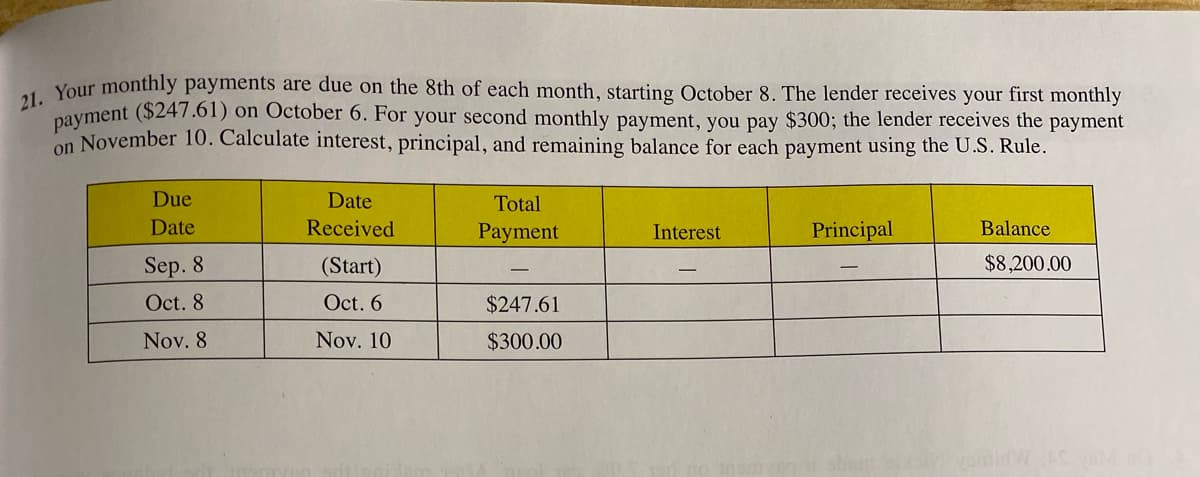

Your monthly payments are due on the 8th of each month, starting October 8. The lender receives your first monthly navment ($247.61) on October 6. For your second monthly payment, you pay $300; the lender receives the payment

Your monthly payments are due on the 8th of each month, starting October 8. The lender receives your first monthly navment ($247.61) on October 6. For your second monthly payment, you pay $300; the lender receives the payment

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

Please show all work for better understanding. I couldn’t figure out how to find the interest without knowing the rate.

The answers in the back of the book are:

$34.60 interest, $213.10 principal, $7986.99 balance

$42.12 interest, $257.88 principal, $7729.11 balance.

Thank you.

Transcribed Image Text:Your monthly payments are due on the 8th of each month, starting October 8. The lender receives your first monthly

payment ($247.61) on October 6. For your second monthly payment, you pay $300; the lender receives the payment

on November 10. Calculate interest, principal, and remaining balance for each payment using the U.S. Rule.

Due

Date

Total

Date

Received

Payment

Interest

Principal

Balance

Sep. 8

(Start)

$8,200.00

Oct. 8

Oct. 6

$247.61

Nov. 8

Nov. 10

$300.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,