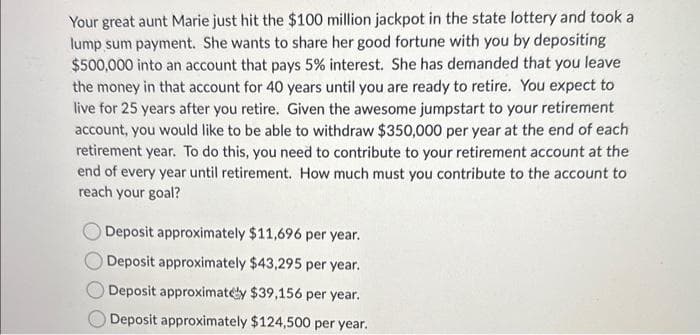

Your great aunt Marie just hit the $100 million jackpot in the state lottery lump sum payment. She wants to share her good fortune with you by depositing $500,000 into an account that pays 5% interest. She has demanded that you leave the money in that account for 40 years until you are ready to retire. You expect to live for 25 years after you retire. Given the awesome jumpstart to your retirement account, you would like to be able to withdraw $350,000 per year at the end of each retirement year. To do this, you need to contribute to your retirement account at the end of every year until retirement. How much must you contribute to the account to reach your goal? Deposit approximately $11,696 per year. Deposit approximately $43,295 per year. Deposit approximately $39,156 per year. Deposit approximately $124,500 per year. took a

Your great aunt Marie just hit the $100 million jackpot in the state lottery lump sum payment. She wants to share her good fortune with you by depositing $500,000 into an account that pays 5% interest. She has demanded that you leave the money in that account for 40 years until you are ready to retire. You expect to live for 25 years after you retire. Given the awesome jumpstart to your retirement account, you would like to be able to withdraw $350,000 per year at the end of each retirement year. To do this, you need to contribute to your retirement account at the end of every year until retirement. How much must you contribute to the account to reach your goal? Deposit approximately $11,696 per year. Deposit approximately $43,295 per year. Deposit approximately $39,156 per year. Deposit approximately $124,500 per year. took a

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 39P

Related questions

Question

Transcribed Image Text:Your great aunt Marie just hit the $100 million jackpot in the state lottery and took a

lump sum payment. She wants to share her good fortune with you by depositing

$500,000 into an account that pays 5% interest. She has demanded that you leave

the money in that account for 40 years until you are ready to retire. You expect to

live for 25 years after you retire. Given the awesome jumpstart to your retirement

account, you would like to be able to withdraw $350,000 per year at the end of each

retirement year. To do this, you need to contribute to your retirement account at the

end of every year until retirement. How much must you contribute to the account to

reach your goal?

Deposit approximately $11,696 per year.

Deposit approximately $43,295 per year.

Deposit approximately $39,156 per year.

Deposit approximately $124,500 per year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning