On October 24, you plan to purchase a $1,500 computer by using one of your two credit cards. The Silver Card charges 18% interest and calculates interest based on the balance on the first day of the previous month. The Gold Card charges 18% interest and calculates interest based on the average daily balance. Both cards have a so balance as of October 1. The closing date is the end of the month for each card. Your plan is to make a $500 payment answers to the nearest cent.) November, make a $500 payment in December, and pay off the remaining balance in January. All your payments will be received and posted on the 10th of each month. No other charges will be made on the account. (Round your (a) Based on this information, calculate the interest (in $) charged by each card for this purchase. Silver Card Gold Card (b) Which card is the better deal and by how much (in $)? The --Select- v is the better deal by $

On October 24, you plan to purchase a $1,500 computer by using one of your two credit cards. The Silver Card charges 18% interest and calculates interest based on the balance on the first day of the previous month. The Gold Card charges 18% interest and calculates interest based on the average daily balance. Both cards have a so balance as of October 1. The closing date is the end of the month for each card. Your plan is to make a $500 payment answers to the nearest cent.) November, make a $500 payment in December, and pay off the remaining balance in January. All your payments will be received and posted on the 10th of each month. No other charges will be made on the account. (Round your (a) Based on this information, calculate the interest (in $) charged by each card for this purchase. Silver Card Gold Card (b) Which card is the better deal and by how much (in $)? The --Select- v is the better deal by $

Chapter12: Current Liabilities

Section: Chapter Questions

Problem 7EA: Homeland Plus specializes in home goods and accessories. In order for the company to expand its...

Related questions

Question

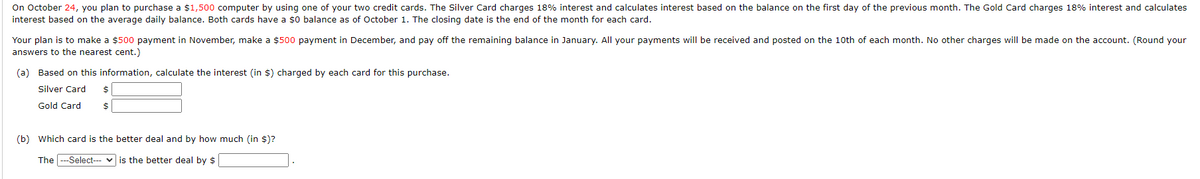

Transcribed Image Text:On October 24, you plan to purchase a $1,500 computer by using one of your two credit cards. The Silver Card charges 18% interest and calculates interest based on the balance on the first day of the previous month. The Gold Card charges 18% interest and calculates

interest based on the average daily balance. Both cards have a $0 balance as of October 1. The closing date is the end of the month for each card.

Your plan is to make a $500 payment in November, make a $500 payment in December, and pay off the remaining balance in January. All your payments will be received and posted on the 10oth of each month. No other charges will be made on the account. (Round your

answers to the nearest cent.)

(a) Based on this information, calculate the interest (in $) charged by each card for this purchase.

Silver Card

24

Gold Card

$4

(b) Which card is the better deal and by how much (in $)?

The ---Select--- v is the better deal bys

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT