Zeema's financial year ends on 30 September. She sublets part of her premises to Faith at an annual rent of $6600. On 1 October 20-3, Faith owed one month's rent. During the year ended 30 September 20-4, Faith paid rent of $8 250. a Write up Zeema's rent receivable account for the year ended 30 September 20-4. Balance the account and show the amount transferred to the income statement. b Prepare a relevant extract from Zeema's income statement for the year ended 30 September 20–4.

Zeema's financial year ends on 30 September. She sublets part of her premises to Faith at an annual rent of $6600. On 1 October 20-3, Faith owed one month's rent. During the year ended 30 September 20-4, Faith paid rent of $8 250. a Write up Zeema's rent receivable account for the year ended 30 September 20-4. Balance the account and show the amount transferred to the income statement. b Prepare a relevant extract from Zeema's income statement for the year ended 30 September 20–4.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter5: Sales And Receivables

Section: Chapter Questions

Problem 79BPSB

Related questions

Question

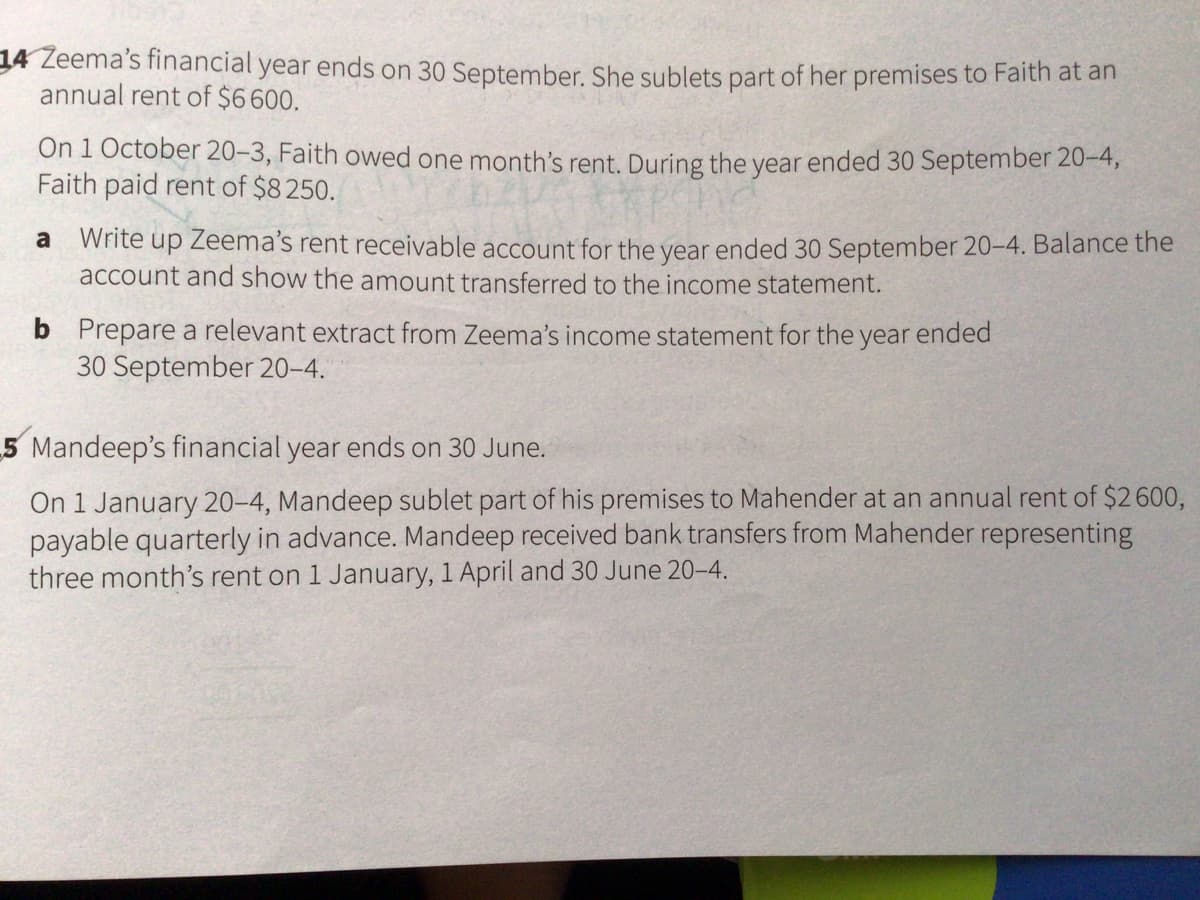

Transcribed Image Text:34 Zeema's financial year ends on 30 September. She sublets part of her premises to Faith at an

annual rent of $6600.

On 1 October 20-3, Faith owed one month's rent. During the year ended 30 September 20-4,

Faith paid rent of $8250.

Write up Zeema's rent receivable account for the year ended 30 September 20-4. Balance the

account and show the amount transferred to the income statement.

a

b Prepare a relevant extract from Zeema's income statement for the year ended

30 September 20–4.

5 Mandeep's financial year ends on 30 June.

On 1 January 20-4, Mandeep sublet part of his premises to Mahender at an annual rent of $2600,

payable quarterly in advance. Mandeep received bank transfers from Mahender representing

three month's rent on 1 January, 1 April and 30 June 20-4.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT