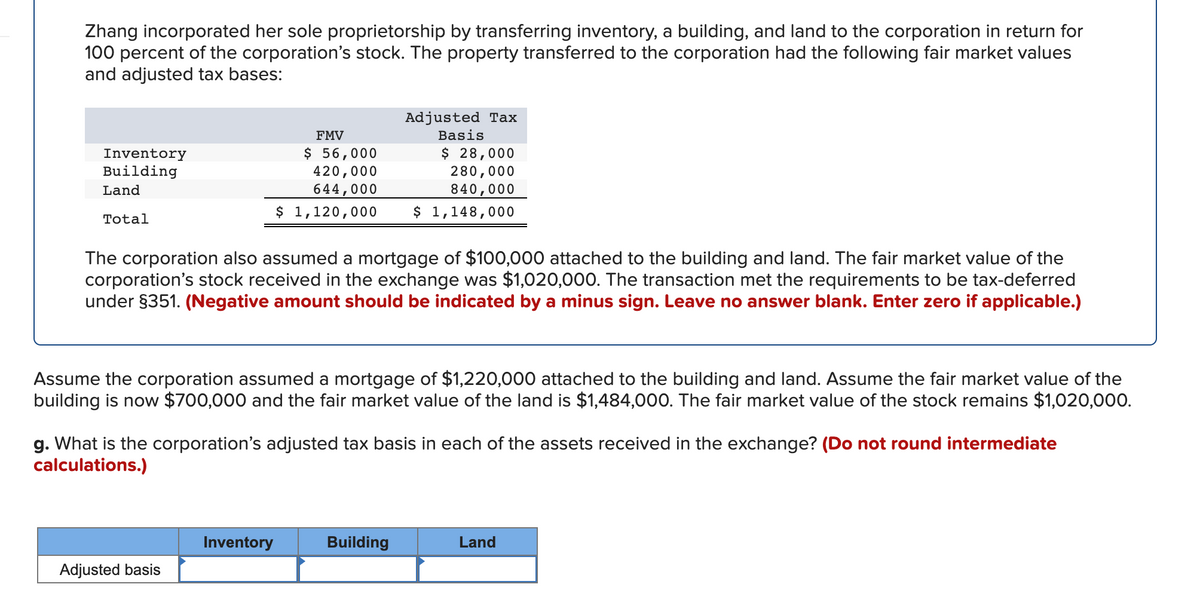

Zhang incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted tax bases: Adjusted Tax FMV Basis $ 28,000 280,000 840,000 $ 1,148,000 Inventory Building $ 56,000 420,000 $ Land 644,000 $ 1,120,000 Total The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $1,020,000. The transaction met the requirements to be tax-deferred under §351. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) Assume the corporation assumed a mortgage of $1,220,000 attached to the building and land. Assume the fair market value of the building is now $700,000 and the fair market value of the land is $1,484,000. The fair market value of the stock remains $1,020,000. g. What is the corporation's adjusted tax basis in each of the assets received in the exchange? (Do not round intermediate calculations.)

Zhang incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and adjusted tax bases: Adjusted Tax FMV Basis $ 28,000 280,000 840,000 $ 1,148,000 Inventory Building $ 56,000 420,000 $ Land 644,000 $ 1,120,000 Total The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market value of the corporation's stock received in the exchange was $1,020,000. The transaction met the requirements to be tax-deferred under §351. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.) Assume the corporation assumed a mortgage of $1,220,000 attached to the building and land. Assume the fair market value of the building is now $700,000 and the fair market value of the land is $1,484,000. The fair market value of the stock remains $1,020,000. g. What is the corporation's adjusted tax basis in each of the assets received in the exchange? (Do not round intermediate calculations.)

Chapter18: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 30P

Related questions

Question

100%

Transcribed Image Text:Zhang incorporated her sole proprietorship by transferring inventory, a building, and land to the corporation in return for

100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values

and adjusted tax bases:

Adjusted Tax

FMV

Basis

$ 56,000

420,000

644,000

$ 1,120,000

$ 28,000

280,000

840,000

Inventory

Building

Land

$ 1,148,000

Total

The corporation also assumed a mortgage of $100,000 attached to the building and land. The fair market value of the

corporation's stock received in the exchange was $1,020,000. The transaction met the requirements to be tax-deferred

under §351. (Negative amount should be indicated by a minus sign. Leave no answer blank. Enter zero if applicable.)

Assume the corporation assumed a mortgage of $1,220,000 attached to the building and land. Assume the fair market value of the

building is now $700,000 and the fair market value of the land is $1,484,000. The fair market value of the stock remains $1,020,000.

g. What is the corporation's adjusted tax basis in each of the assets received in the exchange? (Do not round intermediate

calculations.)

Inventory

Building

Land

Adjusted basis

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT