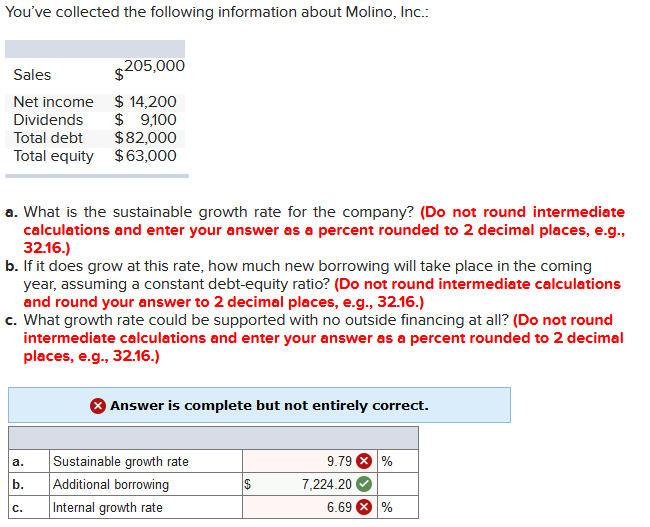

You've collected the following information about Molino, Inc.: $205,000 Sales $ 14,200 $ 9,100 $82,000 $ 63,000 Net income Dividends Total debt Total equity a. What is the sustainable growth rate for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If it does grow at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What growth rate could be supported with no outside financing at all? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. 9.79 8 % Sustainable growth rate b. Additional borrowing Internal growth rate a. 7,224.20 6.69 c. %24

You've collected the following information about Molino, Inc.: $205,000 Sales $ 14,200 $ 9,100 $82,000 $ 63,000 Net income Dividends Total debt Total equity a. What is the sustainable growth rate for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. If it does grow at this rate, how much new borrowing will take place in the coming year, assuming a constant debt-equity ratio? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What growth rate could be supported with no outside financing at all? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) Answer is complete but not entirely correct. 9.79 8 % Sustainable growth rate b. Additional borrowing Internal growth rate a. 7,224.20 6.69 c. %24

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter17: Dynamic Capital Structures And Corporate Valuation

Section: Chapter Questions

Problem 3P

Related questions

Question

Practice Pack

Transcribed Image Text:You've collected the following information about Molino, Inc.:

$205,000

Sales

$ 14,200

$ 9,100

$82,000

$ 63,000

Net income

Dividends

Total debt

Total equity

a. What is the sustainable growth rate for the company? (Do not round intermediate

calculations and enter your answer as a percent rounded to 2 decimal places, e.g.,

32.16.)

b. If it does grow at this rate, how much new borrowing will take place in the coming

year, assuming a constant debt-equity ratio? (Do not round intermediate calculations

and round your answer to 2 decimal places, e.g., 32.16.)

c. What growth rate could be supported with no outside financing at all? (Do not round

intermediate calculations and enter your answer as a percent rounded to 2 decimal

places, e.g., 32.16.)

Answer is complete but not entirely correct.

9.79 8 %

Sustainable growth rate

b.

Additional borrowing

Internal growth rate

a.

7,224.20

6.69

c.

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps with 6 images

Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT