Each family member in the Wise family received a large unexpected inheritance from a long-lost uncle on May 1, 2021. They are still in shock about this nheritance and want to use the money wisely. They have all agreed that the smartest financial move would be for each of them to open Tax-Free Savings Accounts (TFSAs) and to maximize their contributions. To date, no family member has made any TFSA contributions except for Steve who contributed $5,000 a the beginning of this year. They have asked you to help them determine the maximum amount permitted under the TFSA rules and they will then each contribute from their inheritance. (Hint: consider carryforward balances and contributions in 2021). Steve (father) turned 55 on April 10, 2021 Stella (mother) turns 48 on May 5, 2021 Anita (Steve's mother who lives with them) turns 71 on December 10, 2021 John (son) turned 24 on March 2, 2021 Twins (born minutes apart): Alley (daughter) turned 18 on December 31, 2020, and Joseph (son) turned 18 on January 1, 2021 Eva turns 17 on November 1, 2021 Years A Year started 2009-2012 2013-2014 2015 $283,000 B $290,000 C $284,000 Tax-Free Savings Account (TFSA): Annual Limits Annual Limit Years 2016-2018 2019-2020 2021 D $278,000 E $289,000 $5,000/year $5,500/year $10,000/year Annual Limit $5,500/year $6,000/year $6,000/year

Each family member in the Wise family received a large unexpected inheritance from a long-lost uncle on May 1, 2021. They are still in shock about this nheritance and want to use the money wisely. They have all agreed that the smartest financial move would be for each of them to open Tax-Free Savings Accounts (TFSAs) and to maximize their contributions. To date, no family member has made any TFSA contributions except for Steve who contributed $5,000 a the beginning of this year. They have asked you to help them determine the maximum amount permitted under the TFSA rules and they will then each contribute from their inheritance. (Hint: consider carryforward balances and contributions in 2021). Steve (father) turned 55 on April 10, 2021 Stella (mother) turns 48 on May 5, 2021 Anita (Steve's mother who lives with them) turns 71 on December 10, 2021 John (son) turned 24 on March 2, 2021 Twins (born minutes apart): Alley (daughter) turned 18 on December 31, 2020, and Joseph (son) turned 18 on January 1, 2021 Eva turns 17 on November 1, 2021 Years A Year started 2009-2012 2013-2014 2015 $283,000 B $290,000 C $284,000 Tax-Free Savings Account (TFSA): Annual Limits Annual Limit Years 2016-2018 2019-2020 2021 D $278,000 E $289,000 $5,000/year $5,500/year $10,000/year Annual Limit $5,500/year $6,000/year $6,000/year

Chapter6: Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

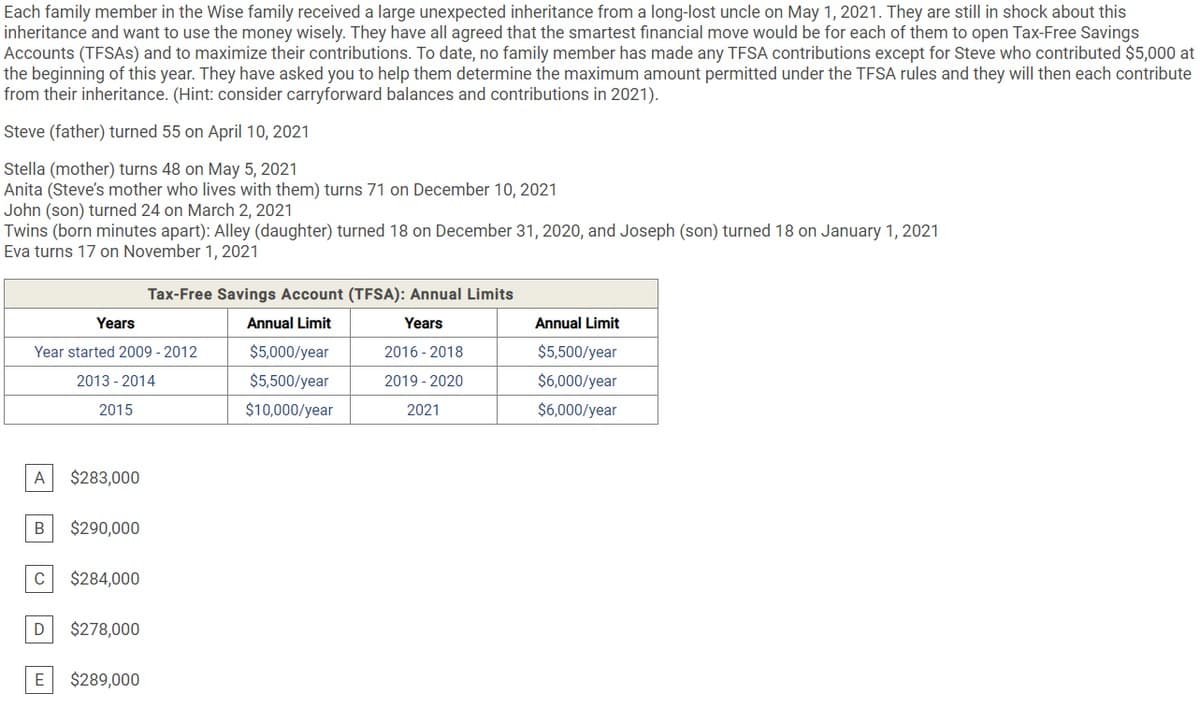

Transcribed Image Text:Each family member in the Wise family received a large unexpected inheritance from a long-lost uncle on May 1, 2021. They are still in shock about this

inheritance and want to use the money wisely. They have all agreed that the smartest financial move would be for each of them to open Tax-Free Savings

Accounts (TFSAs) and to maximize their contributions. To date, no family member has made any TFSA contributions except for Steve who contributed $5,000 at

the beginning of this year. They have asked you to help them determine the maximum amount permitted under the TFSA rules and they will then each contribute

from their inheritance. (Hint: consider carryforward balances and contributions in 2021).

Steve (father) turned 55 on April 10, 2021

Stella (mother) turns 48 on May 5, 2021

Anita (Steve's mother who lives with them) turns 71 on December 10, 2021

John (son) turned 24 on March 2, 2021

Twins (born minutes apart): Alley (daughter) turned 18 on December 31, 2020, and Joseph (son) turned 18 on January 1, 2021

Eva turns 17 on November 1, 2021

Years

A

Year started 2009-2012

2013-2014

2015

$283,000

B $290,000

C $284,000

Tax-Free Savings Account (TFSA): Annual Limits

Annual Limit

Years

2016-2018

2019-2020

2021

D $278,000

E $289,000

$5,000/year

$5,500/year

$10,000/year

Annual Limit

$5,500/year

$6,000/year

$6,000/year

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT