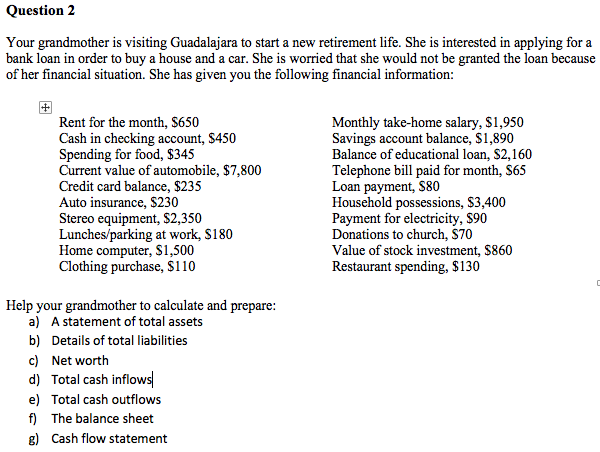

Your grandmother is visiting Guadalajara to start a new retirement life. She is interested in applying for a bank loan in order to buy a house and a car. She is worried that she would not be granted the loan because of her financial situation. She has given you the following financial information: Rent for the month, $650 Cash in checking account, $450 Spending for food, $345 Current value of automobile, $7,800 Credit card balance, $235 Auto insurance, S230 Stereo equipment, S2,350 Lunches/parking at work, $180 Home computer, S1,500 Clothing purchase, $110 Monthly take-home salary, $1,950 Savings account balance, $1,890 Balance of educational loan, S2,160 Telephone bill paid for month, $65 Loan payment, $80 Household possessions, $3,400 Payment for electricity, $90 Donations to church, $70 Value of stock investment, $860 Restaurant spending, $130 Help your grandmother to calculate and prepare: a) A statement of total assets b) Details of total liabilities c) Net worth d) Total cash inflows| e) Total cash outflows f) The balance sheet 8) Cash flow statement

Your grandmother is visiting Guadalajara to start a new retirement life. She is interested in applying for a bank loan in order to buy a house and a car. She is worried that she would not be granted the loan because of her financial situation. She has given you the following financial information: Rent for the month, $650 Cash in checking account, $450 Spending for food, $345 Current value of automobile, $7,800 Credit card balance, $235 Auto insurance, S230 Stereo equipment, S2,350 Lunches/parking at work, $180 Home computer, S1,500 Clothing purchase, $110 Monthly take-home salary, $1,950 Savings account balance, $1,890 Balance of educational loan, S2,160 Telephone bill paid for month, $65 Loan payment, $80 Household possessions, $3,400 Payment for electricity, $90 Donations to church, $70 Value of stock investment, $860 Restaurant spending, $130 Help your grandmother to calculate and prepare: a) A statement of total assets b) Details of total liabilities c) Net worth d) Total cash inflows| e) Total cash outflows f) The balance sheet 8) Cash flow statement

Chapter6: Business Expenses

Section: Chapter Questions

Problem 68P

Related questions

Question

Hello, I need help with f) and g)

I already have the information

Transcribed Image Text:Your grandmother is visiting Guadalajara to start a new retirement life. She is interested in applying for a

bank loan in order to buy a house and a car. She is worried that she would not be granted the loan because

of her financial situation. She has given you the following financial information:

Rent for the month, $650

Cash in checking account, $450

Spending for food, $345

Current value of automobile, $7,800

Credit card balance, $235

Auto insurance, S230

Stereo equipment, S2,350

Lunches/parking at work, $180

Home computer, S1,500

Clothing purchase, $110

Monthly take-home salary, $1,950

Savings account balance, $1,890

Balance of educational loan, S2,160

Telephone bill paid for month, $65

Loan payment, $80

Household possessions, $3,400

Payment for electricity, $90

Donations to church, $70

Value of stock investment, $860

Restaurant spending, $130

Help your grandmother to calculate and prepare:

a) A statement of total assets

b) Details of total liabilities

c) Net worth

d) Total cash inflows|

e) Total cash outflows

f) The balance sheet

8) Cash flow statement

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you