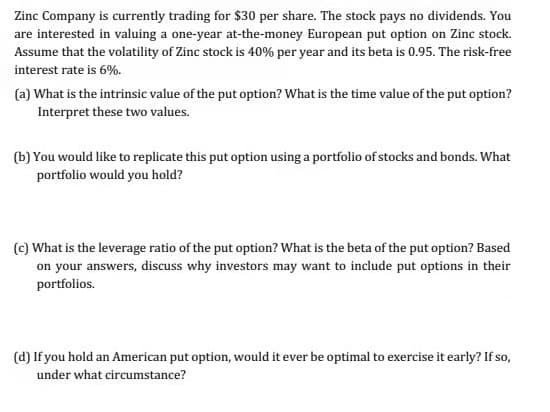

Zinc Company is currently trading for $30 per share. The stock pays no dividends. You are interested in valuing a one-year at-the-money European put option on Zinc stock. Assume that the volatility of Zinc stock is 40% per year and its beta is 0.95. The risk-free interest rate is 6%. (a) What is the intrinsic value of the put option? What is the time value of the put option? Interpret these two values. (b) You would like to replicate this put option using a portfolio of stocks and bonds. What portfolio would you hold? (c) What is the leverage ratio of the put option? What is the beta of the put option? Based on your answers, discuss why investors may want to include put options in their portfolios. (d) If you hold an American put option, would it ever be optimal to exercise it early? If so, under what circumstance?

Zinc Company is currently trading for $30 per share. The stock pays no dividends. You are interested in valuing a one-year at-the-money European put option on Zinc stock. Assume that the volatility of Zinc stock is 40% per year and its beta is 0.95. The risk-free interest rate is 6%. (a) What is the intrinsic value of the put option? What is the time value of the put option? Interpret these two values. (b) You would like to replicate this put option using a portfolio of stocks and bonds. What portfolio would you hold? (c) What is the leverage ratio of the put option? What is the beta of the put option? Based on your answers, discuss why investors may want to include put options in their portfolios. (d) If you hold an American put option, would it ever be optimal to exercise it early? If so, under what circumstance?

Chapter11: Managing Transaction Exposure

Section: Chapter Questions

Problem 35QA

Related questions

Question

Transcribed Image Text:Zinc Company is currently trading for $30 per share. The stock pays no dividends. You

are interested in valuing a one-year at-the-money European put option on Zinc stock.

Assume that the volatility of Zinc stock is 40% per year and its beta is 0.95. The risk-free

interest rate is 6%.

(a) What is the intrinsic value of the put option? What is the time value of the put option?

Interpret these two values.

(b) You would like to replicate this put option using a portfolio of stocks and bonds. What

portfolio would you hold?

(c) What is the leverage ratio of the put option? What is the beta of the put option? Based

on your answers, discuss why investors may want to include put options in their

portfolios.

(d) If you hold an American put option, would it ever be optimal to exercise it early? If so,

under what circumstance?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning