ZNet Co. is a web-based retail company. The company reports the following for the past year. Sales $ 5,000,000 Operating income 1,000,000 Average invested assets 12,500,000 The company’s CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested assets will be the same as for the past year. 1. Compute return on investment for the past year. 2. Compute profit margin for the past year. 3. If the CEO’s forecast is correct, what will return on investment equal for next year? 4. If the CEO’s forecast is correct, what will investment turnover equal for next year?

ZNet Co. is a web-based retail company. The company reports the following for the past year. Sales $ 5,000,000 Operating income 1,000,000 Average invested assets 12,500,000 The company’s CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested assets will be the same as for the past year. 1. Compute return on investment for the past year. 2. Compute profit margin for the past year. 3. If the CEO’s forecast is correct, what will return on investment equal for next year? 4. If the CEO’s forecast is correct, what will investment turnover equal for next year?

Financial & Managerial Accounting

13th Edition

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter23: Performance Evaluation For Decentralized Operations

Section: Chapter Questions

Problem 23.17EX

Related questions

Question

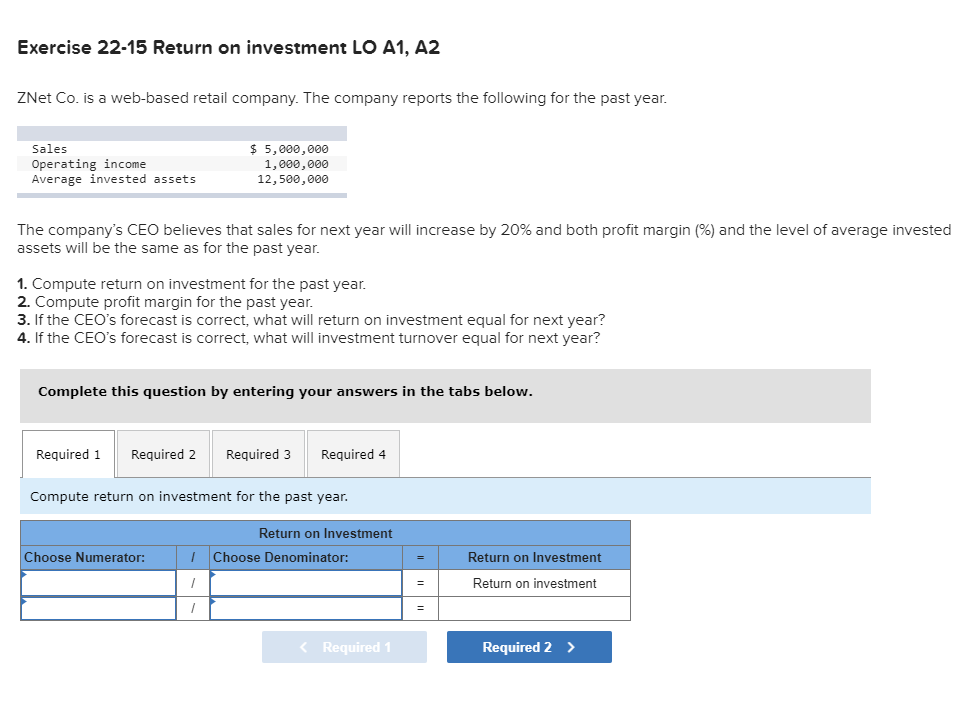

Exercise 22-15 Return on investment LO A1, A2

ZNet Co. is a web-based retail company. The company reports the following for the past year.

| Sales | $ | 5,000,000 | |

| Operating income | 1,000,000 | ||

| Average invested assets | 12,500,000 | ||

The company’s CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested assets will be the same as for the past year.

1. Compute return on investment for the past year.

2. Compute profit margin for the past year.

3. If the CEO’s

4. If the CEO’s forecast is correct, what will investment turnover equal for next year?

Transcribed Image Text:Exercise 22-15 Return on investment LO A1, A2

ZNet Co. is a web-based retail company. The company reports the following for the past year.

Sales

$ 5,000,000

Operating income

Average invested assets

1,000,000

12,500,000

The company's CEO believes that sales for next year will increase by 20% and both profit margin (%) and the level of average invested

assets will be the same as for the past year.

1. Compute return on investment for the past year.

2. Compute profit margin for the past year.

3. If the CEO's forecast is correct, what will return on investment equal for next year?

4. If the CEO's forecast is correct, what will investment turnover equal for next year?

Complete this question by entering your answers in the tabs below.

Required 1

Required 2

Required 3

Required 4

Compute return on investment for the past year.

Return on Investment

Choose Numerator:

Choose Denominator:

Return on Investment

=

Return on investment

%3D

%3D

Required 1

Required 2 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781337119207

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning