Zorro Company has significant amounts of accounts receivable, and experiences uncollectible accounts from time to time. Zorro uses the direct write-c method. When Zorro Company writes off an uncollectible receivable, what is the effect of that single transaction? O A. It will have no effect on net income.

Zorro Company has significant amounts of accounts receivable, and experiences uncollectible accounts from time to time. Zorro uses the direct write-c method. When Zorro Company writes off an uncollectible receivable, what is the effect of that single transaction? O A. It will have no effect on net income.

Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN:9781285595047

Author:Weil

Publisher:Weil

Chapter7: Introduction To Financial Statement Analysis

Section: Chapter Questions

Problem 16E

Related questions

Question

#14

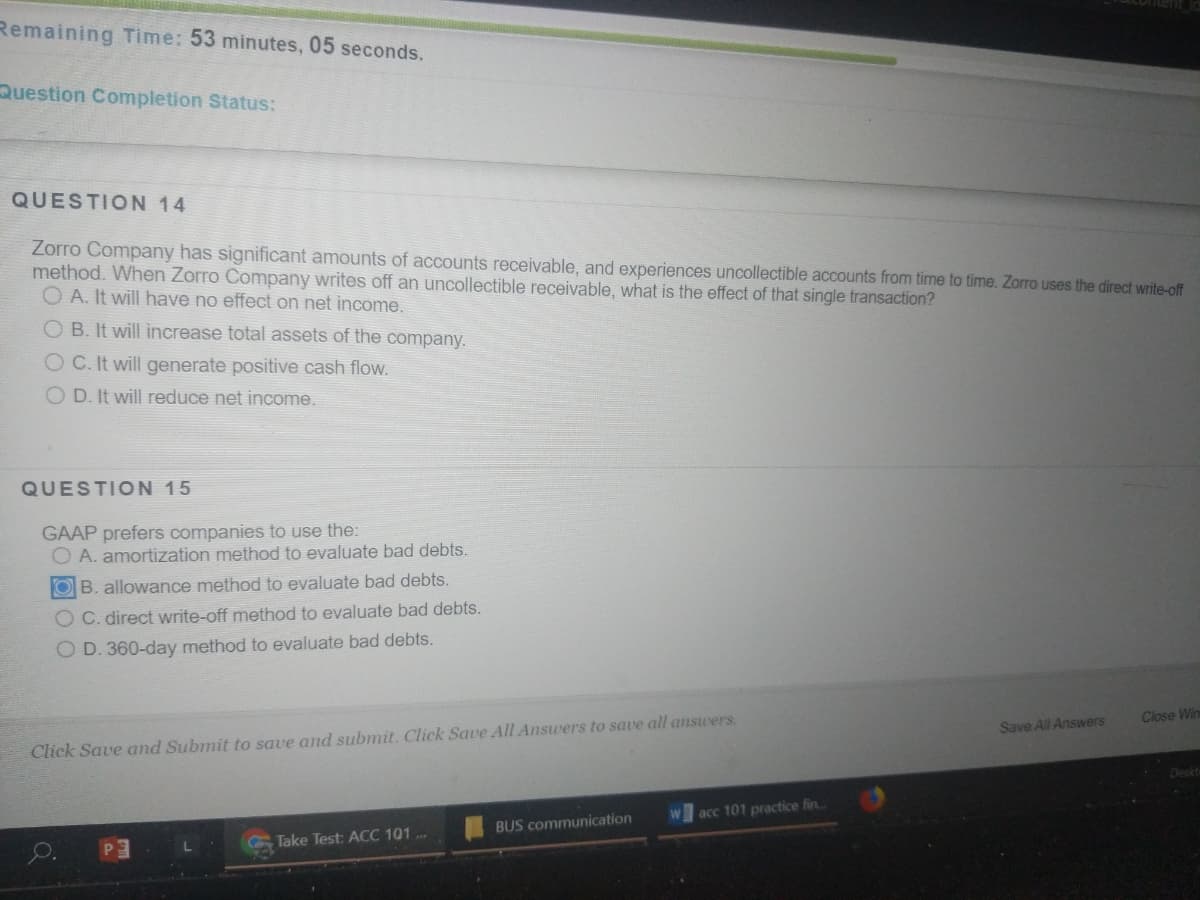

Transcribed Image Text:Remaining Time: 53 minutes, 05 seconds.

Question Completion Status:

QUESTION 14

Zorro Company has significant amounts of accounts receivable, and experiences uncollectible accounts from time to time. Zorro uses the direct write-off

method. When Zorro Company writes off an uncollectible receivable, what is the effect of that single transaction?

O A. It will have no effect on net income.

O B. It will increase total assets of the company.

O C. It will generate positive cash flow.

O D. It will reduce net income.

QUESTION 15

GAAP prefers companies to use the:

O A. amortization method to evaluate bad debts.

OB. allowance method to evaluate bad debts.

OC. direct write-off method to evaluate bad debts.

O D. 360-day method to evaluate bad debts.

Close Win

Save All Answers

Click Save and Submit to save and submit. Click Save All Answers to save all answers.

acc 101 practice fin..

BUS communication

Take Test: ACC 101

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,