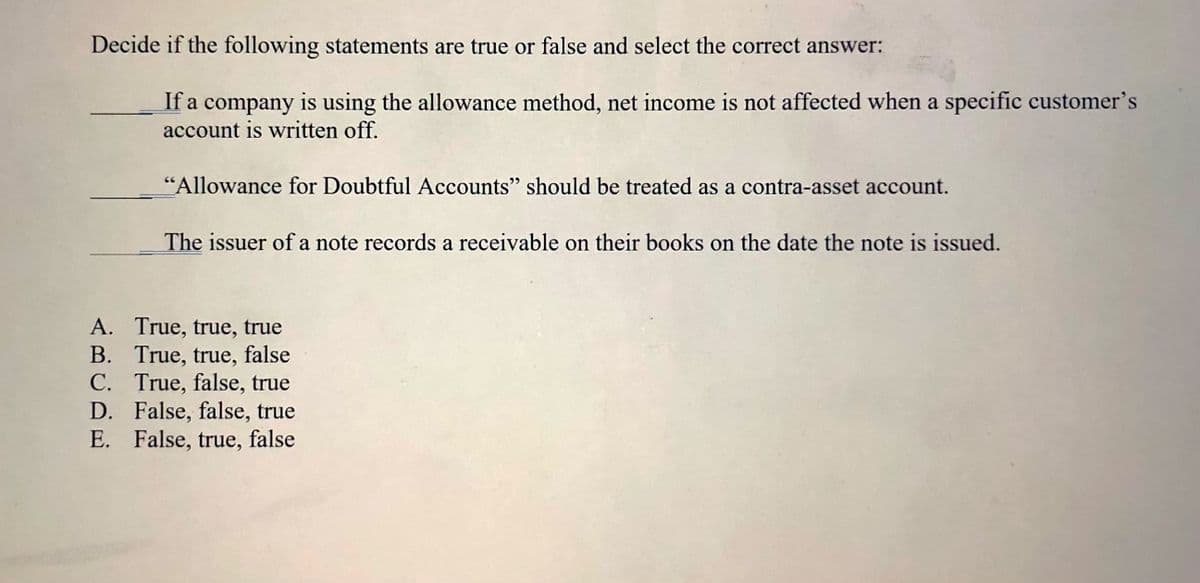

Decide if the following statements are true or false and select the correct answer: If a company is using the allowance method, net income is not affected when a specific customer's account is written off. "Allowance for Doubtful Accounts" should be treated as a contra-asset account. The issuer of a note records a receivable on their books on the date the note is issued. A. True, true, true B. True, true, false C. True, false, true D. False, false, true E. False, true, false

Decide if the following statements are true or false and select the correct answer: If a company is using the allowance method, net income is not affected when a specific customer's account is written off. "Allowance for Doubtful Accounts" should be treated as a contra-asset account. The issuer of a note records a receivable on their books on the date the note is issued. A. True, true, true B. True, true, false C. True, false, true D. False, false, true E. False, true, false

Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Chapter9: Auditing The Revenue Cycle

Section: Chapter Questions

Problem 20MCQ

Related questions

Question

May you please help me determine which statements are false or true?

Transcribed Image Text:Decide if the following statements are true or false and select the correct answer:

If a company is using the allowance method, net income is not affected when a specific customer's

account is written off.

"Allowance for Doubtful Accounts" should be treated as a contra-asset account.

The issuer of a note records a receivable on their books on the date the note is issued.

A. True, true, true

B. True, true, false

C. True, false, true

D. False, false, true

E. False, true, false

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub