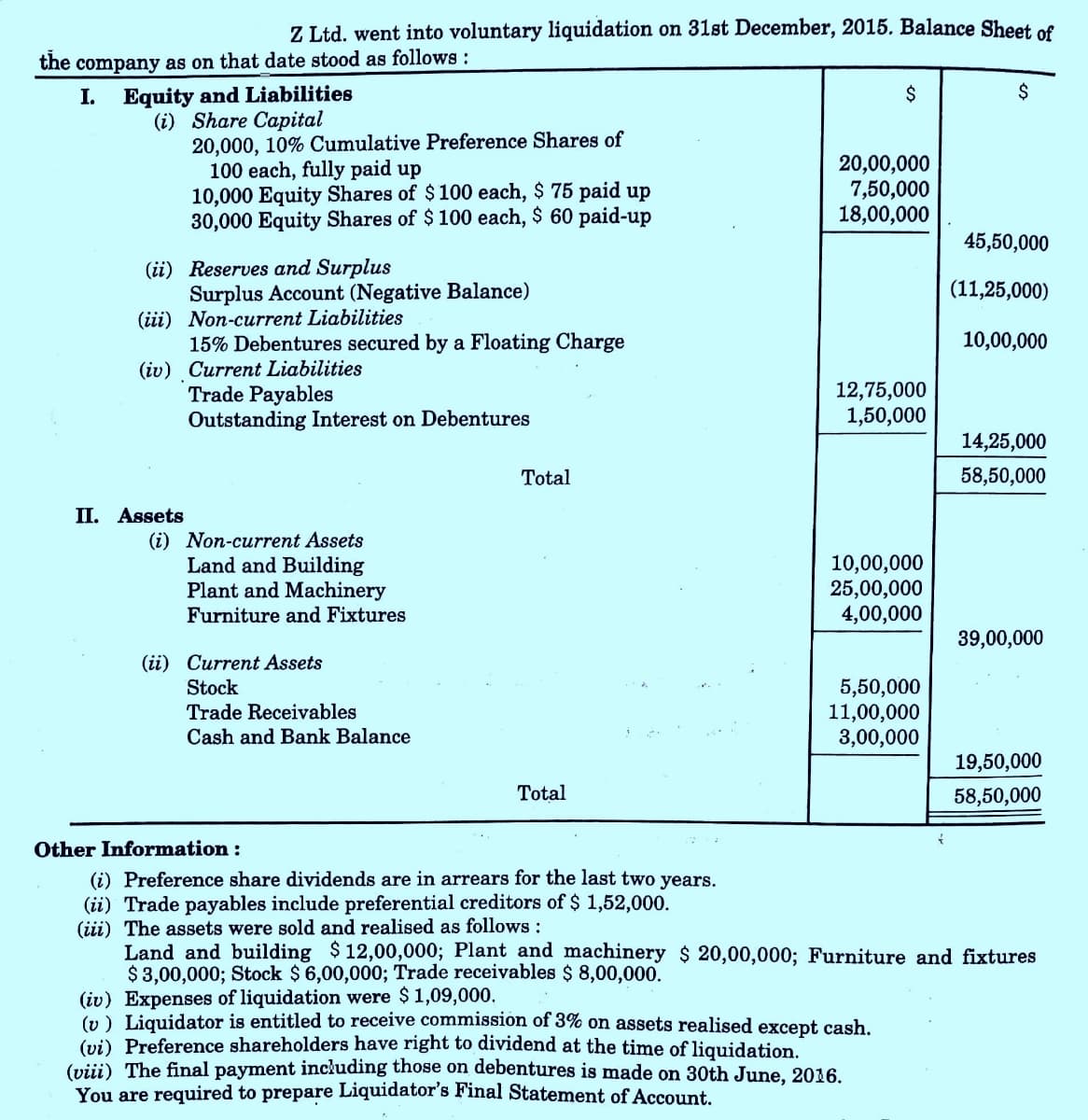

Z Ltd. went into voluntary liquidation on 31st December, 2015. Balance Sheet of the company as on that date stood as follows: I. Equity and Liabilities $ 2$ (i) Share Capital 20,000, 10% Cumulative Preference Shares of 100 each, fully paid up 10,000 Equity Shares of $ 100 each, $ 75 paid up 30,000 Equity Shares of $ 100 each, $ 60 paid-up 20,00,000 7,50,000 18,00,000 45,50,000 (ii) Reserves and Surplus Surplus Account (Negative Balance) (iii) Non-current Liabilities 15% Debentures secured by a Floating Charge (iv) Current Liabilities Trade Payables Outstanding Interest on Debentures (11,25,000) 10,00,000 12,75,000 1,50,000 14,25,000 Total 58,50,000 II. Assets (i) Non-current Assets Land and Building Plant and Machinery Furniture and Fixtures 10,00,000 25,00,000 4,00,000 39,00,000 (ii) Current Assets Stock 5,50,000 11,00,000 3,00,000 Trade Receivables Cash and Bank Balance 19,50,000 Total 58,50,000 Other Information : (i) Preference share dividends are in arrears for the last two years. (ii) Trade payables include preferential creditors of $ 1,52,000. (iii) The assets were sold and realised as follows : Land and building $ 12,00,000; Plant and machinery $ 20,00,000; Furniture and fixtures $ 3,00,000; Stock $ 6,00,0003; Trade receivables $ 8,00,000. (iv) Expenses of liquidation were $ 1,09,000. (v) Liquidator is entitled to receive commission of 3% on assets realised except cash, (vi) Preference shareholders have right to dividend at the time of liquidation. (viii) The final payment incłuding those on debentures is made on 30th June, 2016. You are required to prepare Liquidator's Final Statement of Account.

Z Ltd. went into voluntary liquidation on 31st December, 2015. Balance Sheet of the company as on that date stood as follows: I. Equity and Liabilities $ 2$ (i) Share Capital 20,000, 10% Cumulative Preference Shares of 100 each, fully paid up 10,000 Equity Shares of $ 100 each, $ 75 paid up 30,000 Equity Shares of $ 100 each, $ 60 paid-up 20,00,000 7,50,000 18,00,000 45,50,000 (ii) Reserves and Surplus Surplus Account (Negative Balance) (iii) Non-current Liabilities 15% Debentures secured by a Floating Charge (iv) Current Liabilities Trade Payables Outstanding Interest on Debentures (11,25,000) 10,00,000 12,75,000 1,50,000 14,25,000 Total 58,50,000 II. Assets (i) Non-current Assets Land and Building Plant and Machinery Furniture and Fixtures 10,00,000 25,00,000 4,00,000 39,00,000 (ii) Current Assets Stock 5,50,000 11,00,000 3,00,000 Trade Receivables Cash and Bank Balance 19,50,000 Total 58,50,000 Other Information : (i) Preference share dividends are in arrears for the last two years. (ii) Trade payables include preferential creditors of $ 1,52,000. (iii) The assets were sold and realised as follows : Land and building $ 12,00,000; Plant and machinery $ 20,00,000; Furniture and fixtures $ 3,00,000; Stock $ 6,00,0003; Trade receivables $ 8,00,000. (iv) Expenses of liquidation were $ 1,09,000. (v) Liquidator is entitled to receive commission of 3% on assets realised except cash, (vi) Preference shareholders have right to dividend at the time of liquidation. (viii) The final payment incłuding those on debentures is made on 30th June, 2016. You are required to prepare Liquidator's Final Statement of Account.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter16: Retained Earnings And Earnings Per Share

Section: Chapter Questions

Problem 9P

Related questions

Question

Transcribed Image Text:Z Ltd. went into voluntary liquidation on 31st December, 2015. Balance Sheet of

the company as on that date stood as follows :

I.

Equity and Liabilities

$

(i) Share Capital

20,000, 10% Cumulative Preference Shares of

100 each, fully paid up

10,000 Equity Shares of $100 each, $ 75 paid up

30,000 Equity Shares of $ 100 each, $ 60 paid-up

20,00,000

7,50,000

18,00,000

45,50,000

(ii) Reserves and Surplus

Surplus Account (Negative Balance)

(iii) Non-current Liabilities

15% Debentures secured by a Floating Charge

(iv) Current Liabilities

Trade Payables

Outstanding Interest on Debentures

(11,25,000)

10,00,000

12,75,000

1,50,000

14,25,000

Total

58,50,000

II. Assets

(i) Non-current Assets

Land and Building

Plant and Machinery

Furniture and Fixtures

10,00,000

25,00,000

4,00,000

39,00,000

(ii) Current Assets

Stock

5,50,000

11,00,000

3,00,000

Trade Receivables

Cash and Bank Balance

19,50,000

Total

58,50,000

Other Information :

(i) Preference share dividends are in arrears for the last two years.

(ii) Trade payables include preferential creditors of $ 1,52,000.

(iii) The assets were sold and realised as follows :

Land and building $ 12,00,000; Plant and machinery $ 20,00,000; Furniture and fixtures

$ 3,00,000; Stock $ 6,00,000; Trade receivables $ 8,00,000.

(iv) Expenses of liquidation were $ 1,09,000.

(v) Liquidator is entitled to receive commission of 3% on assets realised except cash,

(vi) Preference shareholders have right to dividend at the time of liquidation.

(viii) The final payment incłuding those on debentures is made on 30th June, 2016.

You are required to prepare Liquidator's Final Statement of Account.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub