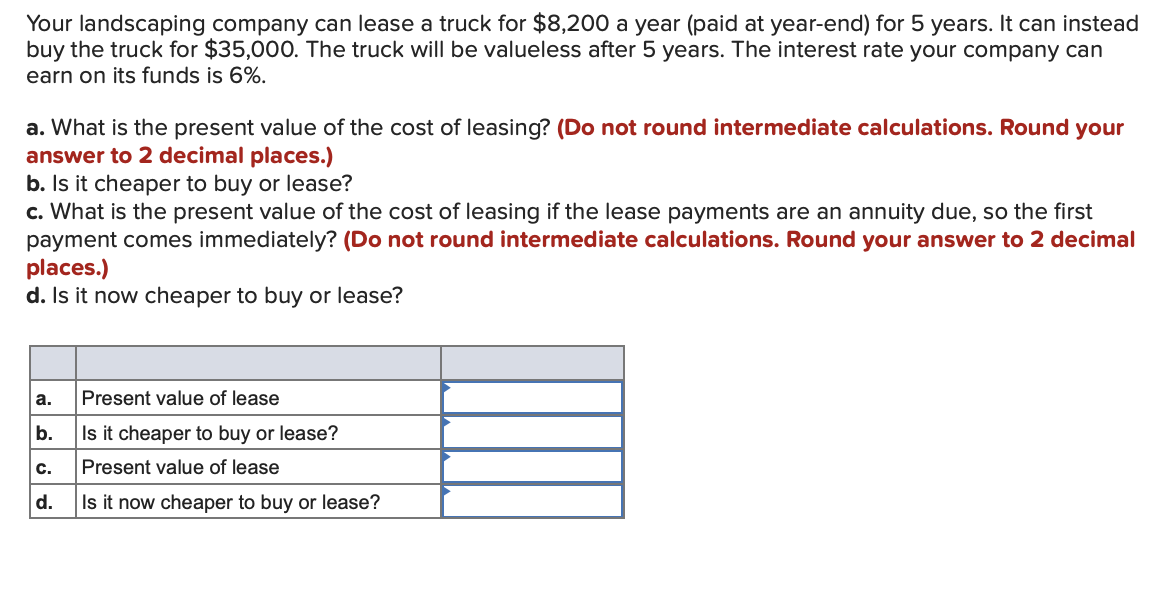

Your landscaping company can lease a truck for $8,200 a year (paid at year-end) for 5 years. It can instead buy the truck for $35,000. The truck will be valueless after 5 years. The interest rate your company can earn on its funds is 6%. a. What is the present value of the cost of leasing? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Is it cheaper to buy or lease? c. What is the present value of the cost of leasing if the lease payments are an annuity due, so the first payment comes immediately? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Is it now cheaper to buy or lease?

Your landscaping company can lease a truck for $8,200 a year (paid at year-end) for 5 years. It can instead buy the truck for $35,000. The truck will be valueless after 5 years. The interest rate your company can earn on its funds is 6%. a. What is the present value of the cost of leasing? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. Is it cheaper to buy or lease? c. What is the present value of the cost of leasing if the lease payments are an annuity due, so the first payment comes immediately? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Is it now cheaper to buy or lease?

Chapter19: Lease And Intermediate-term Financing

Section: Chapter Questions

Problem 9P

Related questions

Question

Your landscaping company can lease a truck for $8,200 a year (paid at year-end) for 5 years. It can instead buy the truck for $35,000. The truck will be valueless after 5 years. The interest rate your company can earn on its funds is 6%.

a. What is the present value of the cost of leasing? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

b. Is it cheaper to buy or lease?

c. What is the present value of the cost of leasing if the lease payments are an

d. Is it now cheaper to buy or lease?

Transcribed Image Text:Your landscaping company can lease a truck for $8,200 a year (paid at year-end) for 5 years. It can instead

buy the truck for $35,000. The truck will be valueless after 5 years. The interest rate your company can

earn on its funds is 6%.

a. What is the present value of the cost of leasing? (Do not round intermediate calculations. Round your

answer to 2 decimal places.)

b. Is it cheaper to buy or lease?

c. What is the present value of the cost of leasing if the lease payments are an annuity due, so the first

payment comes immediately? (Do not round intermediate calculations. Round your answer to 2 decimal

places.)

d. Is it now cheaper to buy or lease?

а.

Present value of lease

b.

Is it cheaper to buy or lease?

c.

Present value of lease

d.

Is it now cheaper to buy or lease?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning