Liabilities and Equity Accounts payable and accruals Short-term debt Long-term debt Common equity Total liabilities and equity Assets Cash $ 120 $ 10 Accounts receivable Inventories Plant and equipment, net Total assets 240 47 360 1,120 2,160 1,703 $2,880 $2,880

Q: Ignacio, Inc., had after-tax operating income last year of $1,196,500. Three sources of financing…

A: Given, Net operating profit = $1,196,500 Mortgage bonds rate = 4% or 0.04 Unsecured bonds rate = 6%…

Q: A firm has total assets of $1 million and a debt ratio of 30%. Currently, it has sales of $2.5…

A: Working note:

Q: ENN Corporation has interest expense of P16,000, sales of P600,000, a tax rate of 30%, and after-tax…

A: Times interest earned ratio = Earnings before interest and tax/interest expense where, Earnings…

Q: The financial breakeven point of Soillnc. is P90,000,while the tax rate applicable to the company is…

A: The financial breakeven can be calculated by using this equation EBITFinBE =Interest cost +Preffered…

Q: Marginal Incorporated (MI) has determined that its before-tax cost of debt is 10.0%. Its cost of…

A: (in million dollar) weight (%) Capital required(in million dollar) Value of debt 372 62 181.66…

Q: Bolero Corporation has one long term loan (interest bearing debt) of $700,000 at an interest rate of…

A: Given: Particulars Amount Rate Debt $700,000 5.20% Equity $1,000,000 16.00%

Q: Skolits Corp. has a cost of equity of 11.8 percent and an aftertax cost of debt of 4.44 percent. The…

A: Weighted Average Cost of Capital is defined as financial metric, which used to help in the…

Q: Chamin, Inc. has earnings before interest and taxes (EBIT) of $375,000. Chamin has interest expense…

A: The degree of financial leverage shows the effect of fixed financial costs on the earnings of the…

Q: Rogers’ Rotors has debt with a market value of $250,000, preferred stock with a market value of…

A: WACC (weighted average cost of capital) refers to the average cost that is paid by a company to…

Q: Marginal Incorporated (MI) has determined that its after-tax cost of debt is 5.0% for the first $62…

A: Capital Budget = $167 million To be financed through: Debt = 167*325/500 = 108.55 million Preferred…

Q: Williamson, Inc., has a debt-equity ratio of 2. The firm's weighted average cost of capital is 10…

A: Given: Debt to equity = 2 WACC = 10% cost of equity re=21.6% tax = 30%

Q: It is known that a firm’s Net Operating Profit After Tax (NOPAT) is $58,000 and its Economic Value…

A: We need to use EVA equation below to calculate WACC EVA =Net Operating Profit After Tax (NOPAT)…

Q: Fama's Llamas has a weighted average cost of capital of 9.5 percent. The company's cost of equity is…

A: Calculation of Target Debt-Equity Ratio:The target debt-equity ratio is 0.91.Excel Spreadsheet:

Q: Williamson, Inc., has a debt-equity ratio of 3. The firm's weighted average cost of capital is 12…

A: The Weighted Average Cost of Capital WACC is calculated with the help of following formula WACC =…

Q: Fama's Llamas has a weighted average cost of capital of 10 percent. The company's cost of equity is…

A: Debt-Equity Ratio is long-term solvency ratio of company. It is calculated by dividing debt by…

Q: Blue Co., a company with 25% tax rate, has a free cash flow of P150,000,000 for the next year and is…

A: FCF1 = P 150,000,000 Growth rate (g) = 4% Debt to equity (D/E) = 0.25 Cost of debt = Rd = 5% Cost of…

Q: Vanderheiden Press Inc. and Herrenhouse PublishingCompany had the following balance sheets as of…

A: The Vanderheiden Press Inc. and Herrenhouse Publishing with the balance sheets as of December 31,…

Q: ABC Company’s cost of equity is 18%, its before-tax cost of debt is 8%, and its corporate tax rate…

A: Cost of Equity = 18% Before Tax Cost of Debt = 8% Tax Rate = 40% Value of Equity = 1200 Value of…

Q: Viserion, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding with…

A: Yield to maturity of the bond is the return which investors would get I the bond is held till…

Q: Last year Jullan Corp. had sales of P302,225 operating costs of P267,500 and year-end assets of…

A: Ratio is a tool which is used to measure the firm’s performance by establishing relation of…

Q: Key Motors has a cost of equity of 14.26 percent and an unlevered cost of capital of 11.34 percent.…

A: levered cost of equity formula: re=ru+DV-D×ru -rd×1-taxwhere,re= levered cost of equityru= unlevered…

Q: The Bigelow Company has a cost of equity of 12 percent, a pre-tax cost of debt of 7 percent, and a…

A: WACC (weighted average cost of capital) refers to the average cost that is paid by a company to…

Q: Russell Securities has $100 million in total assets and its corporate tax rate is 40 percent. The…

A: Before we get into the question, let's understand the two ratios involved in the question:1. BEP =…

Q: The ABC corp. is expected to have the earnings before interest and taxes of $60,000 and the…

A: Value of Unlevered firm (Vu)Vu=EBIT1-TRu where T= Tax rate, Ru=Unlevered cost of capital Value of…

Q: Percy's Wholesale Supply has earnings before interest and taxes of €106,000. Both the book and the…

A: The weighted average cost of capital (WACC) refers to the average cost that is paid by a company to…

Q: PWC Inc. has a policy of distributing 30% of its current year income after interest and taxes. Which…

A: Company's earning after interest and taxes are divided into two parts i.e. dividend payout and…

Q: The ABC corp. is expected to have the earnings before interest and taxes of $60,000 and the…

A: As per MM proportion 2 value of unlevered firm will increase by present value of tax shield provided…

Q: Calculate the WACC for a firm that pays 10% on its debt, requires an 18% rate of return on its…

A: The Weighted average cost of capital(WACC) refers to the method in which each category of capital is…

Q: Barton Industries has operating income for the year of $3,500,000 and a 37% tax rate. Its total…

A: Economic Value Added (EVA) is a financial indicator that helps in determining the profitability of…

Q: Take It All Away has a cost of equity of 10.57 percent, a pretax cost of debt of 5.29 percent, and a…

A: A company has several sources from where it can raise funds. It can issue equity shares and the…

Q: An all -equity firm reports a net profit margin of 12% on sales of $6 million. If the tax rate is…

A:

Q: XYZ anticipates eaming $1,800,000 and paying $300,000 in dividends this year. XYZ's capital…

A: Given:Anticipates earnings=$1800000Dividend=$300000Capital structure=20% debt and 80% equityTax…

Q: A firm has a debt-to-equity ratio of 50 percent. Currently, it has interest expense of 500,000 on…

A: Computation of total equity is as follows: Debt to Equity Ratio=50%Debt to Equity Ratio=Total…

Q: Fama's Llamas has a weighted average cost of capital of 9.7 percent. The company's cost of equity is…

A:

Q: It was reported last week that Blue Bell Enterprises earned $18.5 million this year. The report also…

A: Growth rate = Retention ration * Retrun of equity

Q: The financial breakeven point of Soil Inc. is P90,000, while the tax rate applicable to the company…

A: Interest paid = Outstanding loan * Interest rate = 200000*10% = P20000

Q: ICU Window, Inc., is trying to determine its cost of debt. The firm has a debt issue outstanding…

A: Cost of Debt refers to cost incurred by an entity for having debt fund in capital structure.

Q: Take It All Away has a cost of equity of 11.05 percent, a pretax cost of debt of 5.40 percent, and a…

A:

Q: A company finances its operations with 57 percent debt and the rest using equity. The annual yield…

A: Weighted Average cost of capital helps in determining the cost of financing with different capital…

Q: The Two Dollar Store has a cost of equity of 12.3 percent, the YTM on the company's bonds is 5.8…

A: Given: Cost of equity = 12.3% YTM = 5.8% Tax rate = 39% Debt to equity = 0.58

Q: The S&H construction company expects to have total sales next year totaling $15,300. In addition,…

A: Sales = 15,300 Tax Rate = 35% Interest Expense = 280,000 Cost of goods sold = 57% of Sales Operating…

Q: The ABC Company has a cost of equity of 21.2 percent, a pre-tax cost of debt of 5.2 percent, and a…

A: wacc=wd×rd×1-tax+we×rewhere,wd=weight of debtrd=cost of debtwe=weight of equityre=cost of equity

Q: What is Ningbo Shipping's WACC if it's after tax cost of retained earnings is 14%, and the firm's…

A: Weighted Average Cost of Capital is referred to as the calculation of the cost of capital of the…

Q: Sixx AM Manufacturing has a target debt-equity ratio of 0.65. its cost of equity is 15%, and its…

A: Weighted Average Cost of Capital (WACC) is the overall cost of capital from all the sources of…

Q: Gainer Company has three sources of financing: $3 million of mortgage bonds paying 5 percent…

A: After-Tax Cost for Mortage bonds = Interest rate x (1 - tax rate) = 5% x (1-0.40) = 3% After-Tax…

Q: Gainer Company has three sources of financing: $3 million of mortgage bonds paying 5 percent…

A: Mortgage bonds value=3000000 cost of bond=5% after tax=r1=5(1-0.4)=3% weighted…

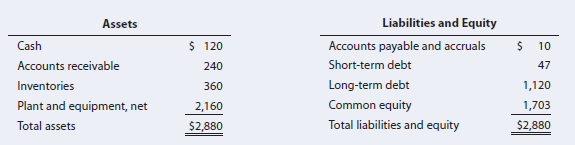

The Paulson Company’s year-end balance sheet is shown below. Its cost of common

equity is 14%, its before-tax cost of debt is 10%, and its marginal tax rate is 40%.

Assume that the firm’s long-term debt sells at par value. The firm’s total debt, which is

the sum of the company’s short-term debt and long-term debt, equals $1,167. The firm has

576 shares of common stock outstanding that sell for $4.00 per share. Calculate Paulson’s

WACC using market-value weights.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

- l-Itihad Corporation Balance SheetDecember 31, 2019AssetsLiability & EquityCurrent AssetsCurrent LiabilityCash$5,000Accounts payable22,000Short term securities10,000Accrual Account8,000Account Receivables30,000Short term debt6,000Inventory32,000Total Current Liability36,000Long-term debt40,000Total Current Assets77,000TotalLiability76,000Long term AssetsEquityNet Property & equipment70,000CommonStocks64,000Retained earnings17,000Total Equity81,000Total Liability and Equity157,000Other assts 10000Total Assets157,000Sur Corporation Income StatementDecember 31, 2019Other Financial information of Sur corporation December 31, 2019Net sales (revenue)$150,000· Average Number of Common shares outstanding 16,000 Shares· Market price of Common share $3.5Cost of goods sold80,000Gross profit70,000Operating expenses30,000EBIT- (Operating profit)40,000Interest expense10,000EBT- ( Earnings before taxes)30,000Income tax 10,000Net Income (net profit)20,000You have to find the following ratios…For Financial year 2021: Current ratio = Current assets / Current liabilities = 43.133 / 29.613 = 1.46 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (29.613 + 25.382) / 47.069 = 1.17 (2.d.p) Return on total assets = Net profit / Average total assets = (-11.195) / 101.964 = -0.11 (2.d.p) Profit margin ratio = Net profit / Net sales = (-11.195) / 81.79 = -0.14 (2.d.p) Debt-to-asset = Total liabilities / Total assets = (29.613 + 25.382) / 101.964 = 0.54 (2.d.p) Cash flow on total assets = Net cash flow from operating activities / Average total assets = 4.717 / 101.964 = 0.05 (2.d.p) For Financial year 2022: Current ratio = Current assets / Current liabilities = 49.476 / 32.754 = 1.51 (2.d.p) Debt-to-equity = Total liabilities / Total equity = (32.754 + 27.625) / 46.732 = 1.29 (2.d.p) Return on total assets = Net profit / Average total assets = (-0.336) / 107.111 = -0.003 (3.d.p) Profit margin ratio = Net profit / Net sales = (-0.336) / 115.56 = -0.003 (3.d.p) Debt-to-asset…Balance SheetAssets LiabilitiesCurrent Assets Current LiabilitiesCash 46 Accounts payable 39Accounts receivable 23 Notes payable/short-term debt 5Inventories 20Total current assets 89 Total current liabilities 44Long-Term Assets Long-Term LiabilitiesNet property, plant,and equipment 121 Long-term debt 133Total long-term assets 121 Total long-term liabilities 133Total Liabilities 177Stockholders' Equity 33Total Assets 210 Total Liabilities and 210Stockholders' Equity The above diagram shows a balance sheet for a certain company. Allquantities shown are in millions of dollars. What is the company's networking capital? Explain

- BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 What is the firms ROE (Return on Equity)?Group of answer choices 9.45% 9.63% 9.84% 10.20%BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 9 What is the firm's Debt Ratio? Group of answer choices 60.0% 65.0% 70.0% 75.0% Question 10 What is the firm's Inventory Turnover? 4.41 4.55 4.69 4.83 Question 11 What is the firm's DPS…BALANCE SHEETCash $ 140.0 Accounts payable $ 800 .0Accts. receivable 880 .0 Notes payable 600.0Inventories 1,320.0 Accruals 400 .0Total current assets $2,340.0 Total current liabilities $1,800.0Long-term bonds 1,000.0Total debt $2,800.0Common stock 200 .0Retained earnings 1,000.0Net plant & equip. 1,660.0 Total common equity $1,200.0Total assets $4.000.0 Total liabilities & equity $4.000.0lNCOME STATEMENTNet sales $6,000.0Operating costs 5,599.8Depreciation 100.2EBIT $ 300.0Less: Interest 96 .0EBT $ 204 .0Less: Taxes 81.6Net income $ 122.4OTHER DATAAnnual Principal and Lease Payments 0.00Shares outstanding (millions) 60 .00Common dividends (millions) $42.8Interest rate on NIP and long-term bonds 6.0 %Federal plus state income tax rate 40%Year-end stock price $30 .60 Question 5 What is the firm's EBITDA coverage? Group of answer choices 3.51 3.69 3.88 4.17 Question 6 What is the firms DSO (Days Sales Outstanding)? Group of answer choices 51.30 days 52.80 days 53.50…

- Current Attempt in Progress XYZ provided the following financial information: XYZBalance SheetAs of 12/31/19 Assets: Liabilities and Equity: Cash and marketable securities $27,476 Accounts payable and accruals $154,860 Accounts receivable $143,519 Short-term notes payable $21,255 Inventory $212,379 Total current liabilities $176,115 Total current assets $383,374 Long term debt $155,510 Net plant and equipment $602,704 Total liabilities $331,625 Goodwill and other assets $42,422 Common stock $312,719 Retained earnings $384,156 Total assets $1,028,500 Total liabilities and equity $1,028,500 In addition, it was reported that the firm had a net income of: $158,402 and net sales of: $4,272,431 Calculate the following ratios for this firm (Use 365 days for calculation. Round answers to 2 decimal places, e.g.…Category Prior Year Current Year Accounts payable 3,123.00 5,969.00 Accounts receivable 6,987.00 8,940.00 Accruals 5,642.00 6,108.00 Additional paid in capital 19,885.00 13,325.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,986.00 18,120.00 Current portion long-term debt 500 500 Depreciation expense 1,035.00 988.00 Interest expense 1,290.00 1,167.00 Inventories 3,006.00 6,743.00 Long-term debt 16,856.00 22,001.00 Net fixed assets 75,521.00 74,000.00 Notes payable 4,072.00 6,540.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,244.00 34,874.00 Sales 46,360 45,055.00 Taxes 350 920 What is the firm's cash flow from financing?Category Prior Year Current Year Accounts payable 3,147.00 5,976.00 Accounts receivable 6,925.00 8,910.00 Accruals 5,635.00 6,187.00 Additional paid in capital 19,527.00 13,950.00 Cash ??? ??? Common Stock 2,850 2,850 COGS 22,974.00 18,270.00 Current portion long-term debt 500 500 Depreciation expense 975.00 976.00 Interest expense 1,278.00 1,155.00 Inventories 3,048.00 6,717.00 Long-term debt 16,569.00 22,919.00 Net fixed assets 75,968.00 73,882.00 Notes payable 4,045.00 6,584.00 Operating expenses (excl. depr.) 19,950 20,000 Retained earnings 35,870.00 34,759.00 Sales 46,360 45,347.00 Taxes 350 920 What is the firm's cash flow from operations? What is the firm's dividend payment in the current year? What is the firm's net income in the current year?

- need the calculation for debt to assets ratio, debt equity ratio, long-term debt to equity and times interest earned ratio. CURRENT ASSETS Cash and cash equivalents $ 5,910 $ 5,238 Marketable securities 406 503 Accounts receivable 10,888 9,645 Less: Allowance for credit losses (138) (93) Accounts receivable, net 10,750 9,552 Assets held for sale 1,197 0 Other current assets 1,953 1,810 Total Current Assets 20,216 17,103 Property, Plant and Equipment, Net 32,254 30,482 Operating Lease, Right-of-Use Asset 3,073 2,856 Goodwill 3,367 3,813 Intangible Assets, Net 2,274 2,167 Investments and Restricted Cash 25 24 Deferred Income Tax Assets 527 330 Other Non-Current Assets 672 1,082 Total Assets 62,408 57,857 Current Liabilities: Current maturities of long-term debt, commercial paper and finance leases 2,623 3,420 Operating Lease, Liability, Current 560 538 Accounts payable 6,455 5,555 Accrued wages and withholdings 3,569 2,552…Particulars As on 31.3.2019(Rupees. In Lacs)As on 31.3.2020(Rupees. In Lacs)Investment in FinancialAssets- 100Equity Share Capital 150 160Long term Loans taken 100 200Dividend paid - 26Dividend received - 10Interest received - 15 Calculate the debt-equity ratio & commentDetermine the missing amount from each of the seperate situations given below. Assets = Liabilities + Equity = $94,000 + $29,000 $110,000 = $40,000 + $144,000 = + $62,000