lie forms Broadbill Corporation by transferring land (basis of $125,000, fair market 375,000. One month prior to incorporating Broadbill, Allie borrows $100,000 for per n the land. Broadbill Corporation issues stock worth $300,000 to Allie and assumes an amount is zero, enter "0". . What are the tax consequences to Allie and to Broadbill Corporation? Allie has a realized gain of $ in the land and Allie has a s ince of which $ as a basis of $ basis in . How would the tax consequences to Allie differ if she had not borrowed the $100,

lie forms Broadbill Corporation by transferring land (basis of $125,000, fair market 375,000. One month prior to incorporating Broadbill, Allie borrows $100,000 for per n the land. Broadbill Corporation issues stock worth $300,000 to Allie and assumes an amount is zero, enter "0". . What are the tax consequences to Allie and to Broadbill Corporation? Allie has a realized gain of $ in the land and Allie has a s ince of which $ as a basis of $ basis in . How would the tax consequences to Allie differ if she had not borrowed the $100,

Chapter4: Corporations: Organization And Capital Structure

Section: Chapter Questions

Problem 38P

Related questions

Question

100%

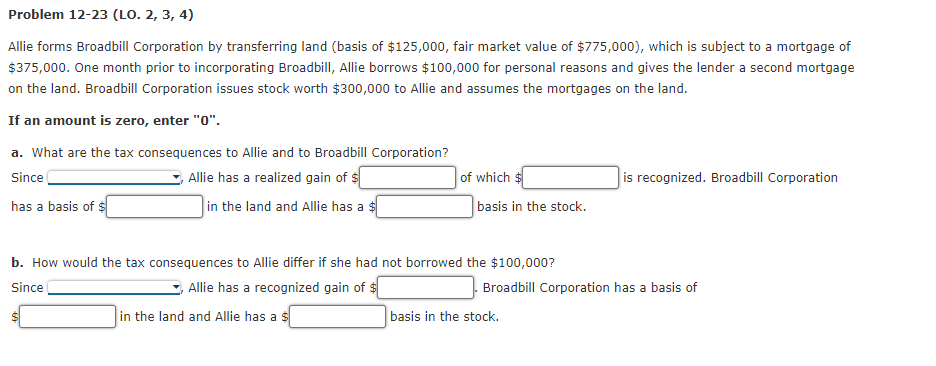

Transcribed Image Text:Problem 12-23 (LO. 2, 3, 4)

Allie forms Broadbill Corporation by transferring land (basis of $125,000, fair market value of $775,000), which is subject to a mortgage of

$375,000. One month prior to incorporating Broadbill, Allie borrows $100,000 for personal reasons and gives the lender a second mortgage

on the land. Broadbill Corporation issues stock worth $300,000 to Allie and assumes the mortgages on the land.

If an amount is zero, enter "0".

a. What are the tax consequences to Allie and to Broadbill Corporation?

Allie has a realized gain of $

of which

is recognized. Broadbill Corporation

Since

has a basis of $

in the land and Allie has a $

basis in the stock.

b. How would the tax consequences to Allie differ if she had not borrowed the $100,000?

Since

Allie has a recognized gain of $

Broadbill Corporation has a basis of

in the land and Allie has a $

basis in the stock.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT